Hedge Ratio Calculator

Lower your investment risk with CalcoPolis

Table of Contents

- What is a hedge ratio?

- Hedge ratio formula

- Hedge ratio calculation example

- What is the best hedge ratio?

- Benefits of Hedging

- Minimization of Losses

- Stabilization of Returns

- Protection against Price Fluctuations

- Achieving the Optimal Hedge Ratio

- Flexibility and Diversification

- Cost Efficiency

- Enhanced Decision Making

- The limitations of this technique

- Types of Hedging Instruments

- FAQ

- What does hedge mean?

- What does a hedging portfolio mean?

In this article, we will briefly explain what a hedge ratio actually is, how you can calculate its value, and finally, how to interpret the results.

What is a hedge ratio?

A hedge ratio is a simple metric that estimates what part of your investment portfolio is hedged from the risk. This simple coefficient allows you to manage the level of risk you are willing to take.

The higher the ratio is, the more significant amount of your portfolio is secured against the investment risk.

The lowest value of the hedge ratio is 0% (no hedge at all) and the maximum value of the hedge ratio is 100% (all assets are hedged).

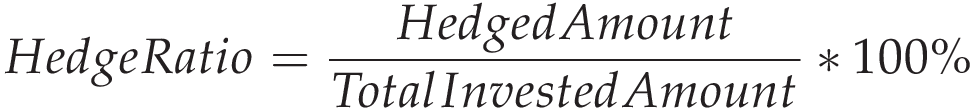

Hedge ratio formula

The formula for calculating the hedge ratio is a simple correlation of the value of hedged investments to the total value of all your assets.

Hedge ratio calculation example

For example, let's analyze the real case scenario of investment: ETF funds. Suppose you have two ETF funds, and one of them is hedged against currency risk.

- Vanguard FTSE All-World ex-US ETF (Hedged) $100k

- ROBO Global Robotics and Automation Index ETF (Unhedged) $50k

Both funds invest in the global stock market, but only the first one has a hedge against currency volatility. So let's calculate the hedge ratio for the entire portfolio.

Total portfolio value = $100k + $50k = $150k

Value of hedged assets = $100k

Hedge Ratio = Value of hedged assets / Total portfolio value * 100% = $100 / $150 = 66%

What is the best hedge ratio?

The best hedge ratio should reflect your risk tolerance. Risk-averse people should go for as high a hedge ratio as possible. On the other hand, people with long-term investment horizons and familiar with risk could even pick no hedging at all.

The hedge ratio could also vary among different asset classes since different types of investments are characterized by different volatility.

Another factor an investor should consider is the cost of the hedge since this kind of "insurance" has its price. It could take the form of a higher commission fee or lower potential for the whole portfolio.

Benefits of Hedging

Hedging, the art of strategically protecting one's investments against potential losses, offers a plethora of advantages. Here, we delve into the core benefits that emerge when an investor opts to hedge their position.

Minimization of Losses

The fundamental essence of hedging lies in its ability to counterbalance potential losses in an investment portfolio. When you hedge a position, you essentially set up a safety net that acts as a counter-move to an unfavorable price shift in your primary investment. This way, the gains from the hedge will offset the losses from the main investment.

Stabilization of Returns

The use of hedging can significantly reduce the standard deviation of returns. By doing so, investors can expect a more stable and predictable stream of earnings, even amidst volatile market conditions. This predictability can aid in better financial planning and portfolio management.

Protection against Price Fluctuations

Commodities, in particular, are notorious for their volatile nature, often seeing sharp price movements within short time frames. By using hedging instruments, an investor can lock in prices, ensuring that they are not adversely affected by sudden spikes or falls in the commodity spot price.

Achieving the Optimal Hedge Ratio

Hedging isn't about eliminating all risks; it's about managing them optimally. By determining the optimal hedge ratio, investors can decide the extent to which they want to hedge their position. This allows for a fine balance between risk and potential returns, ensuring that while they're protected against significant downturns, they also stand to gain if the market moves favorably.

Flexibility and Diversification

Hedging offers a variety of instruments and strategies that can be tailored to an individual's investment profile and risk tolerance. This not only provides flexibility in terms of adjusting the hedge position but also promotes diversification, an essential tenet of sound investment practice.

