Install CalcoPolis as App Add Calcopolis icon to homescreen and gain quick access to all calculators. Click here to see how »

Understanding The Internal Rate of Return (IRR)

Table of Contents

- What is IRR?

- Usage of the IRR Calculator

- Calculating IRR: The IRR Formula

- Interpreting the Results from the IRR Calculator

- Things to Watch Out For When Using the IRR Calculator

- Practical Applications of the IRR

- Delving Deeper: IRR, NPV, and CAGR

- Distinguishing Between IRR and ROI

- Exploring Alternatives: MIRR and XIRR

- Calculate the internal rate of return with ease.

- Cash Flow Analysis: The Backbone of IRR

- Final Thoughts

What is IRR?

The Internal Rate of Return (IRR) is a financial metric used in capital budgeting to estimate the profitability of potential investments. It represents the discount rate that makes the net present value (NPV) of all cash flows (both positive and negative) from a particular investment equal to zero.

Essentially, IRR provides an expected growth rate that forecasts the future cash flows of an investment to break even. This metric aids investors and financial professionals in comparing the potential returns of different investments and determining the desirability of investing in a project.

Imagine you're thinking about investing in a friend's startup. You're excited, but you also want to know if it's a smart move for your money. The Internal Rate of Return (IRR) - a handy tool to help you decide.

Think of IRR as a percentage that tells you how much you might earn from your investment over time. A higher IRR suggests a better return on your money.

Let's break it down with an example:

Initial Investment (Cash Outflow): You invest $1,000 in your friend's startup. This is the money going out of your pocket, so we call it a negative cash flow.

Cash Flow: Over the next three years, the startup does well and pays you back in parts: $500 in the first year, $400 in the second, and $300 in the third. These payments are positive cash flows because it's money coming into your pocket.

Interest Rate & IRR: Now, if you were to put that initial $1,000 in a bank or another investment, it would earn interest. The IRR is like a special interest rate. If the IRR of investing in the startup is, say, 10%, it means the startup's returns are like earning a 10% interest rate on your money.

In simple terms, IRR helps you compare: Is the money better spent on the startup, or should you put it somewhere else? The higher the IRR, the more attractive the investment. It's a way to measure and compare the potential returns from different investments.

Usage of the IRR Calculator

Our online IRR calculator is a digital tool designed to simplify the process of calculating the internal rate of return for a series of cash flows. Its primary function is to provide you with a quick and efficient means to determine the potential profitability of your investments.

To effectively use the IRR calculator, users must input their data in a sequential manner. The initial step involves entering the initial investment amount, typically represented as a negative value since it's an outflow. Subsequent entries should detail expected cash inflows or additional investments, entered chronologically.

The order and timing of cash flows are of paramount importance in this calculation. The value of money changes over time due to factors like inflation and varying interest rates. You might consider specialized tools like the XIRR calculator for investments with irregular intervals.

Calculating IRR: The IRR Formula

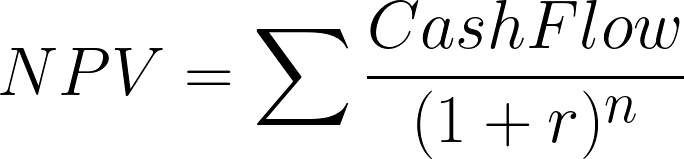

To understand the IRR formula, we first need to grasp the concept of Net Present Value (NPV). NPV tells us the difference between the present value of cash inflows and the present value of cash outflows over a period of time. In simpler terms, it helps us figure out how much more money (or less) we might have in the future compared to today, considering the time value of money.

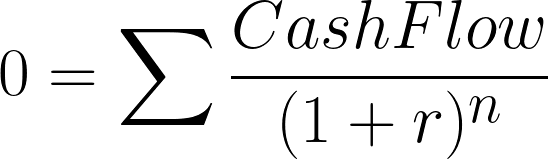

Now, the IRR is the discount rate at which the NPV equals zero. This means at the IRR, the money you invest (cash outflows) and the money you earn back (cash inflows) balance out perfectly when considering the time value of money.

