Install CalcoPolis as App Add Calcopolis icon to homescreen and gain quick access to all calculators. Click here to see how »

Unlock the True Cost of Borrowing with Calcopolis: Your Ultimate APR Calculator

Table of Contents

- What is APR?

- How APR Differs from Interest Rate

- Why APR is a Crucial Factor in Loan Comparison

- Input Fields

- Loan Amount

- Interest Rate

- Period

- Installment Type (Fixed or Decreasing)

- Origination Fee

- Extra Monthly Charges

- Repayment Frequency

- Differences in APR Calculation in the EU and US

- Overview of APR Calculation in the US

- Overview of APR Calculation in the EU

- Why the EU Formula is Better

- Summary

- Final Tips for Potential Borrowers:

- Related tools

When it comes to borrowing money, understanding the cost of a loan is crucial. One of the most important factors to consider is the APR, or Annual Percentage Rate.

The APR represents the total cost of borrowing, including not just the interest rate but also any additional fees and charges associated with the loan. Knowing the APR helps you make informed decisions and compare different loan offers effectively.

We created this tool to assist potential borrowers in understanding and calculating their APR. This APR Calculator allows you to input various details about the loan to get a clear picture of the true cost of borrowing. By using this tool, you can ensure that you are getting the best possible deal on your loan.

What is APR?

The Annual Percentage Rate (APR) is a comprehensive measure of the cost of borrowing that includes not only the interest rate but also any additional fees and charges associated with the loan. It is expressed as a yearly percentage rate, giving borrowers a clear understanding of the total cost they will incur over the life of the loan.

How APR Differs from Interest Rate

While the interest rate is the cost of borrowing the principal amount of the loan, the APR includes other costs such as origination fees, broker fees, and other charges. The interest rate only reflects the cost of borrowing the money, while the APR provides a more complete picture of the overall cost of the loan.

Why APR is a Crucial Factor in Loan Comparison

Understanding the APR is essential when comparing loan offers from different lenders. While one loan might have a lower interest rate, it could have higher fees, leading to a higher APR. By comparing APRs, borrowers can accurately assess which loan is more cost-effective. This comprehensive view helps in making informed financial decisions, ensuring that you do not overlook any hidden costs associated with borrowing.

By using tools like our calculator, you can input various details about your loan, including the loan amount, interest rate, loan period, installment type, origination fee, extra monthly charges, and repayment frequency. This helps you see a clear and complete picture of your loan's cost, making it easier to compare different loan options and choose the best one for your financial situation.

Input Fields

To accurately calculate the APR of a loan using the Calcopolis APR Calculator, you need to understand and input several key pieces of information. Each of these fields plays a crucial role in determining the true cost of borrowing.

Loan Amount

The loan amount is the total sum of money that you borrow from a lender. It is the principal amount that you will need to repay over time, along with any interest and fees.

The loan amount directly influences the APR because it serves as the basis for calculating interest and fees. A higher loan amount might lead to higher total interest payments, but the APR will also reflect how fees spread over the loan term. A smaller loan amount with high fees can result in a higher APR, showing the cost efficiency of the loan.

Interest Rate

he interest rate is the percentage charged on the loan amount by the lender. It is the cost of borrowing the principal and is typically expressed as an annual percentage.

Fixed vs. Variable Interest Rates

- Fixed Interest Rates: These rates remain constant throughout the loan term. This provides predictability in payments, as the interest rate and monthly installment amounts do not change.

- Variable Interest Rates: These rates can fluctuate over the loan period based on changes in market interest rates. While they can start lower than fixed rates, they come with the risk of increasing, potentially leading to higher payments in the future.

Period

The loan period, or loan term, is the duration over which the loan is repaid. It is typically measured in months or years.

A longer loan period generally results in lower monthly payments but can increase the total interest paid over the life of the loan. Conversely, a shorter loan period increases monthly payments but reduces the total interest cost. The APR will reflect these dynamics, helping borrowers understand the overall cost implications of different loan terms.