Cost Efficiency

Though there's a cost associated with setting up a hedge, the potential losses that one might incur without it, especially in highly volatile markets, often far exceed this initial outlay. Moreover, by locking in prices, especially in the case of commodities, businesses can ensure stable operational costs, leading to more predictable financial outcomes.

Enhanced Decision Making

With the safety net of a hedge in place, investors and businesses can make decisions with a clearer mind. The knowledge that potential losses are capped can lead to more assertive and strategic choices, which could prove beneficial in the long run.

In conclusion, while hedging does involve its set of complexities and is not devoid of costs, its benefits in terms of risk management are manifold. It provides investors with a tool to navigate the uncertainties of the market, ensuring that their hard-earned money is shielded from unforeseen adverse movements.

The limitations of this technique

Headgig can be an effective risk management tool. There are several limitations to hedge ratio, including:

-

Accuracy:

Hedge ratios are based on historical data and assumptions about market conditions. As a result, they may not accurately predict future market movements, making them less effective as risk management tools. -

Cost:

Hedging can be expensive, particularly if the underlying asset is volatile or if there are high transaction costs associated with buying and selling futures contracts. -

Liquidity:

In some markets, it may be difficult to find suitable futures contracts to hedge against the underlying asset, which can limit the effectiveness of the hedge. -

Correlation:

The hedge ratio assumes a constant correlation between the underlying asset and the futures contract. If this correlation changes, the effectiveness of the hedge can be reduced. -

Duration:

The hedge ratio assumes a fixed time horizon for the hedge. If the underlying asset's price movement exceeds the time horizon, the hedge may be less effective. -

Counterparty risk:

Hedging involves entering into a contract with a counterparty, which can expose the hedger to counterparty risk if the counterparty fails to meet its obligations. -

Regulatory constraints:

Certain regulations or policies may limit the use of hedging strategies or make them more costly to implement.

Types of Hedging Instruments

With hedging instruments, you can establish a position in the market that offsets potential losses in your investments. There are several types of hedging instruments available, each with its own advantages and applications. Here's a look at some of the primary ones:

-

Futures Contracts: Futures are standardized contracts that bind parties to buy or sell an asset at a predetermined price on a specified date in the future. They are frequently used as hedging tools because they offer a way to lock in a price today for a transaction that will occur in the future. The relationship between spot and futures prices plays a crucial role in determining the value of the hedge position using futures.

-

Options: Options give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a set time frame. They are a popular hedging instrument because they offer protection against adverse price movements while still allowing the investor to benefit from favorable price swings.

-

Forwards: Similar to futures, forwards are contracts that allow the buying or selling of an asset at a specified price on a set date. However, unlike futures, they are not standardized and can be tailored to fit the specific needs of the parties involved.

-

Swaps: Swaps are agreements between two parties to exchange cash flows or other financial variables associated with different assets. They are often used to hedge against interest rate or currency fluctuations.

-

Money Market Instruments: These are short-term debt instruments, like treasury bills or commercial paper, which can be used to hedge against interest rate risks.

-

Currency Forwards and Options: Specifically designed to protect against currency fluctuations, these tools allow companies and investors to lock in a currency rate for future transactions.

-

Commodity Hedging Tools: These are used by businesses and investors to protect against adverse movements in commodity prices. Given the volatile nature of commodities, determining the value of the hedge position becomes vital.

-

Hybrid Instruments: These combine features of the traditional instruments (like futures and options) to create new products tailored for specific hedging needs.

Optimal Hedge Ratio Calculator helps determine the proportion of the portfolio that should be hedged to minimize risk. It assists in identifying the right number of futures or options contracts to achieve the desired level of hedging. By using the optimal hedge ratio formula, you can calculate the hedge ratio that will minimize the portfolio's variance.

When establishing a portfolio that is hedged, it's crucial to select the right hedging instrument suited to the nature of the underlying risk. By using tools like the optimal hedge ratio calculator, investors can calculate hedge ratios and make more informed decisions about how to best protect their investments. Proper hedging not only shields assets but also ensures that the portfolio is optimally positioned to capitalize on market opportunities.

FAQ

What does hedge mean?

Hegde is a method of decreasing the risk of high loss from investment at the expense of the value of future profits.

Hedging is most commonly used for securing currency fluctuations since an unexpected drop in currency value may change a profit into a loss.

What does a hedging portfolio mean?

The process of hedging a portfolio is an action of adjusting an overall level of risk you are willing to take.