Install CalcoPolis as App Add Calcopolis icon to homescreen and gain quick access to all calculators. Click here to see how »

Ultimate Guide to Calculating IRR of Non-Periodic Cash Flows

Table of Contents

- What is XIRR?

- Understanding XIRR with a Simple Example

- How to Use the Our Calculator to Calculate XIRR?

- Interpreting the XIRR Calculation: What Does It Mean?

- Positive vs. Negative XIRR:

- Comparing XIRR to Benchmark Rates:

- Time Value of Money:

- Magnitude and Frequency of Cash Flows:

- Duration of Investment:

- Volatility and Risk:

- What are the Limitations of Extended Internal Rate of Return?

- Reinvestment Assumption:

- Multiple or No Solutions:

- Sensitivity to Cash Flow Timing:

- Doesn't Account for External Factors:

- Complexity and Misinterpretation:

- Not Always Comparable:

- Dependence on Accurate Data:

- Metrics Similar to XIRR

- FAQ

- Why Calculate XIRR?

- How Does XIRR Differ from IRR?

- Why is XIRR Preferred Over CAGR?

- Can I Calculate XIRR Using Excel?

- How Does XIRR Impact SIP Investments and Mutual Funds?

- Is XIRR the Ultimate Return Calculator?

The Extended Internal Rate of Return (XIRR) is a powerful metric that offers insights into the performance of investments with irregular cash flows. But how do you calculate it? Use our online XIRR calculator!

This article delves deep into the XIRR metric, its calculation, and its significance in analyzing the performance of investments. If you're keen on understanding how to evaluate your investments better, this guide is a must-read.

What is XIRR?

XIRR, or Extended Internal Rate of Return, is a financial metric used to determine the profitability of an investment, especially when cash flows (both inflows and outflows) occur at irregular intervals. Unlike its counterpart, the Internal Rate of Return (IRR), which assumes periodic and consistent cash flows, XIRR provides a solution for investments where cash flows don't follow a set pattern.

At its core, XIRR is a measure that seeks to find an interest rate that equates the present value of future cash inflows with the present value of outflows.

In simpler terms, it's the rate at which the net present value (NPV) of all cash flows becomes zero. This rate represents the annualized return on the investment, taking into account the timing of each cash flow.

To understand the significance of XIRR, consider investments like mutual funds, SIP investments, or any scenario where you might invest or withdraw money at irregular intervals. In such cases, traditional metrics like IRR might not provide an accurate representation of the investment's performance due to the inconsistency in cash flows.

XIRR fills this gap by accounting for the exact dates of cash inflows and outflows, ensuring a more precise measure of an investment's performance.

In essence, XIRR offers a nuanced and realistic view of an investment's profitability, especially when dealing with non-periodic cash flows. It factors in the time value of money, ensuring that the timing of each cash flow is considered, making it an indispensable tool for investors and financial analysts alike.

Understanding XIRR with a Simple Example

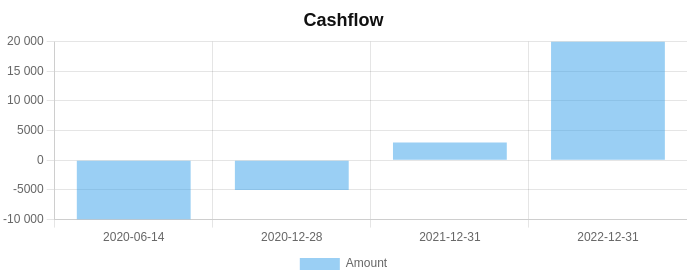

To truly grasp the concept of XIRR, let's walk through a straightforward example.

Imagine you've made an investment in a venture that spans over three years. Here's a breakdown of your cash flows:

- At the start, you invest $10,000.

- After one year, you invest an additional $5,000.

- At the end of the second year, you receive a return of $3,000.

- At the end of the third year, you receive a return of $20,000.

| Year | Cash Flow | Description |

|---|---|---|

| Start | -$10,000 | Initial Investment |

| End of Year 1 | -$5,000 | Additional Investment |

| End of Year 2 | $3,000 | Partial Return |

| End of Year 3 | $20,000 | Final Return |

Given these cash flows, if you were to use a standard IRR calculator, it would assume that the cash flows are periodic (i.e., occurring at regular intervals). However, as we can see, the cash flows are irregular. This is where XIRR comes into play.

