Install CalcoPolis as App Add Calcopolis icon to homescreen and gain quick access to all calculators. Click here to see how »

Build your early retirement strategy with Calcopolis.

Table of Contents

- What is a FIRE Calculator, and how does it work?

- What is so special about our early retirement calculator?

- Realistic simulations

- Rebalancing in the retirement phase

- Extra income on retirement

- Taxes

- Join the FIRE movement with Calcopolis

- How can a FIRE Calculator help me retire early?

- How much do I need to save to retire early?

- How does the savings rate impact my early retirement planning?

- How can I optimize my portfolio to achieve my early retirement goals?

- Set a realistic savings rate.

- Account for inflation

- Don't forget about income growth but do not exaggerate

- Set realistic return rates for your investments.

- Do not forget about mandatory capital gains tax.

- Set a realistic withdrawal rate.

- Assess your retirement expenses carefully.

- Do not exaggerate your retirement income.

- Assume a safe investment portfolio in the retirement phase.

- How do we calculate the results?

Planning for early retirement is an exciting and sometimes daunting task. You need to think about how much money you will need to retire, how to save and invest your money, and what your retirement lifestyle will look like.

That's why we created the tool to help you with all of these calculations, following the principles of the Financial Independence Retire Early method.

What is a FIRE Calculator, and how does it work?

A FIRE Calculator is a tool that helps you plan for early retirement and financial independence.

You can input your retirement goals, savings rate, investment strategies, and other factors to run simulations and see how much money you will need to retire and how long it will take you to achieve financial independence.

Here are some features of Calcopolis:

- Our financial independence calculator considers 20 factors to run the most accurate simulation possible, including savings rate, investment returns, inflation, taxes, and more.

- The tool provides detailed yet easy-to-read reports with plenty of graphs and tables to help you visualize your retirement planning.

- You can use Calcopolis to test different scenarios and strategies for achieving financial independence, such as adjusting your savings rate, investment allocations, or withdrawal rate.

What is so special about our early retirement calculator?

Calcopolis is not just any retirement calculator. Our team has put a lot of effort into making Calcopolis the most advanced and accurate tool available for early retirement planning.

Here are some of the features that set Calcopolis apart:

Realistic simulations

Unlike other retirement calculators, Calcopolis allows you to simulate real-life scenarios.

This means that we take into account factors such as inflation, taxes, and changes in investment returns over time to give you a more accurate picture of your retirement planning.

Rebalancing in the retirement phase

We understand that retirement can be a scary time for some people, especially if they are worried about market volatility or losing their fire savings.

That's why we allow you to rebalance your investment portfolio in the retirement phase to reflect a low-risk approach. This can help you protect your savings and enjoy a more secure retirement.

Extra income on retirement

Calcopolis also takes into account extra income you may receive in retirement from side hustles, real estate, or other sources.

This can help you plan for more flexible types of FIRE like Barista or Lean FIRE.

Taxes

Finally, we take taxes into account when running our simulations. This can help you understand how taxes will impact your retirement savings and income and plan accordingly.

Join the FIRE movement with Calcopolis

How can a FIRE Calculator help me retire early?

Planning for FIRE retirement requires a lot of calculations, assumptions, and projections. Our calculator can help you find answers to all of your early retirement questions by running simulations and scenarios based on your inputs and assumptions.

Here are some common questions that Calcopolis can help you answer:

How much do I need to save to retire early?

One of the most critical questions when planning for early retirement is how much money you need to accumulate (the FIRE number).

With Calcopolis, you can input your retirement goals, such as your desired retirement income, and the tool will tell you how much money you need to save to achieve your goals.

You can adjust your savings rate and other inputs to see how they impact the time to retire.