Installment Type (Fixed or Decreasing)

Fixed installments mean that the borrower pays the same amount every repayment period throughout the loan term. This type of installment makes budgeting easier as the payment amount remains consistent.

Decreasing installments start higher and gradually decrease over time. This happens because the interest is calculated on the remaining loan balance, which decreases with each payment.

Pros and Cons of Each Installment Type

-

Fixed Installments:

- Pros: Predictable payments, easier to budget.

- Cons: May end up paying more in interest over the loan term compared to decreasing installments.

-

Decreasing Installments:

- Pros: Total interest paid over the loan term is usually lower.

- Cons: Higher initial payments, which may be challenging for some borrowers.

Origination Fee

An origination fee is a charge by the lender for processing the loan. It is usually a percentage of the loan amount.

The origination fee is calculated as a percentage of the loan amount and is often deducted from the loan disbursement. This fee increases the APR because it is a cost that must be paid in addition to the interest on the loan.

Extra Monthly Charges

Extra monthly charges can include costs such as insurance, service fees, maintenance fees, or other recurring charges required by the lender.

Including these extra charges in the APR calculation is essential for an accurate reflection of the loan's total cost. These charges can significantly impact the APR, making it higher than just the interest rate alone.

Repayment Frequency

Common Repayment Frequencies

- Monthly: Payments are made once a month.

- Bi-weekly: Payments are made every two weeks.

- Weekly: Payments are made every week.

The repayment frequency can affect the total interest paid over the life of the loan. More frequent payments (such as bi-weekly or weekly) can reduce the total interest because the principal balance decreases faster. This can result in a slightly lower APR compared to less frequent payments.

By understanding these input fields and accurately entering them into the Calcopolis APR Calculator, borrowers can get a precise calculation of their loan's APR, helping them to make well-informed financial decisions.

Differences in APR Calculation in the EU and US

Understanding the differences in how APR is calculated in the EU and the US is crucial for borrowers, as these variations can significantly affect the perceived cost of a loan. The EU's formula is often considered more comprehensive and transparent, providing a clearer picture of the total borrowing cost.

Overview of APR Calculation in the US

In the US, the calculation of APR is regulated by the Truth in Lending Act (TILA), which mandates lenders to disclose the APR to borrowers. The APR includes the interest rate and certain fees associated with the loan, providing a standardized way for consumers to compare different loan offers.

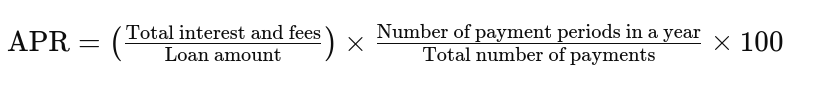

Simplified Explanation of the US Formula The US APR calculation includes:

- The interest rate charged on the loan

- Some fees, such as origination fees and certain closing costs

However, not all costs are included in the APR calculation. For example, fees like late payment penalties, optional insurance, and certain administrative fees may be excluded. The formula used is:

This formula provides an annualized percentage rate but may not account for all costs, potentially underrepresenting the true cost of borrowing.

Overview of APR Calculation in the EU

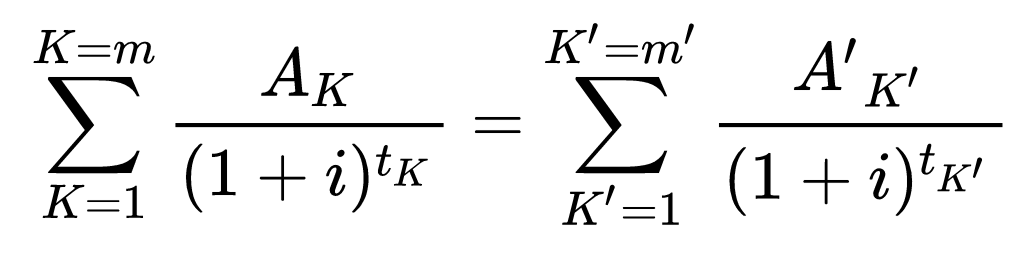

The EU formula for calculating the Annual Percentage Rate (APR) is detailed and comprehensive, ensuring that all costs associated with a loan are included. This formula, as mandated by the Consumer Credit Directive, provides a clear and accurate picture of the total cost of borrowing. The formula is:

