WACC Calculator

The easiest way to calculate the Weighted Average Cost of Capital.

Table of Contents

- What is the Weighted Average Cost of Capital?

- Real-life Example of WACC Calculation

- What is a Good WACC Value?

- Importance of WACC in Business Decisions

- Factors Influencing WACC

- Limitations of WACC

- Comparison with Other Metrics

- Advanced WACC Concepts

- Marginal WACC

- Adjustments for Divisions

- FAQs about WACC

- What does a high WACC mean for my business?

- Can I lower my WACC?

- What’s the difference between WACC and ROI?

- How often should I update my WACC?

- What tools can help calculate WACC easily?

What is the Weighted Average Cost of Capital?

The Weighted Average Cost of Capital (WACC) tells you how much your company pays, on average, to raise money from investors and lenders. In simpler words — it’s the real price of using other people’s money to grow your business.

Small businesses and startups often mix different sources of financing — equity from founders or investors, bank loans, or bonds. Each source has its own cost, and WACC helps you see the big picture by combining them into one number.

Why does it matter? Because your WACC should always be lower than your company’s Return on Invested Capital (ROIC). If it’s higher, it means your money isn’t working efficiently — your financing costs eat too much of your profit.

How to calculate WACC?

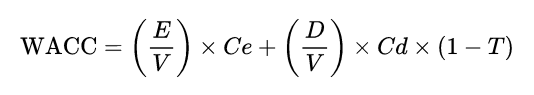

The WACC formula comes directly from the concept of weighted average. It shows how much each source of financing contributes to your overall cost of capital.

WACC formula

Where:

- E – company’s equity value,

- D – company’s debt value,

- V = E + D – total market value of all capital,

- Ce – cost of equity,

- Cd – cost of debt,

- T – corporate tax rate.

Real-life Example of WACC Calculation

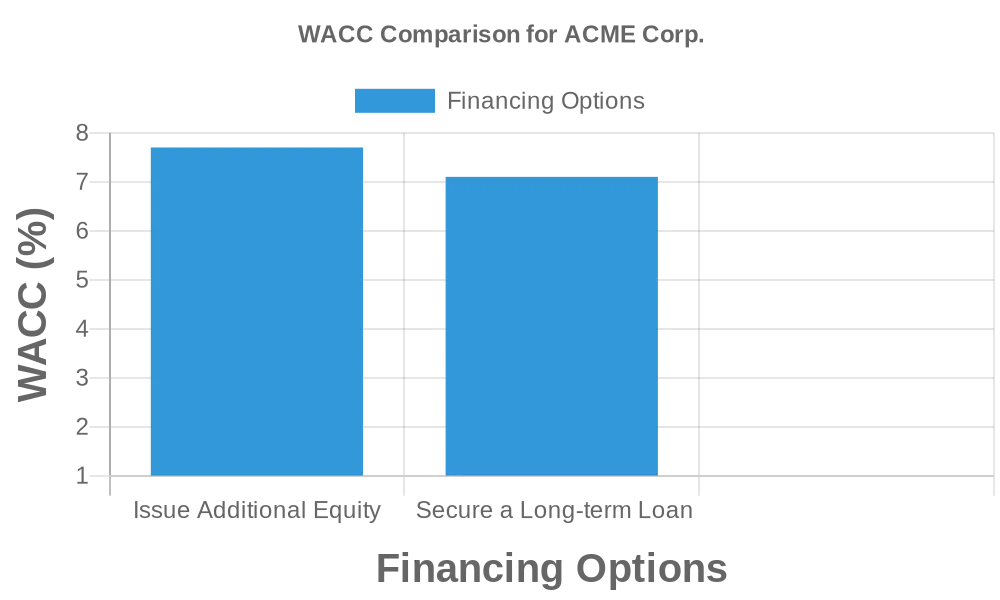

Let’s imagine ACME Corp., a growing company planning to expand its product line. The owners are considering two financing options: issuing new shares or taking a long-term loan. They use a WACC calculator to see which choice makes more sense.

