Intrinsic Value Calculator

Beyond Market Prices: Discover Real Value of Stocks with the Modernized Ben Graham Formula

Table of Contents

- Understanding Intrinsic Value

- What is Intrinsic Value?

- Importance in Investment Decisions

- The Ben Graham Formula

- Original Ben Graham's Formula

- The Revised Formula

- How the Tool Works

- Step-by-Step Calculation

- Assumptions and Inputs

- Calculating Margin of Safety

- Understanding Margin of Safety

- Tool’s Calculation of Margin of Safety

- Practical Application

- Examples and Case Studies

- Interpreting the Results

- Limitations of the tool

- Limitations of the Ben Graham Formula

- Using the Tool Strategically

- Conclusion

Ever wondered how to figure out what a stock is really worth? That's where the concept of intrinsic value comes in, and it's a game-changer in the world of stock investments. It's all about understanding the true, underlying value of a stock, separate from its current market price.

Now, meet our handy tool, based on the revised Ben Graham formula. This isn't just any formula; it's a time-tested approach revamped for today's market. Ben Graham, often called the father of value investing, created a method to calculate the intrinsic value of a stock, and our tool brings his wisdom into the modern age.

Understanding Intrinsic Value

What is Intrinsic Value?

Intrinsic value in stock investing is like finding a diamond in the rough. It's the real value of a company's stock, based on fundamentals, like earnings, dividends, and growth potential, not just what the ticker says on the stock market. It’s about what a company is genuinely worth if all the market noise was stripped away.

Importance in Investment Decisions

Why bother with intrinsic value? Because it's the North Star for smart investing. It helps you figure out if a stock is undervalued (a bargain to snap up) or overvalued (potentially overpriced). Knowing the intrinsic value is key to making informed, savvy investment choices.

Ben Graham's original formula was a pioneering effort to quantify intrinsic value. It considered factors like earnings per share and a conservative growth rate. However, as the investment world evolved, so did his formula. The revised version, which our tool uses, adjusts for modern market conditions, offering a more current perspective on a stock's true value. It’s like having a classic map, but with GPS-level precision for today’s financial landscape.

The Ben Graham Formula

In this section, let's dive into the nuts and bolts of the revised Ben Graham formula, understanding its evolution from the original and its current components that make it so effective for today’s investors.

Original Ben Graham's Formula

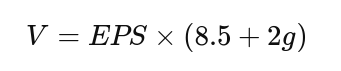

Ben Graham's original formula, developed in the mid-20th century, was a pioneering attempt to value stocks based on fundamentals. It looked something like this:

where V is the intrinsic value, EPS is the earnings per share, and g is the expected annual growth rate (in percent) of the company for the next 7 to 10 years. The number 8.5 represented the P/E base for a no-growth company, and the growth rate was factored in with a multiplier.

The Revised Formula

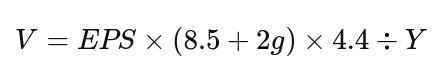

The investing landscape has dramatically changed since Graham's time. The revised formula accounts for these changes, particularly in terms of higher overall market P/E ratios and lower interest rates. The updated formula typically looks like this:

Here, Y represents the current yield of 20-year AAA corporate bonds, and the multiplier 4.4 was the average yield of high-grade corporate bonds at the time of Graham’s writing. This adjustment aligns the formula with modern market conditions, providing a more realistic valuation in today's context.

The tool uses this revised formula, requiring inputs like:

- Earnings Per Share (EPS): Current EPS of the stock.

- Growth Rate (g): Expected annual growth rate of the company’s earnings.

- Current Yield of AAA Corporate Bonds (Y): Reflects the current market interest rates.

By inputting these values, the tool computes the intrinsic value of a stock, offering investors a more accurate picture of what a stock is worth beyond its market price. It's a blend of Graham’s time-tested wisdom with a modern twist to suit today’s investment landscape.

How the Tool Works

Now let's break down how this tool works its magic in calculating the intrinsic value of stock using the revised Ben Graham formula. Here's your step-by-step guide:

Step-by-Step Calculation

-

Enter the Earnings Per Share (EPS): You start by inputting the current EPS of the stock you're interested in. This figure represents the company's profitability on a per-share basis.

-

Input the Expected Growth Rate (g): Next, you'll need to provide the expected annual growth rate of the company's earnings. This is a projection of how much the company's earnings are anticipated to grow each year.

-

Insert the Current Yield of AAA Corporate Bonds (Y): This reflects the prevailing market interest rates. It's used to adjust the formula to current market conditions.

-

Calculation by the Tool: The tool takes these inputs and plugs them into the revised Ben Graham formula to calculate the intrinsic value of the stock.

-

Comparison with Current Stock Price: Finally, the calculated intrinsic value is compared with the current stock price. This comparison helps you understand if the stock is undervalued (intrinsic value > current stock price) or overvalued (intrinsic value < current stock price).

Assumptions and Inputs

The tool assumes that the inputs provided are accurate and reflective of the current market conditions. Accurate EPS and growth rate figures are crucial for a reliable calculation. The bond yield is typically updated within the tool to reflect current rates.

Calculating Margin of Safety

Understanding Margin of Safety

The margin of safety is a fundamental concept in investment, essentially acting as a buffer against errors in calculation or unexpected market fluctuations. It's the difference between the intrinsic value of the stock and its current price.

Tool’s Calculation of Margin of Safety

- Determination of Intrinsic Value: First, the tool calculates the intrinsic value of the stock using the revised formula.

- Comparison with Current Stock Price: The tool then compares this intrinsic value to the stock's current market price.

- Margin of Safety Calculation: The margin of safety is calculated as the percentage difference between the stock's intrinsic value and its current price. A larger margin suggests a safer investment.

Practical Application

Examples and Case Studies

- Example 1: Tech Stock Evaluation: Imagine evaluating a popular tech stock. By inputting its EPS, a projected growth rate, and the current bond yield, you can determine if the stock is a bargain at its current price.

- Example 2: Diversifying Portfolio: When looking to diversify your portfolio with a mix of industries, use the tool to assess the intrinsic value of stocks in different sectors, ensuring a balanced and value-driven selection.

Interpreting the Results

Investors should use the results as a guide to identify potentially undervalued stocks. A stock with a significant margin of safety might be a good buy, while one with a small or negative margin might warrant caution.

Limitations of the tool

Limitations of the Ben Graham Formula

- Market Volatility: The formula doesn’t account for short-term market volatility.

- Growth Rate Projections: Future growth rate projections can be speculative and affect the accuracy of the calculated intrinsic value.

Using the Tool Strategically

- Part of a Broader Strategy: This tool should be one component of a broader investment strategy, supplemented by other forms of analysis like technical analysis, sector trends, and economic forecasts.

- Regular Reviews: Regularly revisit your calculations as market conditions and company fundamentals change.

Conclusion

The intrinsic value calculator based on the revised Ben Graham formula is a powerful tool for any investor's arsenal. It provides a grounded approach to evaluating the true value of stocks, helping you to make informed decisions in your investment journey. Remember, while no tool can guarantee success in the stock market, using this calculator can significantly enhance your ability to identify potential investment opportunities and make well-reasoned choices. So go ahead, incorporate it into your investment analysis process, and step up your investing game with confidence and insight.