Yield to Call Calculator

Mastering Yield to Call With Calcopolis

Table of Contents

- Understanding Yield to Call

- What is Yield to Call?

- Differences from Yield to Maturity (YTM)

- Significance for Bond Investors

- Calculating Yield to Call

- The Yield to Call Formula

- Yield to Call Calculation Example

- Yield to Call Calculator: A Tool for Investors

- Preparing for a Bond Call

- Understanding a Bond Call for Investors

- Strategies for Preparing for a Bond Call

- Importance of Regular YTC Calculation

- Understanding the Difference: Yield to Call vs. Yield to Worst

- Yield to Call (YTC)

- Yield to Worst (YTW)

- Key Differences

- Conclusion

- Related Tools

Yield to Call (YTC) is a vital metric for investors dealing with callable bonds. Unlike traditional bonds, callable bonds offer the issuer the right to redeem the bond before its maturity date, a feature that significantly influences an investor's return. Grasping the concept of YTC is essential for any investor who wants to navigate the complexities of callable bonds effectively.

Understanding Yield to Call

What is Yield to Call?

Yield to Call is a financial term used to describe the total return expected on a bond until the call date, assuming it will be called away by the issuer. This calculation is crucial for callable bonds, which can be redeemed by the issuer before their maturity date at a specified call price.

Differences from Yield to Maturity (YTM)

While Yield to Maturity (YTM) calculates the total return if the bond is held until it matures, YTC focuses on the bond's return if it's called at an earlier date. This distinction is critical because the call feature often leads to a different yield than what would be expected if the bond were held to maturity, especially in fluctuating interest rate environments.

Significance for Bond Investors

YTC becomes particularly significant in environments where interest rates are volatile. Investors need to be cognizant of the YTC to understand the best- and worst-case scenarios for their bond investments, as the issuer's decision to call the bond will be influenced by interest rate movements.

Calculating Yield to Call

The Yield to Call Formula

Calculating YTC requires understanding its formula and the variables involved. The basic formula for YTC is:

- Annual Coupon Payment: Determine the bond’s annual coupon payment.

- Call Price: Identify the price at which the issuer can call the bond.

- Current Price: Note the current market price of the bond.

- Years to Call: Calculate the number of years until the call date.

- Insert Values: Plug these values into the YTC formula.

Each variable in the YTC formula plays a crucial role. The call price reflects the amount the investor will receive if the bond is called. The annual coupon payment influences the ongoing return from the bond. The current price of the bond affects the potential gain or loss if the bond is called, and the time until the call date determines the duration of the bond's holding period. Understanding these variables is essential for an accurate calculation of YTC, allowing investors to assess their potential returns realistically.

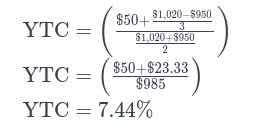

Yield to Call Calculation Example

To understand how to calculate the yield to call, let's consider a practical example. Imagine you are a bondholder of a callable bond with the following characteristics:

- Face Value: $1,000

- Annual Coupon Rate: 5%

- Current Market Price: $950

- First Call Date in 3 Years: The bond can be called at 102% of its face value.

Given this information, let's break down the calculation:

-

Calculate the Annual Coupon Payment:

-

Determine the Call Price:

-

Use the Yield to Call Formula:

So, the yield to call for this bond, if called at the first call date, is approximately 7.44%.

Yield to Call Calculator: A Tool for Investors

The Yield to Call Calculator is a digital tool designed to simplify this complex calculation. It's designed for investors who need a quick and accurate way to calculate the yield to call on their callable bonds.

This calculator typically includes features that enhance the user's understanding and experience:

- Adjustable Inputs: Allows users to input different bond prices, face values, coupon rates, and first call dates.

- Real-Time Calculations: Updates the yield to call instantly as input values change.

- Rate of Return Visualization: Some calculators may provide graphical representations of the bond yield over time, depending on various factors.

- Educational Resources: Often includes tips or guides on how to interpret and use the calculated rate of return.

Whether calculating the yield to call manually or using a digital calculator, understanding this metric is crucial for bondholders to assess their potential returns and make informed investment decisions. The Yield to Call Calculator serves as a valuable asset in any investor’s toolkit, providing clarity and insight into the often complex world of bond investments.