The Formula Connection: The NPV formula is:

Where:

- ∑ represents the summation (or total) of all cash flows.

- Cash FlowCashFlow is the money coming in or going out.

- rr is the discount rate (which we're trying to find when calculating IRR).

- nn is the number of time periods (like years or months).

For IRR, we adjust this formula to find the specific rate rr where NPV equals zero. In other words, we're solving for rr in the equation:

While the equation might look a bit intimidating, the idea is simple: We're trying to find that magic interest rate (the IRR) where our investment breaks even over time. In practice, solving for IRR often requires iterative methods or financial calculators, but understanding its connection to NPV gives us insight into its significance in investment decisions.

Interpreting the Results from the IRR Calculator

Once the IRR calculator provides a value, understanding its implications is vital. The calculated IRR serves as an indicator of the potential profitability of an investment.

A higher IRR suggests that an investment is expected to yield higher returns relative to its costs, making it an attractive proposition. Conversely, a lower IRR might indicate less favorable prospects.

However, while the IRR is a valuable metric, it should not be viewed in isolation. It's essential to compare the IRR to other financial benchmarks.

For instance, if the IRR exceeds a company's cost of capital, the investment can be considered potentially profitable. Additionally, comparing the IRR of different investment opportunities can help in prioritizing and selecting the most lucrative options.

Things to Watch Out For When Using the IRR Calculator

While the IRR is a powerful tool in financial analysis, it comes with certain caveats:

- Multiple IRRs: In some scenarios, especially with non-conventional cash flow patterns, there might be more than one IRR value. This can lead to ambiguity in decision-making.

- Limitations of IRR: The IRR does not always provide a complete picture, especially when comparing projects of different durations or sizes.

- Sensitivity to Estimated Cash Flows: The IRR is highly sensitive to changes in projected cash flows. Overly optimistic or pessimistic projections can skew the IRR, leading to potentially misguided decisions.

- Scale and Timing Problems: The IRR can sometimes be misleading when comparing projects of different scales (scale problem) or when future cash flows are expected at significantly different times (timing problem).

Practical Applications of the IRR

The Internal Rate of Return (IRR) is not just a theoretical concept; it's a practical tool widely used in the world of finance and investment. Here's how it's commonly applied:

-

Evaluating Stocks, Bonds, and Real Estate: Investors often use IRR to gauge the potential returns on stocks, bonds, or real estate investments. By determining the IRR, they can compare the efficiency of different investments and decide which one might offer the best potential return.

-

Investment Project Analysis: Companies, especially those in capital-intensive sectors, use the IRR to evaluate the potential profitability of projects. By calculating the internal rate of return, decision-makers can prioritize projects based on their potential profitability.

- Loan Decisions: Lenders, especially in the realm of personal finance, might use IRR in tandem with other metrics to decide on loan approvals. It helps them understand the return of an investment, considering the time value of money.

-

Understanding Cash Flows: IRR is intrinsically linked to net cash flow. By analyzing the IRR, businesses can forecast their cash flow situation in the future and make informed decisions about expenditures, investments, and financing.

-

Compound Interest Comparisons: While compound interest calculators give us a straightforward understanding of how money grows over time, the IRR or internal rate offers a more nuanced view, especially when cash flows are irregular.

-

Synergy with NPV: IRR doesn't always work in isolation. It's often used alongside Net Present Value (NPV) to provide a clearer picture of an investment's potential. While IRR gives the break-even rate, the NPV value can indicate the net benefit in dollar terms.

-

Annual Cash Flow Analysis: For investments that provide annual cash returns, like some dividend-paying stocks or rental properties, IRR helps investors understand the annualized rate of return, considering both the annual cash inflows and the initial investment.

In essence, the IRR is a versatile tool, offering insights that can guide both individual investors and large corporations in their financial decision-making processes. Whether you're looking at stocks, real estate, or company projects, understanding the IRR is crucial to making informed decisions.