The formula used in the EU is more detailed and includes all compulsory costs, ensuring a more accurate reflection of the loan's total cost. The formula is:

where:

- – The number of each loan disbursement,

- – The number of each loan repayment installment or fee payment,

- K – The amount of loan disbursement K,

- K' – The amount of loan repayment installment or fee payment K′,

- ∑ – The sum of all terms,

- m – The number of the last loan disbursement,

- m′ – The number of the last loan repayment installment or fee payment,

- K – The period, expressed in years or fractions of a year, between the date of the first loan disbursement and the date of disbursement K (where t1=0),

- tK′ – The period, expressed in years or fractions of a year, between the date of the first loan disbursement and the date of repayment installment or fee payment K′,

- – The annual percentage rate (APR).

This formula accounts for all loan disbursements and repayments over time, discounting them back to their present value using the APR i. By considering every cash flow associated with the loan, this method ensures that the APR reflects the true cost of borrowing, including interest, fees, and other charges, spread over the term of the loan. This comprehensive approach makes it easier for consumers to compare different loan offers and understand the full financial impact of their borrowing decisions.

Why the EU Formula is Better

The EU formula is superior because it includes all mandatory costs associated with the loan. This comprehensive approach ensures that borrowers are not surprised by hidden fees or unexpected charges.

By including all costs, the EU formula provides a more accurate reflection of the total borrowing cost. This helps borrowers understand exactly how much they will pay over the life of the loan, enabling better financial planning and decision-making.

The EU formula's thoroughness makes it easier for consumers to compare different loan offers. Since all costs are included in the APR, borrowers can confidently compare the true cost of various loans, leading to more informed choices. Additionally, the increased transparency builds trust between lenders and borrowers, fostering a healthier financial environment.

While both the US and EU have standardized methods for calculating APR, the EU's approach is more inclusive and accurate, offering significant advantages for borrowers. Using tools like the Calcopolis APR Calculator can help you understand these differences and make the best financial decisions when borrowing money.

Summary

Understanding the APR is essential for anyone looking to borrow money. The APR gives a comprehensive view of the true cost of a loan, including interest rates and all associated fees. This knowledge helps borrowers make informed decisions, ensuring they choose the most cost-effective loan option available.

Using the Calcopolis APR Calculator allows you to easily input all relevant details about your loan and receive an accurate calculation of your APR. This tool simplifies the complex process of determining the total cost of a loan, helping you to compare different offers effectively.

Final Tips for Potential Borrowers:

- Always Compare APRs: When evaluating loan offers, look beyond the interest rate and compare the APRs to get a true sense of the total cost.

- Consider All Costs: Remember to include all fees and charges, such as origination fees, administrative fees, and any additional monthly charges, to get an accurate APR.

- Understand Repayment Terms: Be clear about the repayment frequency and how it affects your total interest payments and APR.

- Check for Transparency: Choose lenders who are transparent about all the costs associated with the loan to avoid hidden fees.

- Use Reliable Tools: Utilize tools like the Calcopolis APR Calculator to make the calculation process easier and more accurate.

By understanding and using APR effectively, you can make better financial decisions and ensure that the loans you choose are the best fit for your financial situation.

Use the Calcopolis to guide your borrowing decisions, and you'll be well on your way to managing your finances wisely.

Related tools

- Down Payment Calculator - Check if you meet mortgage requirements by calculating the necessary down payment.

- LTV Calculator - Determine your Loan to Value ratio to understand your borrowing power.

- Installments Type Calculator - Decide between fixed or decreasing installment types for your loan.

- Creditworthiness Calculator - Find out which house you can afford based on your financial situation.

- Loan Comparison Calculator - Compare multiple loan offers and choose the best one for your needs.

- Car Loan Calculator - Analyze the cost of buying your dream car with a loan.

- Mortgage Calculator - Discover how to finance your dream house and calculate your mortgage payments.