Install CalcoPolis as App Add Calcopolis icon to homescreen and gain quick access to all calculators. Click here to see how »

Which installment type should you choose: fixed or decreasing?

Table of Contents

- Understanding Loan Installment Types

- Fixed Installment

- Decreasing Installment

- Which One To Choose?

- Features of Our Calculator

- Choosing the Right Installment Type for Your Needs

- For Long-term Savers

- For Immediate Affordability

- Considering Additional Costs

- Real-world Scenarios and Case Studies

- Case Study 1:

- Case Study 2:

- Full Example:

- Conclusion

Choosing the right mortgage type is a critical factor that can significantly influence your financial wellbeing over for several decades!

With a myriad of loan options available, each with its own set of rules and repayment strategies, navigating through the choices to find the one that best aligns with your financial goals and circumstances can seem daunting. This decision not only affects how much you pay monthly but also the total interest over the life of the loan, impacting your overall financial planning and budgeting.

To aid in this crucial decision-making process, we created this online calculator which lets you to compare the costs associated with different types of loan installments - primarily focusing on fixed and decreasing installments.

This tool is engineered to demystify the complexities surrounding mortgage loans, providing a clear, concise comparison that takes into account not just the basic loan parameters such as interest rates and term lengths, but also additional costs like commissions and mandatory monthly payments. By offering a detailed breakdown in the form of tables and charts, the calculator equips you with the knowledge to make an informed choice tailored to your unique financial situation.

Understanding Loan Installment Types

Before delving into the specifics of how the calculator can benefit you, it’s essential to understand the installment types it compares.

Fixed Installment

These loans maintain a consistent monthly payment throughout the term of the loan.

The predictability of fixed installments is particularly appealing for those who prioritize budget stability, as it ensures the monthly payment amount remains unchanged despite fluctuating interest rates. This consistency aids in long-term financial planning, as you know exactly how much you need to allocate for your mortgage payment each month.

Decreasing Installment

In contrast, decreasing installment loans feature payments that start higher but gradually decrease over the term of the loan.

This structure reflects the decreasing interest component as you progressively pay off the principal. Opting for a decreasing installment could be advantageous for those expecting their income to increase over time, allowing them to comfortably handle larger payments initially in exchange for lower payments in the future.

Which One To Choose?

Comparing fixed and decreasing installment loans reveals a trade-off between stability and potential long-term savings.

Fixed installments offer the peace of mind that comes with knowing your payment amounts will not change, making it easier to manage your monthly budget.

On the other hand, decreasing installment loans may result in lower total interest paid over the life of the loan, as the amount of interest decreases with the gradually reducing principal balance.

However, the choice between fixed and decreasing installments isn't one-size-fits-all; it hinges on personal financial situations, future income expectations, and individual preferences towards risk and stability. This is where the online calculator plays a pivotal role, offering a personalized analysis to help first-time mortgage seekers navigate these options with clarity and confidence.

Features of Our Calculator

The online calculator is ingeniously designed to demystify the financial nuances of your mortgage options. Here's a streamlined overview of its features:

-

Interest Rate Analysis: Quickly understand how different interest rates affect your mortgage, helping you forecast the cost implications of rate fluctuations.

-

Loan Term Adjustability: Experiment with various loan durations to see their impact on your payment structure and interest accumulation, allowing for tailored financial planning.

-

Extra Costs Analysis: It uniquely accounts for all associated costs, including commissions and mandatory payments, offering a full spectrum of your financial commitment.

-

Detailed Reporting: Access to in-depth reports that outline your payment timeline and interest payments.

