Present Value of Annuity Calculator

Understand the Present Value of Annuities with CalcoPolis.

Table of Contents

- Annuity Types

- Unpacking the Present Value of an Annuity

- What is Present Value of Annuity?

- How Present Value Ties Into Annuities

- The Present Value of Annuity Formula

- Explanation of Components

- Applying the Formulas

- How to Use the Present Value of Annuity Calculator

- Input Fields Explained

- Tips for Accurate and Meaningful Results

- Applications of the Present Value of Annuity Calculator

- Evaluating Retirement Plans

- Financial Planning

- Investment Analysis

- Advanced Considerations in Using the Present Value of Annuity Calculator

- Adjusting for Inflation and Changing Interest Rates

- Dealing with Variable Annuities

- List of Related Calculators

- Summary

- Make CalcoPolis a Part of Your Financial Toolkit

Ever thought of annuities as your financial pillow, there to ensure you've got comfort in later years? Well, if you're diving into the world of annuities, you're looking at one of the most popular retirement tools.

From monthly pension payouts to insurance products, annuities can be the monthly checks that keep your boat steady in retirement's waters. But to steer this boat wisely, you'll need to understand their present value.

Annuity Types

An annuity is essentially a series of payments made at equal intervals. There are two main types to know:

- Ordinary Annuities: Payments are made at the end of each period, like most retirement benefits or loan repayments.

- Annuities Due: Payments are made at the beginning of each period, often seen in rental agreements or insurance premiums.

Unpacking the Present Value of an Annuity

Understanding the present value of an annuity is like knowing the secret sauce recipe—it lets you determine today's worth of all those future payments you're supposed to receive.

It's a key financial concept, especially when you're comparing different financial options or planning for a stable financial future.

Our Present Value of Annuity Calculator can be your financial compass.

It helps map out how much those future annuity payments are really worth today. With inflation and interest rates ever-fluctuating, this calculator isn't just helpful; it’s essential for anyone planning their retirement or managing financial portfolios.

What is Present Value of Annuity?

Present Value of Annuity is a term that might sound as exciting as watching paint dry, but it's actually where the magic happens in finance.

It calculates the current worth of a future series of annuity payments, considering a specified rate of return or discount rate. This concept is crucial because it helps you make apples-to-apples comparisons between varying financial strategies.

How Present Value Ties Into Annuities

When you look at an annuity through the lens of present value, you're taking the flashy future promises and weighing them against today's value of money.

It’s like asking, "What’s more valuable? A bird in hand today or two in the bush tomorrow?" Calculating the present value of an annuity tells you exactly how many birds in hand those future payments are worth.

The Present Value of Annuity Formula

When it comes to crunching numbers for annuities, the Present Value of Annuity Formula is like your financial GPS. It helps you navigate through the future fog to see the real worth of money in your pocket today. Let’s break it down, whether you're dealing with an ordinary annuity or an annuity due.

The formula takes a slightly different form depending on the type of annuity:

-

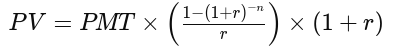

Ordinary Annuity (payments at the end of each period):

-

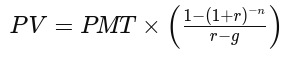

Annuity Due (payments at the beginning of each period):

Explanation of Components

Each part of these formulas plays a crucial role in determining the present value:

-

PMT (Payment Amount) - This is the regular amount received from the annuity. Whether it's a monthly pension or quarterly insurance payout, PMT is what you expect to get in each period.

-

r (Discount Rate) - Think of r as the interest rate's alter ego. Instead of growing your investment, it shrinks the future payments to their value today. It reflects the time value of money, essentially asking, "What would these payments be worth if they were in my bank account now?"

-

n (Number of Periods) - This is the total count of payments you expect to receive. If your retirement annuity is set to pay out monthly over 20 years, n would be 240 (12 months × 20 years).