Delving Deeper: IRR, NPV, and CAGR

While the IRR provides insights into the potential percentage return on investment, other metrics offer additional perspectives:

-

Net Present Value (NPV): This metric calculates the difference between the present value of cash inflows and outflows. A positive NPV indicates that the projected earnings (in present dollars) exceed the anticipated costs.

-

Compound Annual Growth Rate (CAGR): CAGR offers a smoothed annual rate of growth, eliminating the effects of volatility and fluctuations to provide a clearer picture of an investment's growth trajectory over time.

Distinguishing Between IRR and ROI

Both IRR and Return on Investment (ROI) are pivotal in evaluating investments, but they serve different purposes. While IRR indicates the break-even interest rate of an investment, ROI provides a straightforward percentage that shows the return on an initial investment relative to its cost.

Exploring Alternatives: MIRR and XIRR

Beyond the standard IRR, other variations cater to specific scenarios:

-

Modified IRR (MIRR): This considers both the financing cost (the cost of the initial investment) and the reinvestment rate (the rate at which returns are reinvested). It addresses some of the limitations of the traditional IRR.

-

Extended IRR (XIRR): Ideal for scenarios with irregular cash flow intervals, the XIRR offers a more flexible approach to calculating the internal rate of return.

Calculate the internal rate of return with ease.

The journey through the intricacies of the IRR and its online calculator underscores the importance of this financial metric in the realm of investment decisions. Whether you're a seasoned financial analyst, a budding entrepreneur, or an individual investor, understanding the nuances of the IRR can significantly enhance your decision-making prowess.

Like any tool, the true potential of the IRR calculator is unlocked through consistent use and practice. By experimenting with different investment scenarios, users can gain a more intuitive understanding of how various factors influence the IRR. This hands-on experience is invaluable, especially when faced with real-world investment decisions.

Cash Flow Analysis: The Backbone of IRR

The Internal Rate of Return (IRR) is more than just a percentage rate; it's a reflection of an investment's entire journey, and central to this journey is cash flow analysis. Understanding the movement of money – when it comes in, when it goes out, and how much – is crucial to making informed investment decisions.

To calculate the IRR, one must first lay the groundwork with a thorough cash flow analysis. This involves:

-

Mapping Outflows and Inflows: Before you can calculate the internal rate of return, you need a clear picture of all expected cash movements. This includes initial investments (outflows) and anticipated returns (inflows).

-

Understanding Cash Flow Frequency: Not all investments yield returns at the same pace. Some might provide monthly dividends, while others might have annual payouts. Recognizing the cash flow frequency is vital to accurate IRR calculations.

-

Counting the Number of Cash Events: It's not just about how much money moves but also how often. The number of cash events, whether they're inflows or outflows, can significantly impact the IRR. For instance, a single large influx might yield a different IRR compared to several smaller additions that total the same amount.

-

NPV and IRR: Once you've mapped out your cash flows, you can delve into IRR calculations. If the NPV is positive at a given discount rate, it indicates that the returns surpass the costs at that rate. The IRR is that specific rate where the NPV hits zero, meaning the investment breaks even.

-

Using Tools for Analysis: While you can manually calculate the IRR, tools like Excel have made the process more straightforward. By simply entering cash flows into a spreadsheet, functions within Excel can quickly compute the IRR, saving investors valuable time.

-

The Importance of Precision: A forward-looking approach is only as good as the data it's based on. Successful investors often distinguish themselves by their meticulous approach to cash flow analysis. They don't just estimate; they research, project, and often re-evaluate their cash flow assumptions to ensure they're on the right track.

In essence, cash flow analysis is the foundation upon which IRR stands. It's the detailed blueprint that, when interpreted correctly, can guide investors toward more profitable decisions.

Final Thoughts

For those keen on delving deeper, exploring related metrics like the Net Present Value (NPV) and the Compound Annual Growth Rate (CAGR) can offer complementary insights. Moreover, alternative tools like the MIRR and XIRR cater to specific investment scenarios, broadening the investor's toolkit.

In conclusion, the IRR and its online calculator are indispensable assets in the investor's arsenal. By mastering this tool and understanding its context, one can navigate the complex waters of financial investment with confidence and clarity.