ROI Calculator

Measure the profitability of your investments with CalcoPolis.

Table of Contents

- Understanding the Return Rate of Investments

- When to use the ROI calculator

- Characteristics

- How to calculate ROI?

- The ROI formula

- What is a good return of investment?

- Pros and cons

- The advantages of ROI

- The disadvantages of ROI

- Examples

- How to calculate ROI of Amazon marketplace?

- How to calculate ROI in stocks?

- Annualized ROI

- The annualized ROI formula:

- 2 years

- 3 months

- Alternative mertics to ROI

Understanding the Return Rate of Investments

ROI is a popular financial indicator for evaluating the performance of investments. Due to its simplicity it is most commonly used for forecasting possible profits and comparing attractiveness of different investments.

When to use the ROI calculator

Using this tool is best suited for:

-

Calculating the gain or loss from investment

-

Forecasting the profitability of your ventures

-

Comparing the performance of different asset classes

When not to use ROI

Although ROI is easy and quick to use, you need to know that this simplicity comes with a trade-off as ROI cannot always be applied to approximate future profits.

A basic ROI calculator should not be used for comparing investments with different periods, since this metric does not take time frames into consideration. There is an enhanced version called Annualized ROI. Although it is a more accurate indicator, it’s still not suitable for investments with high volatility.

Characteristics

-

ROI is a simple method of approximating an investment's performance.

-

It is a universal metric that can be applied to any asset class: real estate, stocks, marketing, sales, etc.

-

It’s expressed as a percentage value.

-

It can take positive or negative values

-

It should not be used for comparing investments with different holding periods.

How to calculate ROI?

ROI is simply a ratio of net return of investment to its cost. It is usually expressed as a percentage value.

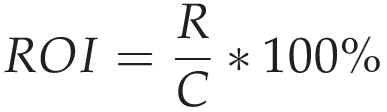

The ROI formula

Where:

-

R - net return of investment

-

C - cost of investment

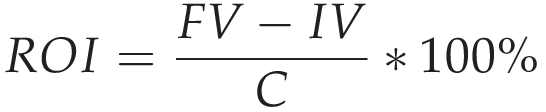

Since net return may be expressed as final value (FV) minus initial value (IV), we can derive an alternative formula for working out ROI.

Key takeaways from those equations:

-

Since the final value may be greater or lower than the initial value, ROI may take both positive and negative values.

-

Time period is not a part of the formula, so ROI is time-agnostic, which means that comparing return rates of investments with different time horizons may be misleading.

-

In order to achieve accurate results you need to consider all the costs related to investment.

-

You cannot mix gross and net values. Before substituting data into the formula you should convert all the variables to net or gross.

What is a good return of investment?

This is the most common question people ask. Unfortunately, there is no easy answer to that.

It stands to reason that ROI should be positive, because a negative value would mean loss. But even a positive ROI may not always be a sign of good performance.

ROI percentage should be equal or higher than the results of other assets within the same period of time, in order to be able to classify ROI as a good result.

Although ROI does not consider risk factors, it should be taken into account while evaluating attractiveness of investments.

For example, risky investments with a rate of return similar to those offered by safe asset classes (like government bonds, saving accounts or certificates of deposit) certainly cannot be perceived as a viable alternative to those financial products.

It’s worth mentioning that a positive ROI which is still lower than the inflation rate may be considered as a negative rate of return, since in fact it brings a real loss in value of the initial amount.

Pros and cons

So far we have mentioned only briefly the pros and cons of the ROI metric. Let's dive into this topic and analyze in which cases ROI is a good gauge of investment attractiveness and when it would be advisable to use different metrics.

The advantages of ROI

Easy to use

Simplicity is the biggest advantage of ROI. Thanks to this you can analyze potential returns of different ventures in minutes or even seconds.

The ease of interpreting the result or return of investment calculations is a very strong benefit too. It not only saves time, but helps to avoid drawing wrong conclusions.

Allows to compare different investment types

Due to its universality ROI allows us to compare the performance of any kind of investment, without deep analysis of each asset.

The disadvantages of ROI

Does not take time into consideration

This is the biggest disadvantage of ROI, because it may lead to wrong conclusions. Although a 20% return rate might be a good result for a one year investment, for a period of 10 years it is clearly not an attractive return.

Alternatively, a 0,7% monthly ROI is a quite good result.

Risk is not taken into account

Nowadays it is hard to find a risk-free asset class, since even government bonds may have real negative yields.