-

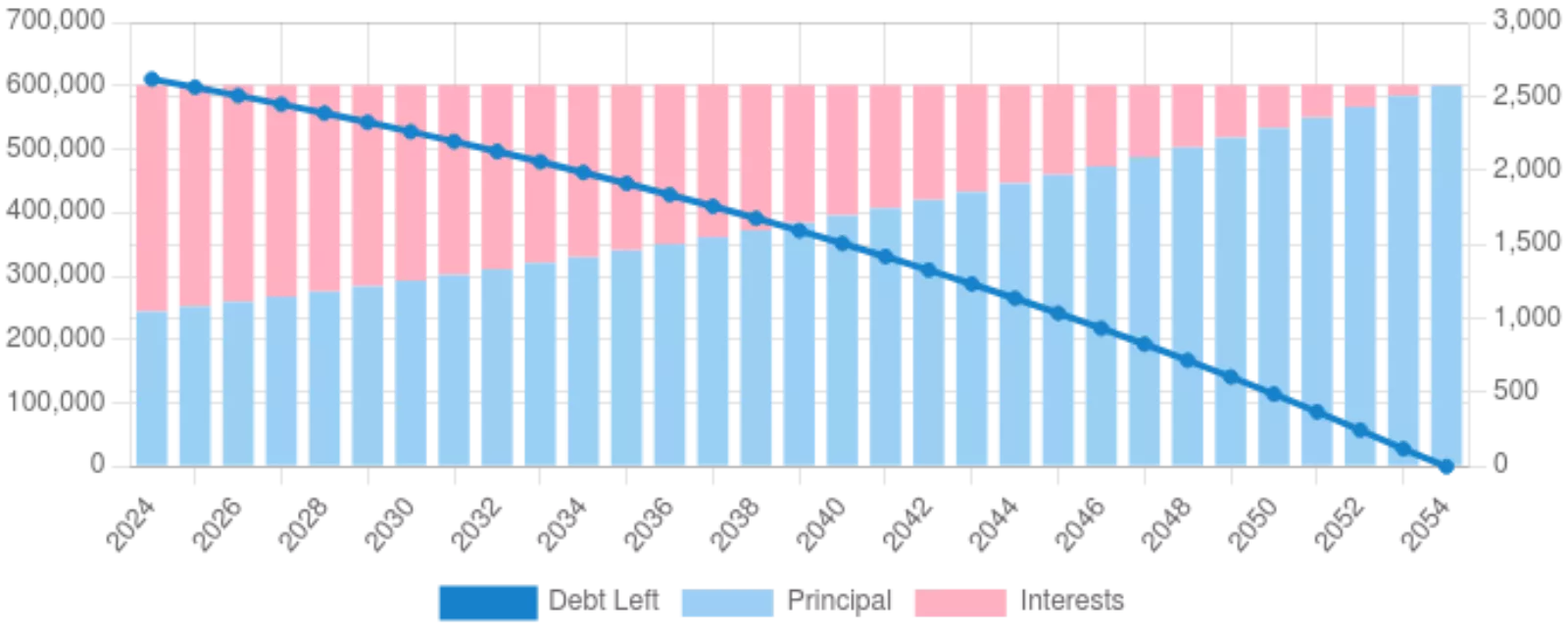

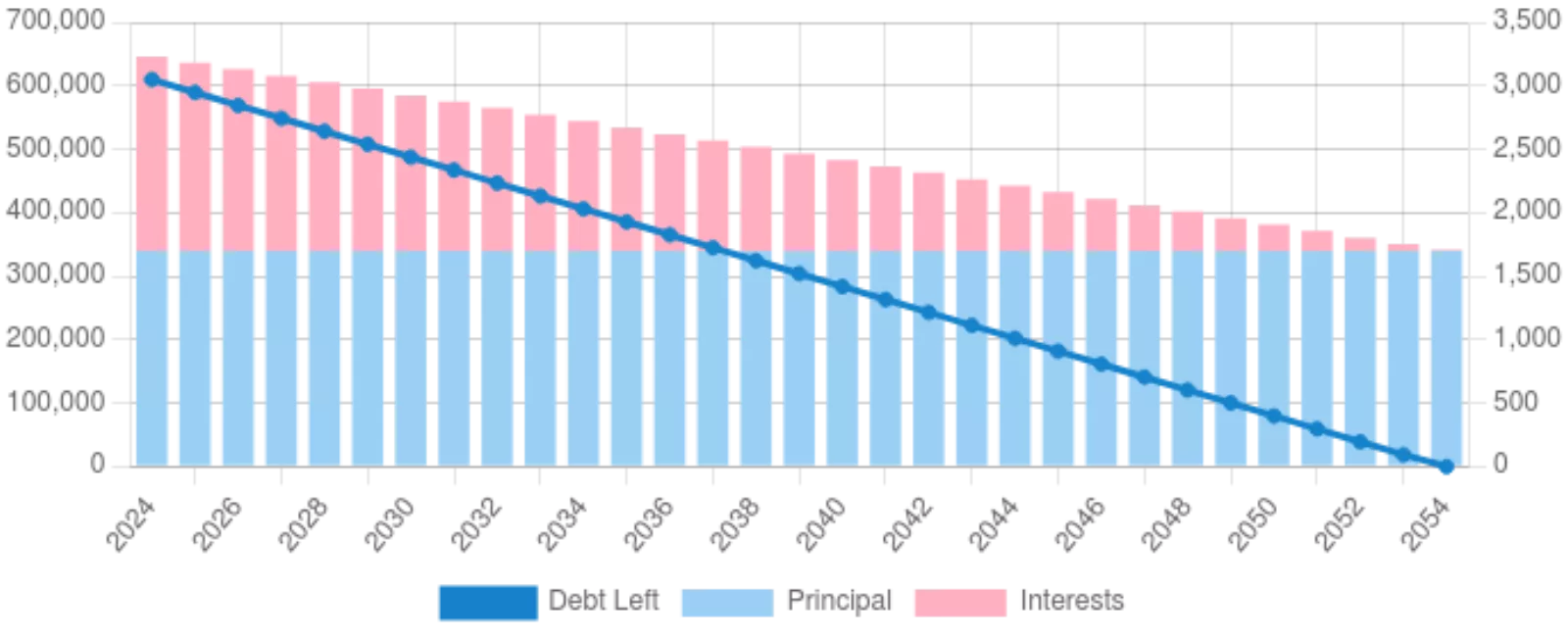

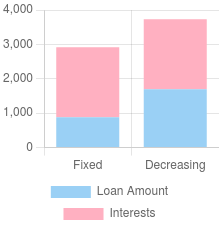

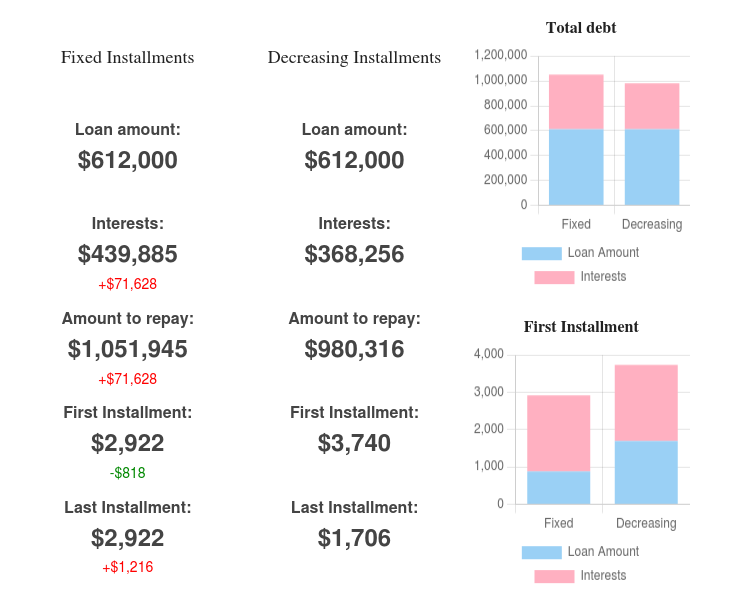

Visual Comparisons: Utilizes tables and charts for a clear, comparative view of fixed versus decreasing installment plans, enhancing decision-making through visual aids.

