Future Value Calculator

Plan Smarter with Calcopolis: Maximize Your Returns Using Our Future Value Calculator!

Table of Contents

- What is Future Value?

- Understanding the Basics of Future Value

- Time Value of Money

- Practical Examples of Using Future Value

- Key Components of the Future Value Formula

- Basic Future Value Formula

- Multiple Compounding Periods

- Impact of Different Compounding Frequencies

- Practical Applications of Future Value Calculations

- Adjusting Variables to Meet Financial Goals

- Advanced Topics in Future Value Calculation

- Adjusting for Inflation

- Considering Taxes

- Incorporating Risk

- Time Value of Money

- Related Calculators

- Conclusion

Ever thought about how today’s savings could turn into tomorrow’s fortune? You can figure it out with our Future Value Calculator, a brilliant tool that projects the growth of your current investments over time.

It will allow you foresee the value of your money years from now. Whether planning for retirement, a child’s education, or your dream house, understanding future value is your first step towards achieving those goals.

What is Future Value?

Future Value (FV) is a core concept in finance, denoting the amount of money an investment will grow to, based on an assumed rate of return, over a specified period. It's a calculation that considers the potential gains from interest or market returns and is fundamental in planning any investment that anticipates growth over time.

Understanding the Basics of Future Value

Future Value (FV) is formally defined as the value of a current asset at a future date, calculated under the assumption of a specific rate of return. It’s relevant because it allows investors and savers to estimate how much their current savings and investments will be worth in the future.

This estimation is critical for effective financial planning and making informed decisions about long-term financial commitments.

Time Value of Money

The principle of the time value of money is foundational in understanding future value. It posits that a dollar today is worth more than a dollar tomorrow due to its potential earning capacity. This principle is vital because it underpins the rationale for investment—investing money now to reap more in the future.

Practical Examples of Using Future Value

Retirement Savings:

For someone planning their retirement, calculating the future value of their current retirement fund helps determine how much more they need to save to ensure a comfortable retirement lifestyle. It’s like making sure you have enough fuel to reach a distant, dreamy destination.

Educational Funds:

Parents setting aside money for their children's college education use future value to find out how much their initial investment will grow by the time their child heads to university. It’s like planting a tree today so your kids can enjoy the shade tomorrow.

Major Purchases:

If you're saving up for a big-ticket item like a house or a car, understanding the future value of your savings can guide your budgeting process. It's about filling the piggy bank now so you can smash it later for a bigger reward.

Key Components of the Future Value Formula

To effectively plan your financial future, it's crucial to grasp the core elements of the Future Value (FV) formula. This formula provides insights into how your investments could grow over time, offering a clear picture of potential financial outcomes.

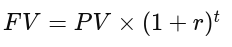

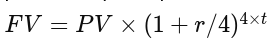

Basic Future Value Formula

The most straightforward version of the Future Value formula is used when interest is compounded annually.

This formula is expressed as:

Here's a breakdown of each component:

- PV (Present Value): This is the initial amount of your investment, essentially your financial starting point.

- r (Annual Interest Rate): This is the rate at which your investment is expected to grow each year.

- t (Number of Years): This represents the duration over which your investment will grow.

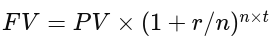

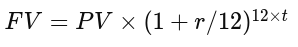

Multiple Compounding Periods

Investments often compound more frequently than once a year. To accommodate this, the Future Value formula can be adjusted to reflect different compounding frequencies, enhancing the accuracy of your financial predictions.

When dealing with multiple compounding periods per year, the formula expands to:

Where:

- n (Number of Compounding Periods per Year): This factor determines how often interest is applied to the investment balance annually. More frequent compounding can lead to greater growth due to interest being calculated on a gradually increasing principal.

Impact of Different Compounding Frequencies

The frequency of compounding has a significant impact on the growth of your investment. Here's how the formula varies with different compounding intervals:

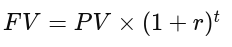

-

Annually: Compounded once per year, as shown in the simplified formula.

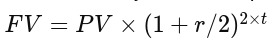

-

Semi-annually: Compounded twice a year. The annual interest rate is divided by two, and the number of years is multiplied by two:

-

Quarterly: Compounded four times a year. The rate is quartered, and the number of periods is quadrupled:

-

Monthly: The most frequent standard compounding interval, with twelve periods per year:

Understanding these variations helps you tailor your investment strategy to match your financial goals more precisely. By choosing the appropriate compounding frequency, you can optimize the growth of your investments, much like tuning an engine to get the best performance for specific driving conditions. This knowledge empowers you to make more informed decisions and better predict the future value of your investments.