By inputting these cash flows and their respective dates into an XIRR calculator or using the XIRR function in Excel, you'd get an annualized rate of return that accurately reflects the performance of this investment, considering the timing of each cash flow.

In this hypothetical example, let's say the XIRR calculator gives us a rate of 21%. This means that, considering the timing and amounts of the cash flows, the investment has an annualized return of 21% over the three years.

This example illustrates the power of XIRR in providing a more accurate and realistic picture of an investment's performance, especially when cash flows don't follow a regular pattern.

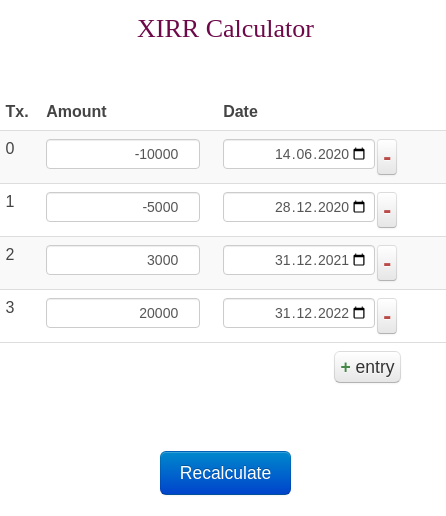

How to Use the Our Calculator to Calculate XIRR?

Using our online XIRR calculator is straightforward:

- Input the dates of each cash flow.

- Enter the corresponding amounts (inflows and outflows).

- The calculator will then calculate the XIRR, providing an annualized return that reflects the investment's performance.

There is no need for you to know the XIRR formula. Just use Calcopolis to calculate it.

Interpreting the XIRR Calculation: What Does It Mean?

To drive the right conclusion, you need not only calculate XIRR but also adeptly interpret its results. Let's delve deeper into what this rate signifies and how to extract nuanced insights from it for more informed investment decisions.

Positive vs. Negative XIRR:

Positive XIRR: A positive XIRR value indicates that the investment has yielded a profit over the period under consideration. The higher the XIRR, the better the investment has performed in terms of returns.

Negative XIRR: A negative XIRR suggests that the investment has resulted in a loss. The more negative the XIRR, the more significant the loss.

Comparing XIRR to Benchmark Rates:

Once you have the XIRR value, it's essential to compare it against a benchmark or a standard rate of return.

For instance, if you're evaluating a mutual fund, compare its XIRR to the average return of other funds in the same category or to a relevant index. This comparison helps determine if the investment has outperformed or underperformed the market or its peers.

Time Value of Money:

XIRR inherently considers the time value of money. This means that it gives weightage to the timing of cash flows. An earlier cash inflow is valued more than a later inflow because the money available at the present time is worth more than the same amount in the future due to its potential earning capacity.

Magnitude and Frequency of Cash Flows:

While interpreting XIRR, it's crucial to consider the magnitude and frequency of cash flows.

Two investments might have the same XIRR, but one might involve more frequent cash inflows, while the other might have larger but less frequent inflows. Depending on an investor's needs (e.g., regular income vs. long-term growth), one might be preferable over the other.

Duration of Investment:

XIRR provides an annualized rate of return, which means it projects the rate over a year. If the actual investment duration is significantly shorter or longer than a year, it's essential to consider the absolute returns alongside XIRR.

For instance, a high XIRR for a short-term investment might result in a smaller absolute profit compared to a slightly lower XIRR for a long-term investment.

Volatility and Risk:

A higher XIRR might indicate higher returns, but it could also suggest higher volatility or risk.

It's essential to balance the potential returns (as indicated by XIRR) with the associated risks. Investments with highly volatile cash flows might have a high XIRR but could be riskier than more stable investments with a slightly lower XIRR.

What are the Limitations of Extended Internal Rate of Return?

While XIRR is a powerful and insightful metric, especially for investments with irregular cash flows, it's essential to understand its limitations to ensure a comprehensive and accurate analysis. Here are some key constraints and nuances associated with XIRR:

Reinvestment Assumption:

One of the primary limitations of XIRR is its assumption that all interim cash inflows are reinvested at the XIRR rate itself. In real-world scenarios, this might not always be the case. The actual reinvestment rate could be higher or lower, leading to potential discrepancies between the projected and actual returns.

Multiple or No Solutions:

For certain patterns of cash flows, the XIRR calculation might yield multiple solutions or, in some cases, no solution at all. This can make the interpretation of results challenging and might require additional analysis or alternative methods to evaluate the investment.