Choosing the Right Installment Type for Your Needs

When it comes to selecting the optimal installment plan for your mortgage, understanding your financial priorities is key. Here’s how to align your loan structure with your long-term financial goals:

For Long-term Savers

If minimizing total interest paid over the life of your loan is your top priority, decreasing installment loans might be your best bet.

These loans are structured to reduce the interest component faster than fixed installment loans, potentially saving you a significant amount in the long run. This option is particularly attractive for borrowers who anticipate a stable or increasing income, enabling them to comfortably manage the initially higher payments that gradually decrease over time.

For Immediate Affordability

Borrowers prioritizing manageable, consistent monthly payments will find fixed installment loans more appealing.

This structure ensures your monthly payment remains unchanged throughout the loan term, providing predictability and ease in budgeting. It's an ideal choice for those who value financial stability and prefer a straightforward approach to their mortgage payments.

Considering Additional Costs

An often-overlooked aspect of choosing a loan is the additional costs, such as commissions and mandatory fees, which can significantly affect the overall cost of your loan.

Our calculator factors in these costs, offering a holistic view of your financial commitment. This feature is invaluable for making an informed decision that accounts for all potential expenses, not just the principal and interest.

Real-world Scenarios and Case Studies

To illustrate the practical benefits of using the online calculator, let’s explore how different users leveraged it to make informed decisions:

Case Study 1:

John, a long-term saver, used the calculator to compare loans for his $600,000 mortgage at 4% interest rate. He discovered that by choosing a decreasing installment plan, he could save $71,628 in total interest payments over 30 years. This realization aligned perfectly with his financial strategy of reducing long-term costs, even though it meant higher payments in the early years.

Case Study 2:

Sarah, who needed to keep her monthly expenses predictable due to a tight budget, opted for a fixed installment loan after using the calculator. It showed her that her initial monthly payments would be $2,922 (over $800 less than in case of decreasing installments), a figure that fit comfortably within her monthly budget, ensuring financial stability for her family.

Full Example:

The calculator also highlighted a scenario where the total cost and monthly payment differences between installment types were stark. For a $600,000 mortgage, the difference in total interest paid could amount to $71,628, with initial monthly payments for a decreasing installment starting at $3,967 (initial) and reducing to $1,424 (final), compared to a steady $3,058 monthly payment for a fixed installment. This comparison made it clear how each option could suit different financial circumstances and goals.

These scenarios underscore the calculator’s utility in navigating the complex landscape of mortgage planning, providing tailored insights that guide users to the loan structure best suited to their needs and financial objectives.

Conclusion

Choosing the right installment type for your mortgage is more than just a financial decision; it's a step towards realizing your dream of homeownership while ensuring your financial health remains intact. Whether your priority lies in minimizing total interest payments with a decreasing installment loan or securing budget predictability with fixed installments, understanding the implications of each choice is crucial.

Calcopolis by providing a detailed, personalized comparison of fixed and decreasing installment loans and factoring in all associated costs, empowers you to make informed decisions that align with your financial circumstances.

But the journey doesn't end here. Calcopolis offers an array of other tools designed to provide comprehensive support for your financial decision-making process.

From an APR calculator that helps you understand the true cost of borrowing, a Loan Comparison Tool that allows for simultaneous evaluation of multiple loan options, to a Creditworthiness Calculator that assesses your borrowing potential, each tool adds another layer of depth to your financial insights.

Additionally, the LTV (Loan to Value) calculator and Down Payment Calculator are invaluable resources for prospective homeowners, simplifying complex calculations into actionable insights.

By leveraging the power of Calcopolis, you equip yourself with the knowledge and insights necessary to navigate the financial aspects of homeownership and beyond, ensuring that your financial future is as secure and prosperous as possible.