Preparing for a Bond Call

Understanding a Bond Call for Investors

A bond call occurs when the bond issuer decides to redeem the bond before its maturity date. This is typically done when interest rates have fallen since the bond was issued, allowing the issuer to refinance its debt at a lower rate. For investors, a bond call means that the bond will cease to generate income earlier than expected, and the principal will be returned at the call price, which is often close to the face value of the bond. It's important to note that the value of the bond at the time of the call might differ from its present value or purchase price.

Strategies for Preparing for a Bond Call

-

Reinvestment Planning: Investors should have a strategy for reinvesting the principal received from a called bond. This might involve finding other investment vehicles offering similar returns or adjusting to current market conditions.

-

Portfolio Diversification: To mitigate the risk of income loss from bond calls, investors should diversify their portfolio. This includes investing in a mix of bonds with different maturities, yields, and call provisions, as well as other types of assets.

-

Regular Use of a YTC Calculator: Regularly calculating the Yield to Call of bonds using a YTC calculator helps investors stay informed about the potential return of their investments and the likelihood of a bond being called. This foresight can be crucial in making timely portfolio adjustments.

Importance of Regular YTC Calculation

Regular calculation of YTC is essential for monitoring the performance and potential of callable bonds in an investment portfolio. It gives investors a clearer picture of the present value and potential future value of their bond investments. Understanding the YTC helps in assessing the risk that the bond issuer might exercise their call option, and the impact it would have on the investment's returns.

Understanding the Difference: Yield to Call vs. Yield to Worst

Yield to Call (YTC)

As previously discussed, Yield to Call (YTC) is a measure used in bond investments to calculate the expected return on a callable bond if the issuer exercises their option to redeem it before its maturity date. It's an important metric for investors holding callable bonds, as it provides insight into the potential early return of the investment.

Yield to Worst (YTW)

Yield to Worst (YTW), on the other hand, is a measure that calculates the lowest potential yield that can be received on a bond without the issuer actually defaulting. YTW is considered in bonds that have multiple potential outcomes, such as those with several call dates, put options, or other features. It's essentially the worst-case scenario for yield, taking into account every possible call or redemption date.

Key Differences

-

Scope of Calculation:

- YTC: Focuses specifically on the scenario where the bond is called before maturity.

- YTW: Considers all possible outcomes (including call, put, and maturity dates) and identifies the lowest yield among them.

-

Purpose and Usage:

- YTC: Useful for understanding the specific return if the issuer redeems a callable bond early.

- YTW: Provides a comprehensive view of the bond's yield under the worst-case scenario. It's a conservative measure often used by risk-averse investors.

-

Investor Expectation:

- YTC: An investor uses YTC to gauge potential returns in an environment where interest rates may lead the issuer to call the bond.

- YTW: Investors use YTW to understand the minimum yield they can expect from a bond, considering all negative contingencies (except default).

-

Interest Rate Environment:

- YTC: More relevant in a declining interest rate environment where the chances of a bond being called are higher.

- YTW: Important in any interest rate environment as it provides the floor for the bond’s yield.

So, while Yield to Call is a specific measure focused on the return if a bond is called before maturity, Yield to Worst is a broader measure that calculates the lowest possible yield considering all potential early redemption scenarios. Both metrics are essential for bond investors to understand and assess the risk and potential return of their bond investments.

Conclusion

The concept of Yield to Call is fundamental for anyone invested in or considering callable bonds. It provides a comprehensive view of the potential returns of a bond investment, considering the possibility of the bond being called before its maturity.

The use of a YTC calculator simplifies this complex calculation, making it an essential tool for any investor's toolkit. By regularly calculating YTC and preparing for the possibility of a bond call through strategic reinvestment and diversification, investors can better navigate the uncertainties of bond investing and optimize their portfolio's performance.

Understanding and utilizing YTC effectively allows for more informed and strategic investment decisions, ultimately leading to better financial outcomes.

Related Tools

Yield to Maturity (YTM) Calculator: Calculates the total return expected on a bond if it is held until maturity.

Bond Price Calculator: Helps determine the current market price of a bond based on its coupon rate, maturity, and the market interest rate.

Bond Yield Calculator: Calculates the current yield of a bond, which is the annual income (interest or dividends) divided by the current price of the security.