Capital Gains Yield Calculator

Maximize Your Wealth: Mastering the Art of Capital Gains

In the dynamic world of investing, understanding the nuances of your investment's performance is crucial. One key concept that stands out is the capital gains yield. This metric is essential for investors who aim to assess the growth potential of their assets. By quantifying the appreciation in the value of an investment, capital gains yield offers a clear perspective on the success of an investment strategy.

What is Capital Gains Yield?

Capital gains yield is a financial term used to measure the appreciation or increase in the value of an investment over time. It is expressed as a percentage and calculated based on the rise in the investment's price from its original purchase price. This yield is crucial in the investment world as it provides investors with an insight into the portion of their total return attributable solely to the appreciation in value, excluding dividends or interest earnings.

Unlike total returns, which consider all sources of investment income, including dividends and interest, capital gains yield focuses exclusively on the increase in the market value of the investment. This distinction is vital for investors who are more interested in the growth aspect of their investments rather than income generation.

Capital Gains Yield Formula

The Capital Gains Yield Formula is straightforward yet pivotal in understanding the appreciation of an investment. It is expressed as:

Where

- Current Price: This is the market value of the investment at the present time or at the time of the calculation.

- Purchase Price: The original price paid to acquire the investment.

Example:

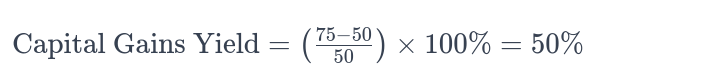

Suppose you purchased a stock for $50 (purchase price), and it is now worth $75 (current price). The capital gains yield would be calculated as follows:

This result indicates that the stock's value has increased by 50% since the time of purchase, exclusive of any dividends or interest earnings. Understanding and applying this formula helps investors to gauge the effectiveness of their investment strategies focused on growth and value appreciation.

Understanding the Calculator

The Capital Gains Yield Calculator emerges as a valuable tool in this context. Its primary function is to simplify the process of calculating the yield from capital gains. It's designed for ease of use, requiring only two key inputs: the purchase price (the price at which the investment was originally bought) and the current price (the investment's present market value).

By inputting these figures, the calculator efficiently computes the capital gain yield. It does this by first determining the absolute gain (current price minus purchase price) and then dividing this figure by the purchase price. The result is then converted into a percentage, offering a clear and immediate understanding of the investment's growth in value since purchase.

This tool is particularly useful for investors seeking a quick and straightforward method to evaluate the performance of their investments in terms of market value appreciation, providing a snapshot of investment success that is integral to informed financial decision-making.

Interpreting the Results

Understanding the Calculator's Output The results from a Capital Gains Yield Calculator, expressed as a percentage, provide a clear picture of how much the price of a security has appreciated. Interpreting these results is crucial for investment analysis:

- High Capital Gains Yield: A high yield typically indicates significant appreciation in the stock price since purchase. This could reflect a successful investment decision, market trends favoring the security, or both.

- Low or Negative Capital Gains Yield: A low yield, or a negative figure indicating a capital loss, suggests that the current market price is close to or below the purchase price. This could signal a need for a re-evaluation of the investment strategy.

Practical Applications

Utilizing the Calculator in Investment Decisions Investors use the capital gains yield calculator to assess and compare the growth potential of various securities. For instance:

- Comparing Stocks: By calculating the capital gains yield of different stocks, investors can identify which securities have appreciated more and might be more lucrative.

- Timing of Sales: Shareholders might use the calculator to decide the best time to sell, maximizing capital gains based on the current market price.

Real-Life Examples

- An investor compares two stocks: Stock A shows a capital gains yield of 20%, while Stock B shows 10%. This helps in deciding which stock might be more profitable to retain or buy more of.

- Before selling shares, an investor uses the calculator to understand how much the share price has appreciated, aiding in determining if it's a favorable time to sell.

Limitations of the Calculator

The Capital Gains Yield Calculator, while useful, has limitations:

- Excludes Dividends: It does not account for dividend yield, which can be a significant part of the total return.

- Does Not Factor in Taxes and Fees: The calculator does not consider capital gains taxes or transaction fees, which can impact the net returns.

- Inflation Ignored: The effects of inflation on the purchasing power of the capital gains are not reflected in the calculation.

Importance in Investment Strategy

In a comprehensive investment strategy, understanding and calculating capital gains yield is fundamental:

- Asset Allocation: It aids in deciding the allocation of assets in a portfolio, balancing between high-growth (high capital gains yield) and stable (low capital gains yield but perhaps higher dividend yield) investments.

- Performance Measurement: It's a tool for assessing the performance of investments over time, influencing future investment decisions.

The Capital Gains Yield Calculator, therefore, is more than just a numerical tool; it's a part of the larger decision-making process in investment and portfolio management. It helps investors not only calculate capital gains yield but also make informed choices about buying, holding, or selling securities based on the current market price and potential for capital appreciation or loss.

Conclusion

In the realm of investment, the ability to accurately calculate and interpret capital gains yield is invaluable. This simple yet powerful metric offers a snapshot of an investment's performance in terms of market value appreciation, independent of dividends or interest income. While the Capital Gains Yield Calculator provides crucial insights, it's important to remember that it's just one piece of the puzzle in a comprehensive investment strategy.

Investors are encouraged to use this tool as part of their broader financial analysis, keeping in mind its limitations and the importance of considering other factors like dividend yield, taxes, fees, and inflation. By doing so, investors can make more informed decisions, aligning their investment choices with their financial goals and market conditions.

Related Calculators

To further enhance investment analysis and decision-making, here are several related calculators that investors might find useful:

- Dividend Yield Calculator: Helps in determining the dividend yield of a stock, which is vital for investors focusing on income-generating investments.

- Investment Return Calculator: Provides a broader view of investment performance, including both capital gains and other returns over a specified period.

- Inflation Calculator: Helps investors understand the impact of inflation on the purchasing power of their investment returns.

- Stock Profit Calculator: Determines the profit or loss from buying and selling stocks, factoring in transaction costs.

- Portfolio Allocation Calculator: Aids in balancing a portfolio according to risk tolerance and investment goals.