Sensitivity to Cash Flow Timing:

Small changes in the timing of cash flows can lead to significant variations in XIRR. This sensitivity means that if cash flows are projected or estimated, even minor inaccuracies in timing can distort the XIRR value, potentially leading to misleading conclusions.

Doesn't Account for External Factors:

While XIRR provides a measure of an investment's internal rate of return, it doesn't factor in external elements like market conditions, inflation rates, or geopolitical events. Such factors can significantly impact an investment's actual performance.

Complexity and Misinterpretation:

Due to its iterative nature, XIRR can be computationally intensive. Moreover, without a proper understanding, there's a risk of misinterpreting the results. For instance, a high XIRR might be seen as an indicator of a good investment, but without considering the associated risks or the investment's duration, such a conclusion might be premature.

Not Always Comparable:

While XIRR offers a standardized annualized return, comparing XIRRs across different investments can sometimes be misleading. Factors like the investment's nature, associated risks, duration, and the investor's objectives need to be considered to make meaningful comparisons.

Dependence on Accurate Data:

The accuracy of XIRR is heavily reliant on precise cash flow data. Estimations or inaccuracies in recording the amounts or dates of cash flows can lead to skewed results, potentially affecting investment decisions.

While XIRR is an invaluable tool in the investor's toolkit, it's crucial to be aware of its limitations. A holistic approach, which considers XIRR alongside other financial metrics and qualitative factors, will ensure a more rounded and informed investment analysis.

Metrics Similar to XIRR

XIRR is just one of many tools available to investors. Let's delve into some other metrics that, like XIRR, help in evaluating the performance and potential of investments.

Each offers unique insights, and when used in tandem, they provide a comprehensive view of an investment's potential and performance.

IRR (Internal Rate of Return):

Often used interchangeably with XIRR, the IRR is its periodic counterpart. While XIRR evaluates investments with irregular cash flows, IRR assumes cash flows occur at regular intervals. Many use a calculator to calculate IRR to determine the annualized rate of return where the net present value (NPV) of all cash flows equals zero.

Future Value (FV):

Future value is a concept that estimates what a sum of money today will be worth in the future, given a certain rate of return. It's crucial to understand the potential growth of an investment over time. While XIRR provides an annualized rate of return, FV gives a tangible amount, showcasing the monetary growth of an investment.

Net Present Value (NPV):

NPV is a method used to determine the current value of all future cash flows of an investment, discounted back to the present using a specific discount rate. A positive NPV indicates that the projected earnings (in present dollars) exceed the anticipated costs, making it a potentially profitable investment.

Discount Rate:

The discount rate is the interest rate used to determine the present value of future cash flows. It's a foundational concept in both NPV and XIRR calculations. In the context of XIRR, it's the rate that makes the NPV of all cash flows equal to zero.

FAQ

Why Calculate XIRR?

Calculating the extended internal rate of return provides a clearer picture of an investment's profitability. It considers the timing and amounts of cash inflows and outflows, ensuring that the time value of money is factored into the calculation. This makes XIRR a more accurate measure than the annualized rate of return, especially for investments with irregular cash flows.

How Does XIRR Differ from IRR?

While both XIRR and IRR aim to calculate the return on investment, their approach differs. IRR assumes regular intervals, like annual cash flows, whereas XIRR accounts for irregular intervals. This distinction is crucial when evaluating investments with irregular cash flows, as using the IRR can lead to misleading results.

Why is XIRR Preferred Over CAGR?

While CAGR (Compound Annual Growth Rate) offers insights into the growth of an investment over time, it assumes a smooth, linear path. XIRR, on the other hand, factors in the volatility and timing of cash flows, providing a more realistic picture of an investment's performance.

Can I Calculate XIRR Using Excel?

Absolutely! Excel offers the XIRR function, which requires two primary inputs: cash flows and their respective dates. By inputting these into an Excel spreadsheet, the XIRR function will return the calculated extended internal rate of return.

How Does XIRR Impact SIP Investments and Mutual Funds?

For SIP investments and mutual funds, which often involve irregular cash flows, XIRR offers a more accurate measure of performance than traditional metrics. By accounting for the timing of each cash flow, XIRR provides a clearer picture of an investment's true profitability.

Is XIRR the Ultimate Return Calculator?

While XIRR is a powerful tool, it's essential to use it in conjunction with other financial metrics for a comprehensive analysis. No single metric can capture every nuance of an investment's performance, but XIRR certainly comes close, especially for investments with irregular cash flows.