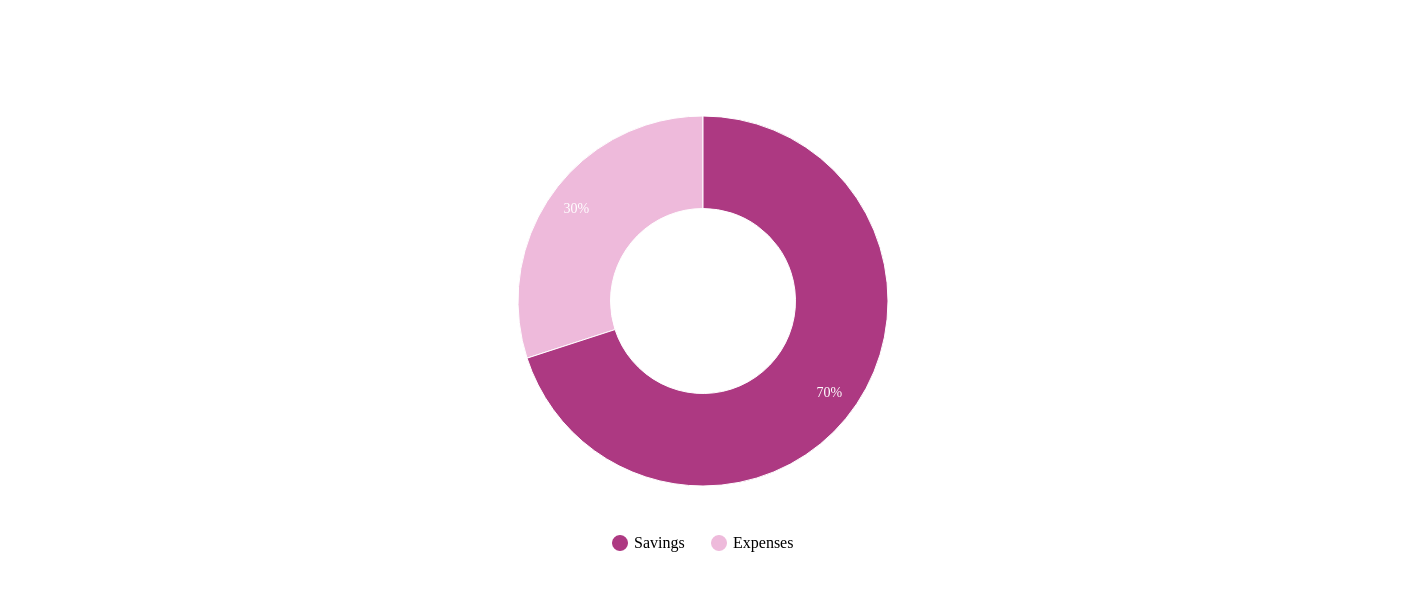

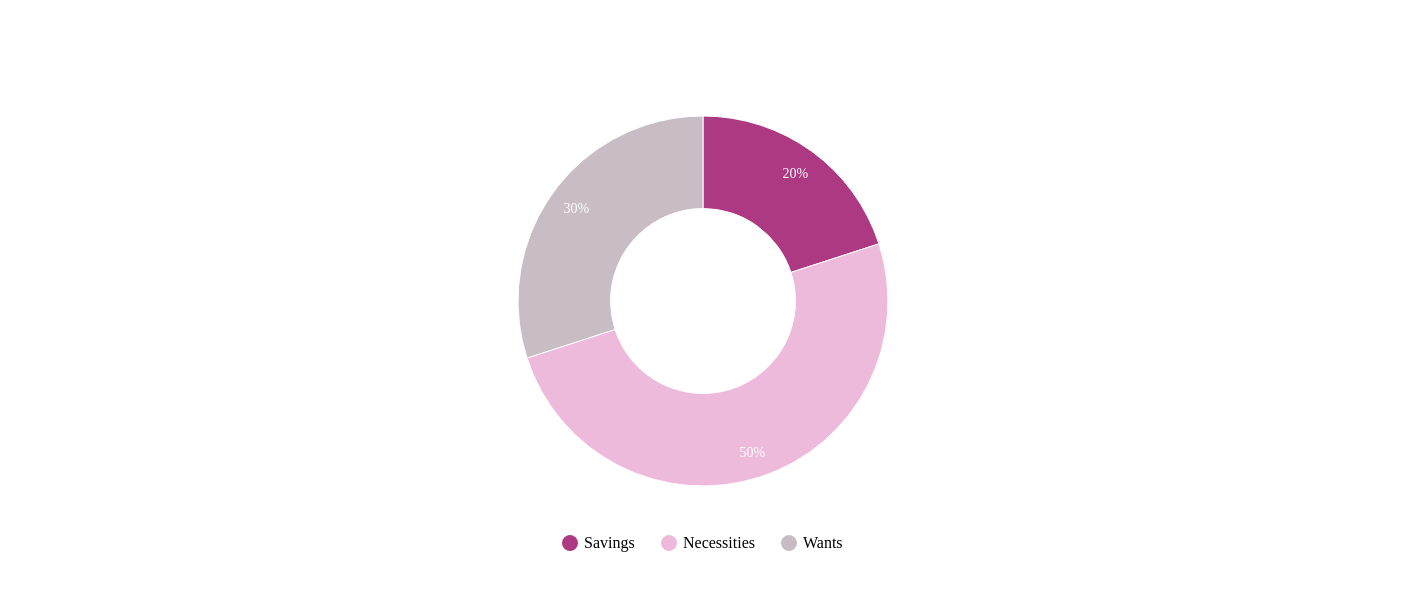

The members of the FIRE movement recommend saving even 70% of your income, which is possible if you have a really high income (and strong self-discipline). Alternatively, you can test less demanding saving schemes like the 50/30/20 rule.

| Saving 70% of salary | 50/30/20 rule |

|

|

How does the savings rate impact my early retirement planning?

