Debt To Capital Ratio Calculator

Understand the proportion of debt used in a company's capital structure

The debt-capital ratio stands as a crucial metric, offering insights into a company's financial structure and risk profile. This ratio is particularly significant for investors and businesses as it helps in assessing a company's financial health and stability. By understanding the proportion of debt used in a company's capital structure, stakeholders can make more informed decisions about investing and managing finances.

What is the Debt to Capital Ratio?

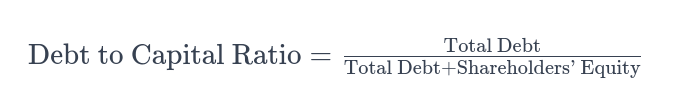

The Debt to Capital Ratio is a financial metric that measures the proportion of a company's total capital that is financed through debt. It is calculated using the formula:

Components of the Debt to Capital Ratio Formula:

- Total Debt: This includes all of a company's liabilities, both short-term and long-term.

- Total Capital: This is the sum of a company's debt and shareholders' equity.

- Shareholders' Equity represents the amount owners have invested in the company.

This ratio essentially shows how much of a company's operations are financed by debt compared to what is financed by its owners' investments (equity).

The Benefits of Using the Debt-to-Capital Ratio for Investors

The Debt to Capital Ratio is a potent tool in an investor's arsenal, offering valuable insights into a company's financial health and strategy. Here's how investors can benefit from using this ratio:

-

Assessing Financial Stability and Risk: The Debt to Capital Ratio allows investors to gauge how much a company relies on debt financing as opposed to equity. A lower ratio typically indicates a company with less debt relative to its equity, suggesting a potentially more stable financial position. Conversely, a higher ratio can signal greater financial risk due to higher debt levels, which can be particularly concerning during economic downturns or periods of high interest rates.

-

Informed Decision-Making: By understanding a company's financial leverage, investors can make more informed decisions about whether to invest in or divest from a company. A company with a high Debt to Capital Ratio might be taking on too much risk, which could lead to financial distress. On the other hand, some level of debt can be beneficial if managed wisely, as it can fuel growth and expansion.

-

Comparative Analysis: Investors often use this ratio to compare companies within the same industry. Since acceptable levels of debt vary across industries, the Debt to Capital Ratio provides a way to understand how a company stacks up against its peers. This comparative analysis can be crucial in identifying investment opportunities and avoiding potential pitfalls.

-

Predicting Future Performance: A company’s approach to leveraging debt can offer clues about its future performance. Companies with a balanced approach to debt and equity may have more sustainable growth models, while those with high debt levels might face challenges in sustaining their growth or surviving adverse economic conditions.

-

Evaluating Dividend Viability: For income-focused investors, the Debt to Capital Ratio can be an indicator of a company's ability to sustain or increase its dividends. Companies with lower debt levels are generally in a better position to maintain dividend payments, as they aren't burdened with high-interest costs that could eat into their profits.

-

Identifying Leverage-Induced Opportunities: Some investors seek companies with higher leverage as they might offer higher returns. Such companies, if they manage their debts well, can amplify their earnings, potentially leading to higher returns on equity. However, this comes with increased risk, and the Debt to Capital Ratio helps in identifying and quantifying this leverage.

-

Long-term Investment Strategy: Investors focused on long-term growth and stability can use the Debt to Capital Ratio to identify companies with a conservative approach to debt. These companies often demonstrate prudent financial management and may be less volatile in turbulent market conditions.

Interpreting the Results

Understanding the Ratio:

- A lower Debt to Capital Ratio suggests a company is using less debt in its capital structure, implying lower financial risk.

- A higher ratio indicates a higher reliance on debt, which can increase financial risk but may also suggest higher growth potential through leveraged investments.

Industry Benchmarks and Variances:

- It's crucial to compare a company's ratio with industry benchmarks, as acceptable levels of debt vary greatly between industries.

Limitations:

- This ratio shouldn't be used in isolation for financial analysis. It's important to consider other factors like market conditions, company growth prospects, and industry-specific risks.

Comparison with Other Financial Ratios

- Debt to Equity Ratio: Focuses specifically on the relationship between debt and equity, without considering the overall capital structure.

- Debt to Asset Ratio: Examines the proportion of a company's assets financed through debt.

When to Use the Debt to Capital Ratio:

This ratio is particularly useful when assessing the overall financial leverage of a company, as it considers the entire capital structure rather than focusing on just one aspect.

Conclusion

The Debt to Capital Ratio is a fundamental tool in financial analysis and decision-making. Its role in assessing a company's financial leverage and stability cannot be overstated. However, its effective use requires a holistic approach, considering various financial metrics and industry-specific factors. By responsibly utilizing the Debt to Capital Ratio Calculator, investors and business managers can gain valuable insights into the financial health and risk profile of companies, aiding in more informed and strategic decision-making.

FAQ

What does it mean when a company has more debt than equity?

When a company has more debt than equity, it indicates that it has financed a larger portion of its operations and assets through borrowing rather than through shareholder investment. This condition, known as high leverage, can increase the company's financial risk but may also provide opportunities for higher returns on equity.

Is high debt always bad for a company?

Not necessarily. While high debt increases financial risk, particularly in terms of meeting interest and principal payments, it can also enable a company to grow faster. The impact of high debt depends on the company's ability to manage and service the debt, the cost of the debt, and how effectively the borrowed funds are used.

How does a high debt-to-equity ratio affect a company's stock?

A high debt-to-equity ratio can lead to negative perceptions among investors, potentially lowering the stock price. Investors may view high debt as a risk factor, especially in uncertain economic times. However, if the company is managing its debt effectively and generating good returns, the impact on stock may be neutral or even positive.

What are the risks of investing in a company with high leverage?

The risks include the possibility of bankruptcy if the company cannot meet its debt obligations, reduced financial flexibility, potential for lower credit ratings, and a higher likelihood of volatility in earnings. Additionally, in tough economic times, such companies may struggle more than less leveraged peers.

Can a company reduce its debt-to-equity ratio? If so, how?

Yes, a company can reduce its debt-to-equity ratio by paying off debt, converting debt to equity, increasing equity through new stock issuances, or improving profitability to grow retained earnings (a component of shareholders' equity). It can also be reduced by refraining from taking on additional debt.

What is the difference between short-term and long-term debt in this context?

Short-term debt refers to obligations that are due within a year, while long-term debt refers to obligations due beyond a year. High short-term debt can pose immediate liquidity challenges, whereas long-term debt is more about the company’s long-term financial strategy and stability.

How do interest rates affect a company's debt situation?

Higher interest rates can increase the cost of borrowing, impacting companies with variable-rate debts immediately and affecting the cost of new debt. For companies with significant existing fixed-rate debt, changes in interest rates may not have an immediate impact but can influence refinancing options.

Are there industries where high debt is more common?

Yes, capital-intensive industries like utilities, telecommunications, and heavy manufacturing often have higher debt levels due to the significant upfront investment required in infrastructure and equipment.

What other financial ratios should be considered alongside the debt-to-equity ratio?

Investors should look at ratios like the interest coverage ratio, current ratio, quick ratio, return on equity, and debt-to-capital ratio to get a comprehensive view of the company's financial health.

What should investors do if they're concerned about a company's high debt levels?

Investors should conduct a thorough analysis of the company's financial statements, understand the context of the industry, evaluate the company's debt management strategies, and assess the overall risk tolerance of their investment portfolio before making decisions. Consulting a financial advisor can also provide additional insights.