Cost of Equity Calculator

Discover the True Value of Your Investments with Our Cost of Equity Tool

Table of Contents

- What is the Cost of Equity?

- How to Calculate Cost of Equity?

- The Capital Asset Pricing Model (CAPM) Method

- The Dividend Capitalization Model Method

- Comparative Analysis

- Using the Cost of Equity Calculator

- Interpreting the Results

- Case Studies

- Best Practices for Using the Cost of Equity Calculator

- Conclusion

- Related Tools

The cost of equity is a fundamental concept, representing the return investors expect to invest in a company's equity. It is the compensation that the market demands in exchange for owning the stock and bearing the risk of ownership. The significance of understanding and accurately calculating the cost of equity cannot be overstressed—it is a critical input in various financial models and a determinant in gauging the relative attractiveness of investments.

We build our Cost of Equity Calculator to demystify the intricate calculations involved in determining equity costs. Our calculator serves a dual purpose: it simplifies the process for seasoned financial analysts and educates the novices on the practical applications of financial theories.

What is the Cost of Equity?

For a company, the cost of equity is essentially the rate of return that it must offer to attract investors to buy and hold its shares. For investors, it is the anticipated return for the risk they accept by investing their capital in the firm. This cost reflects the opportunity cost of the investors' capital—what they would earn by putting the same money into a different investment with a similar risk profile.

The Pillar of Investment Decisions and Valuation

The cost of equity plays a pivotal role in investment decisions and company valuation. It is a key component in the Weighted Average Cost of Capital (WACC), which is used to discount future cash flows in valuation models. The higher the cost of equity, the higher the rate at which future cash flows are discounted back to their present value, often leading to a lower valuation of the company. Conversely, a lower cost of equity suggests a less risky investment and can lead to a higher valuation.

In conclusion, the cost of equity is a vital metric that bridges the expectations of investors with the strategic financial management of a company. It is the invisible hand that guides and balances the scales of risk and return, and understanding it is essential for anyone involved in the spheres of investment and corporate finance. The Cost of Equity Calculator is the tool that brings clarity and precision to this complex calculation, providing a foundation for sound financial decision-making.

How to Calculate Cost of Equity?

Calculating the cost of equity is a critical step in assessing a company's financial health and strategic potential. There are two primary methods widely used in the industry: the Capital Asset Pricing Model (CAPM) and the Dividend Capitalization Model. Both approaches serve to estimate the return that investors require, serving as a guide for corporate decision-making and investment strategy.

The Capital Asset Pricing Model (CAPM) Method

The CAPM is a robust method for calculating the cost of equity that reflects the risk-return profile of an investment. It is based on the premise that investors need to be compensated in two ways: time value of money and risk.

Breaking Down the CAPM Formula

The CAPM formula is expressed as follows:

-

Risk-Free Rate: This is the return on an investment with zero risk, typically represented by government bonds.

-

Beta (β): This measures a stock's volatility relative to the overall market. A beta greater than one indicates higher volatility, while a beta less than one indicates lower volatility.

-

Market Risk Premium: This is the expected return of the market above the risk-free rate, representing the additional return demanded by investors for taking on the higher risk of investing in the stock market.

Advantages and Limitations of CAPM

CAPM's major advantage is its simplicity and its incorporation of systematic risk, represented by beta. However, its limitations include the assumption of a single period of investment and the challenges in accurately determining the risk-free rate and beta.

The Dividend Capitalization Model Method

The Dividend Capitalization Model, also known as the Gordon Growth Model, estimates the cost of equity by evaluating the dividends a company pays out to its shareholders.

Using Dividend Yield and Growth

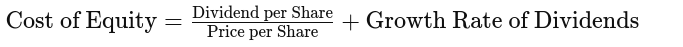

The model is articulated by the formula:

-

Dividend per Share: This is the expected dividend payment to shareholders.

-

Price per Share: Current market price of the stock.

-

Growth Rate of Dividends: The expected growth rate of the dividends over time.

Comparative Suitability

The Dividend Capitalization Model is particularly suited for companies with stable and predictable dividend policies. Unlike CAPM, which considers a market-related risk premium, the dividend model focuses on the individual company's dividends. However, it's less applicable for companies that do not pay dividends or whose dividend patterns are irregular or unpredictable.

Comparative Analysis

When choosing between CAPM and the Dividend Capitalization Model, one must consider the nature of the company and the quality of available data. CAPM is universally applicable and deeply rooted in market dynamics, making it suitable for a broad range of companies. On the other hand, the Dividend Capitalization Model is best for companies with established dividend histories and a clear trajectory of dividend growth. Both methods have their merits and can sometimes be used in conjunction to provide a more comprehensive view of a company’s cost of equity.