Reverse Sales Tax Calculator

Guide how to reverse sales tax.

Breaking down the gross price can be a complex task, but tools like the reverse sales tax calculator by CalcoPolis can help.

You can use it to figure out the price before taxes and the tax value, provided that you have the gross amount and the local sales tax percentage.

How to Reverse Sales Tax?

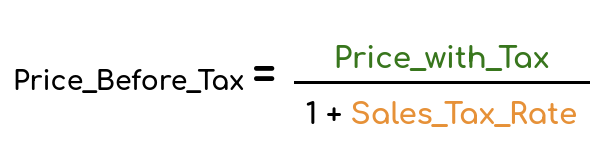

The CalcoPolis reverse sales tax calculator relies on a simple formula to extract the pre-tax price from the gross amount:

Meanwhile, the sales tax rate itself is calculated by dividing the sales tax percentage by 100.

For instance, you might come across a product that costs $2,090 as a gross amount in a region with a local sales tax of 4.5%. Using the rate (0.045) in the first equation, you can find that the actual price without tax is $2000.

Similarly, a gross of $52.25 in the same region would reverse to $50 without the sales tax.

However, the reverse sales tax calculator does all the math for you with a few clicks, so you don’t have to worry too much about the equations and conversions.

All in all, the tool’s interface is rather intuitive, but if you’re not sure how to use it yet, you can check out these three simple steps:

Set up the Calculation Mode

First, you’ll need to check that the calculator is set to “gross to net.”

If you use the “net to gross” mode, the tool will add the sales tax percentage to the amount instead of breaking the gross to net and tax.

Fill in the Blank Spots

Next, you’ll need to fill the first two slots with the gross amount (price with tax) in the first one and the sales tax (as a percentage) in the second.

Just note that you don’t have to calculate the rate here at all. The percentage alone will do the trick.

Of course, that exact percentage varies from one state to the other. So, you’ll need to check which local sales tax applies to your business before completing this step.

Check the Results

Once you’re done filling in the info, you can press “calculate” to see the results.

In the “net value” slot, you’ll get the price without the sales tax. Under this slot, you’ll see “tax amount.” That’s the exact tax value that you would have to collect from the customer on top of the product’s price.

Possible Applications for the Reverse Sales Tax Calculator

So, now you know how to use the CalcoPolis reverse sales tax calculator, but when would you actually need to use it?

Let’s check out the top applications for small businesses.

Finding the Price Before Sales Tax

Sometimes, customers prefer to find out what a certain product costs pre-tax to break down the price tag.

However, if you’re a new business owner, you’ll also need to figure out the price before tax for the end product you’re selling to be able to calculate your revenues accurately.

Of course, if you know that exact sales tax value, the process should be a breeze. You’ll just subtract it from the gross amount to get the net. However, since most people only know the local percentage, tools like the reverse calculator can take the guesswork out of the equation.

Finding the net invoice amount

Another reason to use the reverse sales tax calculator is to figure out the amount you’ll need to put on the net invoice.

Why would you even need to issue a net invoice instead of a gross invoice in the first place?

Well, remember that some companies (charitable, religious, educational, or governmental) can be tax-exempt. So, if you’re selling a product or a taxable service to one of those entities, you might need to give them a net invoice covering the cost without the sales tax.

Just keep in mind that you’ll need to check the validity of the company’s exemption certificate and keep a copy on record. Otherwise, you might have to shoulder the sales tax yourself in an audit.

In other cases, a customer could show you a reseller’s permit or a resale certificate. This means they could be exempt from sales taxes under the “purchase for resale” band as long as they don’t use the product themselves and tax the end consumer instead.

Reversing the Tax and Applying a New Value of Sales Tax

Since sales taxes vary on both state and local levels, the reverse tax calculator can come in handy for companies with more than one location.

However, that’s not the only reason to reverse gross to net and apply a new sales tax.

Suppose that you live in a region with destination-based tax rules, and you’re conducting an out-of-state transaction. In that case, you’ll need to readjust the gross amount by shifting the sales tax percentage based on where your customer is, not where your business is located.

Here’s how you can do that:

- Use the CalcoPolis reverse sales tax calculator in the “gross to net” mode as usual and note down the “net value.”

- Shift the calculation mode to “net to gross.”

- Fill in the first slot with the “net value” that you noted down earlier.

- Check the new local sales tax percentage you need to apply and enter it in the “tax” slot.

- Click “recalculate” to see the new price in the “gross value” slot.