- Issue additional equity shares

- Secure a long-term loan (debt)

Current Financial Structure:

- Equity (E): $5 million

- Total Debt (D): $2 million

- Cost of Equity (Ce): 8%

- After-tax Cost of Debt (Cd): 5%

- Corporate Tax Rate (T): 30%

Option 1: Issue Additional Equity

With a new share issue worth $3 million, the expected cost of equity rises to 9% due to added risk.

WACC = (E / (E + D)) × Ce + (D / (E + D)) × Cd × (1 − T)

WACC = (5/10) × 0.09 + (2/10) × 0.05 × (1 − 0.30)

WACC = 7.7%

Option 2: Secure a Long-term Loan

If ACME borrows $3 million at 6% interest, total debt increases, and the calculation looks like this:

WACC = (E / (E + D)) × Ce + (D / (E + D)) × Cd × (1 − T)

WACC = (5/10) × 0.08 + (5/10) × 0.06 × (1 − 0.30)

WACC = 7.1%

From the WACC perspective, taking a loan is slightly cheaper than issuing new shares. This shows why understanding your cost of capital can help small business owners make smarter financing decisions. However, ACME must still consider other aspects like cash flow stability and flexibility before deciding.

What is a Good WACC Value?

There’s no universal “perfect” WACC, as it varies by industry and market conditions. However, benchmarks can give context. According to KPMG’s Cost of Capital Study, the average WACC for European companies in 2024 ranged roughly from 6% to 9%. Data collected by Professor Aswath Damodaran (NYU Stern) also shows typical sector values — for instance, technology firms often report around 8%, while utilities can have WACC below 5%.

For small businesses, a WACC between 6–10% is generally healthy. A lower WACC means easier access to cheap capital, while a higher one signals either greater risk or limited financing options.

Importance of WACC in Business Decisions

WACC as a decision tool: Think of WACC as your “financial compass.” When you evaluate new projects, compare their expected return to your WACC. If the project brings higher returns than your WACC, it’s likely a good investment.

Capital budgeting: Many businesses use WACC as a hurdle rate when deciding on new investments. If a project’s internal rate of return (IRR) is higher than your WACC, it adds value to your company.

Factors Influencing WACC

Market conditions: Rising interest rates or inflation can push your cost of debt and cost of equity up, increasing overall WACC. Keeping an eye on these trends helps you plan financing more effectively.

Your company’s structure: A balanced mix of debt and equity can keep WACC in check. Too much debt increases risk, while relying only on equity may make financing unnecessarily expensive.

Limitations of WACC

- Assumptions: WACC depends on assumptions like the accuracy of your cost of equity (often based on CAPM). Mistakes here can distort the result.

- Low WACC isn’t always better: A very low cost of capital might suggest the business is too cautious and missing growth opportunities.

Comparison with Other Metrics

WACC vs. ROE and ROA: While WACC shows your overall cost of capital, ROCE, ROE, or ROA focus on profitability. Together, they paint a full picture of your financial performance.

When to use WACC: Use WACC when you assess new investments, value your business, or compare financing options. For operational decisions, other metrics like margins or ROI may be more useful.

Advanced WACC Concepts

Marginal WACC

When your company raises additional capital, the next dollar might cost more or less than previous funds. This change is called the marginal WACC.

Adjustments for Divisions

Large businesses with multiple divisions often calculate separate WACC values for each segment, considering their unique risks.

FAQs about WACC

What does a high WACC mean for my business?

A high WACC usually means investors and lenders see your company as risky. It may also indicate heavy debt or volatile earnings.

Can I lower my WACC?

Yes. Reducing risk, improving profitability, maintaining steady cash flow, or refinancing expensive debt can all help reduce your cost of capital.

What’s the difference between WACC and ROI?

WACC is your financing cost, while ROI measures your investment return. If ROI exceeds WACC, you’re creating value.

How often should I update my WACC?

At least once a year or whenever your financing structure changes — for example, when you take new loans or issue shares.

What tools can help calculate WACC easily?

You can use our free online WACC Calculator to quickly estimate your cost of capital and compare financing options.

See also: ROCE Calculator, Unlevered Beta Calculator and Tax Shield Calculator.