Practical Applications of Future Value Calculations

Understanding the sensitivity of your future value to changes in input variables (like the interest rate or the amount invested) is crucial. If your initial calculations fall short of your goals, you can:

Future Value Calculators are powerful tools that bring precision to planning for financial goals. They offer clear insights into how today’s choices shape tomorrow’s possibilities, equipping you with the knowledge to make informed decisions and strategize effectively. Whether you're a budding investor or planning a major financial milestone, mastering this calculator can be a game-changer.

-

Planning for Retirement Savings:

- Emma, aged 30, plans to retire at 65 and wants to know how much her current savings of $20,000 will grow if she adds $200 monthly at an average return of 6% compounded monthly.

- Using a Future Value Calculator, she finds she can expect around $400,000 by 65, giving her confidence and clarity in her retirement planning.

-

Investing in the Stock Market or Bonds:

- Raj invests $10,000 in bonds offering a 5% return, compounded annually.

- After 10 years, the Future Value Calculator shows that his investment will grow to approximately $16,289. This visibility helps him compare different investment options.

-

Evaluating Real Estate Investment Opportunities:

- Linda is considering buying an investment property worth $300,000 that is expected to appreciate by 3% annually.

- Calculation shows the property would be worth about $406,000 in 10 years, aiding her decision on whether to invest or look for higher-yielding opportunities.

Adjusting Variables to Meet Financial Goals

Understanding the sensitivity of your future value to changes in input variables (like the interest rate or the amount invested) is crucial. If your initial calculations fall short of your goals, you can:

- Increase the amount invested initially or periodically.

- Search for investment opportunities with higher returns.

- Extend the investment duration to allow more time for compounding.

Advanced Topics in Future Value Calculation

As you delve deeper into the realm of future value calculations, you'll encounter more sophisticated aspects that can significantly influence your financial forecasts. These advanced topics include adjusting for inflation, accounting for taxes, and considering various risks.

Adjusting for Inflation

Inflation reduces the purchasing power of money over time, which means that a dollar today will not buy as much in the future. To get a more accurate forecast of your investments:

- Adjust the interest rate to reflect the real rate of return: Subtract the expected inflation rate from your nominal interest rate.

- Use inflation-adjusted returns in your calculations: This provides a clearer picture of what your future value will really be worth in today's dollars.

Considering Taxes

Taxes can take a significant bite out of your returns, affecting the future value of your investments.

- Incorporate tax rates into your calculations: Adjust the interest rate based on your expected tax bracket at the time of the investment’s maturity.

- Plan for capital gains and income taxes: Different investments are taxed differently, which can impact the actual future value of your returns.

Incorporating Risk

All investments carry some level of risk, which can affect both the principal and the potential returns.

- Assess risk tolerance and adjust scenarios accordingly: Higher-risk investments typically offer higher returns, but the possibility of loss is greater.

- Use a range of projected outcomes: Calculate the best, expected, and worst-case scenarios to understand potential volatility.

Time Value of Money

The concept of the Time Value of Money underlines that money available at the present time is worth more than the same amount in the future due to its potential earning capacity. This principle is fundamental in finance and is used to guide investment decisions.

Related Calculators

To fully explore the Time Value of Money, various calculators can be utilized:

- Present Value Calculator: Determines how much a future sum of money is worth in today’s dollars.

- Compound Interest Calculator: Calculates the growth of an initial investment with reinvested interest over time.

- Present Value of Annuity Calculator: Finds today's value of a series of future payments.

- Future Value of Annuity Calculator: Computes the future value of a series of regular payments.

- Regular Saving Calculator: Projects the future value of a series of regular savings.

- FIRE Calculator: Estimates how long it will take to reach financial independence and early retirement.

Conclusion

Understanding the future value of your investments is crucial for making informed financial decisions.

It not only helps you visualize the potential growth of your savings but also equips you with the knowledge to strategize effectively under varying economic conditions.

Regular use of the Future Value Calculator should be an integral part of your financial planning toolkit. Embrace this tool to chart a clearer path toward your financial goals, ensuring that every dollar you invest today is optimized for tomorrow’s gains.