CAPM Calculator

Understanding The Capital Asset Pricing Model

The Capital Asset Pricing Model (CAPM) stands as a cornerstone theory, offering essential insights into the relationship between risk and expected return. This model has become a vital tool for investors, analysts, and financial professionals, enabling them to make informed decisions about the risks and potential returns of various investments.

Our CAPM Calculator simplifies the process of calculating expected returns on securities, taking into account their inherent risks, thus aiding in the strategic planning of investment portfolios.

What is CAPM?

The Capital Asset Pricing Model is a theoretical framework used to determine the expected return on an investment, considering its risk in relation to the overall market. CAPM is pivotal in modern financial theory, helping investors understand the trade-off between risk and return in the securities market.

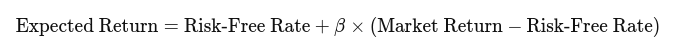

The CAPM Formula

The CAPM formula incorporates three key components:

-

Risk-Free Rate: This is the return of an investment with zero risk, typically represented by government bond yields. It serves as a baseline for assessing the risk of other securities.

-

Beta (β): Beta measures a security's volatility or risk compared to the broader market. A beta greater than 1 indicates that the security is more volatile than the market, while a beta less than 1 suggests it is less volatile.

-

Market Risk Premium: This is the difference between the expected return of the market as a whole and the risk-free rate. It represents the additional return expected by investors for taking on the higher risk of investing in the market rather than choosing risk-free securities.

The CAPM formula is expressed as:

This formula and its components form the basis of the CAPM Calculator, allowing users to input specific values and calculate the expected return of an investment, considering its risk profile.

Overview of the CAPM Calculator

The CAPM Calculator is a specialized financial tool designed to implement the Capital Asset Pricing Model for individual securities. It offers a user-friendly platform for investors and financial analysts to gauge the expected return on investments, accounting for the risk involved compared to the general market.

Required Inputs

To effectively use the CAPM Calculator, several key inputs are required:

-

Risk-free interest rate: This is the return expected from a risk-free investment, often represented by government bond yields. It's the baseline for comparison.

-

Beta of the Security (β): Beta measures the volatility or systemic risk of a security in comparison to the market. This value indicates how much the security's price moves relative to the market.

-

Broad market return rate: This is the anticipated return of the market, often based on historical data and future market projections.

Once these inputs are provided, the CAPM Calculator utilizes the standard CAPM formula:

The calculation process involves:

- Subtracting the risk-free rate from the expected market return to determine the market risk premium.

- Multiplying this premium by the beta of the security.

- Adding the product to the risk-free rate to yield the expected return.

This process allows users to understand the potential return on a security, factoring in its market risk. The simplicity and speed of the CAPM Calculator make it an invaluable tool for investment analysis and portfolio management.

Practical Applications of The Capital Asset Pricing Model

The CAPM Calculator finds its significance in various facets of investment analysis and portfolio management, proving to be an essential tool in the modern financial landscape.

Investment Analysis

-

Assessing Stock Performance: Investors use the CAPM Calculator to estimate the expected return of individual stocks. By inputting the beta value of a share, alongside market expectations, they can gauge whether a stock is likely to perform above or below market average.

-

Comparing Securities: The calculator allows for comparison between securities with different risk profiles. By calculating the expected return for various shares, investors can make more informed choices about where to allocate their funds.

Portfolio Management

-

Determining Cost of Capital: For portfolio managers, CAPM is vital in calculating the cost of capital. This involves assessing the risk and potential return of various investments, including stocks and treasury bonds, to optimize the portfolio's overall performance.

-

Balancing Risk and Return: The CAPM Calculator aids in balancing the risk-reward ratio within a portfolio. By understanding the expected rate of return of different assets, managers can adjust their investment strategies to meet specific risk tolerance levels.

Limitations of The Capital Asset Pricing Model

While the CAPM Calculator is a powerful tool, it operates within the confines of the CAPM model, which has inherent limitations.

-

Market Assumptions: CAPM is based on several assumptions, including market efficiency and the idea that investors hold diversified portfolios. These assumptions are not always reflective of real-world scenarios, which can lead to discrepancies in the expected rate of return.

-

Static Beta: The calculator uses a static beta value, which may not account for the dynamic nature of market volatility and how it impacts individual securities.

-

Focus on Systemic Risk: CAPM and, by extension, the calculator primarily focus on systemic risk, overlooking other forms of risk that might affect an asset's return.

-

Historical Market Returns: The expected market return input is often based on historical data, which might not accurately predict future market behavior.

Despite these limitations, the CAPM Calculator remains a valuable tool for investors and portfolio managers. It provides a foundational understanding of the potential return on investment, considering market risks. However, it's crucial to complement its output with other analysis tools and market insights for a more comprehensive investment strategy.

Summary

The Capital Asset Pricing Model (CAPM) and its accompanying CAPM Calculator are fundamental tools in the realm of finance and investment. This article has covered the essential aspects of CAPM, including its purpose, the components of its formula—risk-free rate, beta, and market risk premium—and its practical application in investment analysis and portfolio management.

The CAPM Calculator simplifies the process of estimating the expected rate of return on stocks, treasury bonds, and other assets, considering their inherent risks compared to the overall market. While invaluable, it's essential to recognize the limitations of CAPM, such as its reliance on market assumptions and static beta values and its focus on systemic risk.

Despite these constraints, the CAPM Calculator remains a crucial tool for investors and portfolio managers, aiding in informed decision-making by balancing risk and potential returns.

FAQ

1. What is the main purpose of the CAPM Calculator?

The CAPM Calculator is used to estimate the expected return on an asset, taking into account its risk relative to the market.

2. How is beta used in the CAPM Calculator?

Beta measures a stock's volatility compared to the market. In CAPM, it's used to adjust the market risk premium based on the stock's relative risk.

3. Can the CAPM Calculator predict the exact future returns of an investment?

No, the CAPM Calculator provides an estimation based on current data and assumptions. It does not guarantee future returns.

4. What are the limitations of using CAPM for investment decisions?

CAPM assumes a perfect market and relies on historical data for market returns. It focuses solely on systemic risk and uses a static beta, which may not always reflect current market conditions.