Install CalcoPolis as App Add Calcopolis icon to homescreen and gain quick access to all calculators. Click here to see how »

Unlock Better Mortgage Terms: Lower Your LTV with Calcopolis!

Table of Contents

- Introduction to the Loan to Value (LTV) Ratio

- The Significance of the LTV Calculator in the Mortgage Process

- Importance of the LTV Ratio in Mortgage Applications

- Impact of LTV Ratio on Mortgage Approval Rates

- Benefits of a Low LTV Ratio

- Reduced Interest Rates

- Lower Monthly Payments

- Increased Equity

- Easier Loan Approvals

- Avoidance of Mortgage Insurance

- Utilizing the LTV Calculator for Mortgage Planning

- Strategies for Homeowners to Lower Their LTV Ratio

- Real-world Applications of the LTV Calculator

- Conclusion

- Choose Wisely With Calcopolis

The Loan to Value (LTV) ratio is crucial for both prospective and current homeowners. The LTV ratio is a financial term used by lenders to express the ratio of a loan to the value of an asset purchased. This figure is a critical determinant in the mortgage lending process, influencing not only the approval of the loan but also the terms and conditions attached to it.

Introduction to the Loan to Value (LTV) Ratio

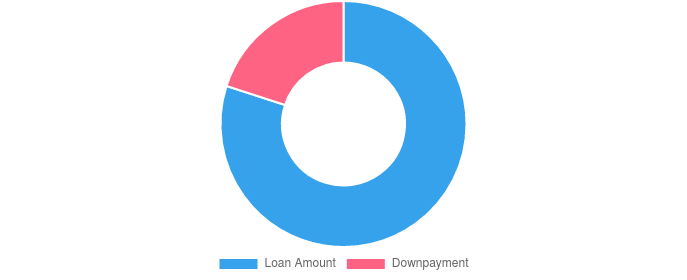

The LTV ratio is calculated by dividing the amount of the loan by the value of the property being purchased and then multiplying by 100 to get a percentage.

For instance, if you're buying a home valued at $200,000 and you have a down payment of $40,000, you would need a loan of $160,000. The LTV ratio in this scenario would be 80% ($160,000 loan divided by $200,000 home value, multiplied by 100).

This metric serves as a crucial indicator of risk for lenders. A lower LTV ratio suggests that the loan constitutes a smaller portion of the property's market value, indicating less risk in the event of a default.

Conversely, a higher LTV ratio, where the loan amount approaches or exceeds the value of the property, represents a higher risk to lenders.

The Significance of the LTV Calculator in the Mortgage Process

The LTV calculator emerges as an indispensable tool in this context, offering prospective borrowers the ability to quickly assess their standing in the eyes of lenders.

By inputting the necessary financial details—such as the property's purchase price and the loan amount—individuals can easily calculate their LTV ratio, gaining immediate insights into their loan's feasibility and the potential terms they may face.

Importance of the LTV Ratio in Mortgage Applications

Lenders meticulously assess the LTV ratio when reviewing mortgage applications.

A lower LTV ratio is often rewarded with more favorable loan conditions, such as lower interest rates and the possibility to forego private mortgage insurance (PMI), leading to significant savings over the life of the loan. This is because a lower LTV ratio indicates a larger down payment and a smaller loan amount, reducing the lender's exposure to loss.

Impact of LTV Ratio on Mortgage Approval Rates

The LTV ratio also plays a pivotal role in determining the approval rate of mortgage applications.

Loans with a high LTV ratio are seen as riskier investments, potentially leading to higher interest rates or even application denial. In contrast, applicants with lower LTV ratios are generally viewed as more creditworthy, increasing their chances of approval and securing more attractive loan terms.

In essence, the LTV ratio is a cornerstone of financial assessment in the mortgage approval process, affecting everything from interest rates to approval likelihood. The LTV calculator, therefore, becomes an invaluable resource for individuals navigating the complex landscape of home financing, empowering them with the knowledge to make informed decisions and optimize their mortgage outcomes.

Benefits of a Low LTV Ratio

The advantages of maintaining a low Loan to Value (LTV) ratio extend far beyond the initial mortgage application phase, affecting the overall cost of the loan, the equity built in the property, and even the ease with which borrowers can navigate financial hurdles. Here’s a closer look at the myriad benefits of a low LTV ratio:

Reduced Interest Rates

Favorable Financing: Lenders often offer lower interest rates to borrowers with low LTV ratios. This is because a low LTV ratio signifies a lower risk to the lender, as it indicates the borrower has a significant equity stake in the property. As risk decreases, lenders are more inclined to offer competitive rates, reducing the cost of borrowing for the homeowner.

Lower Monthly Payments

Direct Cost Savings: A lower interest rate, courtesy of a low LTV ratio, directly translates to lower monthly mortgage payments. This reduction in monthly outlay can significantly impact a borrower's budget, freeing up funds for other investments, savings, or expenditure. The initial effort to achieve a lower LTV ratio pays dividends throughout the life of the loan in the form of these monthly savings.