The savings rate is a crucial factor in early retirement planning. It determines how much money you can save and invest each year, impacting how long it will take you to achieve your financial goals.

With Calcopolis, you can test different savings rates and see how they impact your retirement planning.

You can also adjust other factors, such as investment returns, to see how they interact with your savings rate.

How can I optimize my portfolio to achieve my early retirement goals?

Investment optimization is another critical aspect of early retirement planning.

You need to allocate your investments to maximize your returns while minimizing your risks.

Calcopolis can help you do this by allowing you to split your portfolio into different assets to reflect your risk tolerance, investment goals, and other factors.

You can also test different investment strategies and see how they impact your retirement planning.

How can I use a retirement calculator to plan for early retirement?

In this section, we'll explore how you can use a retirement calculator to plan for early retirement and achieve your financial goals.

The key is to set realistic goals. Don't be too optimistic about your retirement income or investment returns.

Your FIRE agenda should be bulletproof so that you can enjoy your retirement without financial worries.

Set a realistic savings rate.

One of the most critical factors in planning for early retirement is the savings rate. Think carefully about how much you can really put aside each month, including reserves for emergencies like car repairs, etc.

Check our our emergency fund calculator.

Account for inflation

Inflation is an essential consideration when planning for early retirement. You need to account for the impact of inflation on your savings and retirement income.

A retirement calculator can help you account for inflation and adjust your retirement planning accordingly.

Don't forget about income growth but do not exaggerate

While you need to account for inflation, you also need to consider income growth. Your income may increase over time, reflecting inflation and the growth of your skills.

However, don't exaggerate your income growth assumptions.

Set realistic return rates for your investments.

Investment returns are a critical factor in retirement planning. However, you need to set realistic return rates for your investments.

Don't assume that your investments will always perform well. Check historical return rates for long periods (30+ years), do not base them on the last few years.

Do not forget about mandatory capital gains tax.

Capital gains tax is a mandatory consideration when planning for early retirement. You need to account for the impact of capital gains tax on your investment returns.

A retirement calculator can help you evaluate the impact of capital gains tax on your investment returns and adjust your retirement withdrawal strategies.

Set a realistic withdrawal rate.

The withdrawal rate is an essential factor in retirement planning. You need to set a realistic withdrawal rate that covers your living expenses without depleting your savings too quickly.

The most popular approach is to set a low 4% withdrawal rate, but even this approach is often criticized as too optimistic, especially in the case of investors with a long retirement horizon of over 40 years (source).

Our calculator can help you evaluate different withdrawal rate scenarios and set a realistic withdrawal rate for your retirement.

Assess your retirement expenses carefully.

Retirement expenses are another critical factor in retirement planning. You need to evaluate your retirement expenses carefully.

Your future expenses for sure will be completely different than now. Not only due to inflation but primarily to different life circumstances.

Maybe you will repay your mortgage by then, or your kids will become adults and independent.

Do not exaggerate your retirement income.

While it's essential to have realistic income growth assumptions, you should not exaggerate your retirement income.

Be conservative with your income assumptions and assume that your income may be lower than expected.

A retirement calculator can help you evaluate different income scenarios and set realistic retirement income assumptions.

Assume a safe investment portfolio in the retirement phase.

Finally, you need to assume a more conservative investment portfolio in the retirement phase.

High volatility may ruin your retirement, so you need to allocate your investments to minimize risks. A retirement calculator can help you evaluate different investment scenarios and set a safe investment portfolio for the retirement phase.

How do we calculate the results?

- We distinguish two phases allocation and retirement.

- The compound interest formula is a base for calculations.

- We calculate monthly savings and add them to the current savings balance.

- We split savings according to your asset allocation preferences and calculate interest according to expected return rates.

- We take inflation into account and increase the expenses each month according to the expected annual inflation rate.

- In the retirement phase, we allow for rebalancing the investment portfolio to reflect low-risk investments.