That's why every investment should be considered as a correlation of gain to possible risk.

May be misleading if not all costs are considered

Although the expected roi calculator is quick and easy to use, in order to get realistic results you need to consider all the costs attached to the investment.

For example, in the case of stocks you should consider not only the cost of shares, but all the commission fees, taxes, etc.

It is worth mentioning that depending on the country's tax jurisdiction, there may be different tax rates when selling stocks and different for dividends.

So the bottom line is - you need to understand the investment properly in order to calculate ROI correctly.

Examples

How to calculate ROI of Amazon marketplace?

Selling on Amazon Marketplace is a very popular ecommerce business model. For the purpose of this example we will briefly tell that small retailers are allowed to sell products through the Amazon website in exchange for a commission fee.

Let’s assume you sold a laptop for a net price of $1000. In order to calculate ROI we need to list and summarize all the costs related to the transaction:

-

Purchase cost of product ($700)

-

Amazon commission 8% ($80)

-

Shipping cost ($12)

Revenue = $1000

Costs = $700 + $80 + $12 = $792

Net_return = $1000 - $792

ROI = (Net_return / Costs) * 100% = 26%

In the analyzed example, the return rate of selling this product on Amazon was 26% (before tax). In order to simplify the example we assumed that shipping costs covered all the costs related to packaging and delivering the parcel to the customer.

How to calculate ROI in stocks?

ROI calculation for a single transaction on the stock market is quite easy. You only need to remember to include all the costs related to the transaction, not only the purchase cost of the shares.

In the costs you should include:

-

Initial stock value

-

Transaction fee

-

Taxes

For the return you should calculate:

-

Increase in value

-

Dividends

Suppose you invested in 10 shares of Microsoft (MSFT) for $296 per share, then you kept the stocks till ex-dividend date and sold them immediately after that.

The return:

-

This will give us initial stock value of 10* $296 = $2,960

-

The stocks grew in value 10% till the day of dividend $2,960 * 10% = $296

-

The final stocks value reached then $3,256

-

Dividend yield was 1,5% so it gave us $3,256 *1,5% = $48.84

-

Your return in dollars was $296 + $48.84 = $344.84

The costs:

-

initial value of $2,960

-

Purchase fee 0,2% = $2,960 * 0,2% = $5.92

-

Selling fee 0,2% = $3,256 * 0,2% = $6.51

-

Capital gains tax 15% * ($3,256 - $2,960) = $44.4

-

Tax from dividend 15% * $48.84 = $7.33

-

Your total cost will be:

-

C = initial_stock_value + purchase_fee+selling_fee+capital_gain_tax+dividend_tax = $2,960 + $5.92 + $6.51 + $44.4 + $7.33 = $3,024.16

Let’s substitute the following values into the ROI equation:

ROI = R / C * 100% = $344.84 / $3,024.16 * 100% = 11.4%

It turns out that the ROI of your hypothetical investment in stocks was 11.4%. Immediately it raises the question: is it a good or bad result? Well…

It depends. In our example we haven't considered the time factor. For the period of a few months 11.4% would be a spectacular result, but for the time frame of a few years it’s far below average.

That's why there is one more topic regarding the return rate of investment we need to cover.

Annualized ROI

Annualized ROI is an enhanced version of the ROI definition, which solves the problem of not considering time frames of the investment.

The annualized ROI formula:

Annualized_ROI = [(1+ROI)1/n −1]×100%

Where n represents the number of years of an investment.

Let’s go back to the previous example with MSFT stocks and analyze two different time frames: 2 years and 3 months.

2 years

ROI was 11.4% so let us put this into our equation:

Annualized_ROI = [(1+0.114)1/2 −1]×100% = 5.55%

The resulting 5.55% return rate was far long-term NASDAQ average, so it is fair to say that the analyzed investment wasn’t a huge success.

3 months

If you wish to calculate the annualized ROI for a shorter period, the only thing you need to do is to substitute a fraction of year for a variable. For example in our case 3 months will be 0.25 of a year.

Annualized_ROI = [(1+ROI)1/n −1]×100% = [(1+0.114)1/0.25 −1]×100% = 54%

This time the result reached a spectacular 54%. Wow!

As you see, the holding period is a very important factor for an investor while analyzing investment performance.

Alternative mertics to ROI

Although ROI is a very useful financial metric there are other metrics that allow for the more granular analysis of the investment performance for example Return on Equity, Return on Assets or Return on Sales.