Increased Equity

Accelerated Ownership: Starting with a lower LTV ratio means the borrower is closer to outright ownership from day one. As mortgage payments are made, the portion of those payments contributing to the principal balance effectively accelerates equity building. This increased equity can be advantageous for homeowners looking to refinance in the future or leverage their home equity for loans.

Easier Loan Approvals

Streamlined Processing: The mortgage application process can be smoother and faster for applicants presenting a low LTV ratio. Lenders perceive these applicants as less risky, often leading to quicker approvals. Moreover, the strong financial position implied by a low LTV ratio may open the door to more favorable loan terms and a wider array of lending options.

Avoidance of Mortgage Insurance

Cost-Efficient Borrowing: Typically, lenders require borrowers to purchase private mortgage insurance (PMI) when the LTV ratio exceeds 80%. PMI is designed to protect the lender in case of default but adds a significant cost to the borrower's monthly payments. By achieving a low LTV ratio—below 80%—borrowers can avoid the need for PMI, resulting in substantial savings over the life of the loan.

The effort to achieve a low LTV ratio can profoundly impact a borrower's financial health in terms of reduced interest rates, lower monthly payments, quicker equity building, easier loan approvals, and the avoidance of PMI. Each of these benefits contributes to a more secure, cost-effective, and flexible financial future, underscoring the importance of aiming for a low LTV ratio when planning for a mortgage.

Utilizing the LTV Calculator for Mortgage Planning

Navigating the path to homeownership can be complex, but with the right tools and knowledge, prospective home buyers can make informed decisions that lead to substantial financial benefits. The Loan to Value (LTV) calculator is one such tool, offering clarity and insight into the mortgage planning process. Here’s how to make the most of it:

- Increase Your Down Payment: The most straightforward way to lower your LTV ratio is to increase your down payment. Saving more before purchasing can lead to a lower LTV ratio, resulting in better loan terms.

- Opt for a Less Expensive Property: Choosing a home that fits comfortably within your budget can also help you achieve a lower LTV ratio, making your loan application more attractive to lenders.

Strategies for Homeowners to Lower Their LTV Ratio

- Extra Principal Payments: Making additional payments towards the loan principal can decrease your LTV ratio over time, increasing your home equity faster.

- Home Improvements: Investing in home improvements can increase your property's value, potentially lowering your LTV ratio if the new value is considered by your lender.

Real-world Applications of the LTV Calculator

Understanding the practical impact of the LTV ratio on mortgage terms and costs can be illustrated through real-world case studies:

Case Study 1:

Jane, a first-time homebuyer, used the LTV calculator to determine that a larger down payment would reduce her LTV ratio from 90% to 80%, eliminating the need for PMI and saving her thousands of dollars over the life of her loan.

Case Study 2:

Mark and Lisa, looking to refinance their home, utilized the LTV calculator to find that making a few extra principal payments had lowered their LTV ratio sufficiently to qualify for a much lower interest rate, significantly reducing their monthly payments.

These examples highlight how the LTV calculator can be a powerful tool in both planning for a new mortgage and managing an existing one. By understanding and improving your LTV ratio, you can secure more favorable mortgage terms, save money, and increase your financial stability over time.

Conclusion

The Loan to Value (LTV) ratio is a cornerstone metric in the landscape of mortgage planning and decision-making. It serves as a key determinant in the eyes of lenders, influencing the terms of your mortgage, the interest rates you qualify for, and your overall financial health as a homeowner.

Understanding and optimizing your LTV ratio can lead to substantial benefits, including lower interest rates, reduced monthly payments, faster equity accumulation, streamlined loan approvals, and the avoidance of private mortgage insurance (PMI).

The journey to a financially healthier mortgage begins with informed planning and strategic decision-making.

Our calculator is invaluable in this process, offering a clear picture of where you stand and how you can improve your financing conditions. By providing insights into your potential loan's dynamics, it empowers you with the knowledge to make choices that align with your financial goals and capabilities.

Choose Wisely With Calcopolis

We encourage you to utilize the LTV calculator to assess your mortgage scenario and explore ways to enhance your financial position. Whether you're a prospective homebuyer aiming for the most advantageous mortgage terms or an existing homeowner looking to refine your financial strategy, the LTV calculator is your first step towards achieving a more secure and beneficial mortgage arrangement.

For a more comprehensive approach to mortgage planning and financial assessment, Calcopolis offers a suite of tools designed to address various aspects of the home buying and financing process:

- Down Payment Calculator: Determine how your down payment affects your mortgage terms and LTV ratio.

- Mortgage Calculator: Calculate your monthly mortgage payments, including interest and principal, to plan your budget effectively.

- Installment Type Calculator: Compare fixed and decreasing installment plans to find the best fit for your financial situation.

- Creditworthiness Calculator: Assess your credit standing and understand how lenders might view your loan application.

- Loan Comparison Calculator: Evaluate different loan offers side by side to choose the most cost-effective option.

By leveraging these tools, you can navigate the complexities of mortgage planning with confidence and precision. Visit Calcopolis today to explore these resources and take control of your financial future. Start with the LTV calculator to assess your current or potential mortgage scenario, and discover how strategic planning can lead to a more prosperous homeownership experience.