Applying the Formulas

- If you’re handling an ordinary annuity, like a retirement fund that pays at the end of each month, use the first formula. It accounts for the money coming in after each period has ended.

- For an annuity due, such as a lease where payments are made at the start of each month, the second formula kicks in. This boosts the present value slightly, reflecting the earlier receipt of payments.

Understanding these elements and how they interact within the formula allows you to gauge the true value of various annuities, equipping you with the knowledge to make informed financial decisions.

Whether planning for the future or advising clients, mastering this formula is a surefire way to enhance your financial acumen.

How to Use the Present Value of Annuity Calculator

Navigating the Present Value of Annuity Calculator is like setting up your GPS before a road trip. You input the necessary details, and it maps out the financial landscape for you. Here’s how to use this tool effectively:

Input Fields Explained

-

Annuity Type (Ordinary or Due):

- Ordinary Annuity: Payments received at the end of each period.

- Annuity Due: Payments received at the beginning of each period.

-

Payment Amount:

- This is the amount you receive or expect to receive regularly from the annuity.

-

Payments Frequency:

- How often you receive payments—monthly, quarterly, or annually.

-

Interest Rate:

- The discount rate used to calculate the present value of future payments.

-

Annuity Term:

- The total duration of the annuity payments, typically in years.

-

Compounding:

- This defines how often the interest is compounded within a year. Choices usually include annual, semi-annual, or monthly.

Tips for Accurate and Meaningful Results

- Double-check the interest rate: Ensure it reflects the current market conditions or the rate offered by your annuity.

- Match the payment frequency and compounding: Misalignment here can skew results significantly.

- Consider inflation: Adjust the discount rate to include inflation expectations to maintain the purchasing power of the projected payments.

Applications of the Present Value of Annuity Calculator

Understanding how much a series of future annuity payments is worth today can profoundly impact financial decision-making.

Evaluating Retirement Plans

Use the calculator to compare different retirement options. By calculating the present value of various annuity-based retirement plans, you can choose the one that offers the best value for your investment, ensuring a comfortable retirement.

Financial Planning

Determine how much you need to save now to secure a desired regular income in the future. This is crucial for setting realistic savings goals that align with your long-term financial aspirations.

Investment Analysis

Assess the worth of an annuity investment in comparison to other investment opportunities. Calculating the present value helps you see which options provide superior returns when adjusted for the time value of money.

Using the Present Value of Annuity Calculator isn’t just about plugging in numbers; it’s about giving you the clarity to make informed, strategic financial decisions. Whether you're planning for retirement, setting savings goals, or evaluating investment options, this tool can provide the insights needed to navigate your financial future with confidence.

Advanced Considerations in Using the Present Value of Annuity Calculator

Mastering the Present Value of Annuity Calculator involves more than just knowing the basics. There are advanced factors to consider that can significantly influence the results and your financial planning.

Adjusting for Inflation and Changing Interest Rates

Inflation can erode the purchasing power of money over time, and interest rates fluctuate based on economic conditions. Here’s how to handle these variables:

- Inflation Adjustments: Increase the discount rate to include an inflation factor. This provides a more realistic view of the annuity’s value in today's dollars. For instance, if the discount rate is 3% and expected inflation is 2%, consider using a 5% rate for more conservative planning.

- Changing Interest Rates: Regularly update the discount rate in your calculations to reflect current market conditions. This is especially important for long-term annuities where the economic landscape can shift dramatically.

Dealing with Variable Annuities

Variable annuities, which can include payments that change over time, require special attention:

- Variable Payment Annuities: If the payments increase or decrease, adjust the PMT value for each period accordingly. This might require multiple calculations for different phases of the annuity term.

-

Growing Annuity Options: For annuities that grow at a consistent rate (e.g., an annual increase to counteract inflation), modify the formula to reflect this growth. The growing annuity formula typically looks like this:

Here, g represents the growth rate of the annuity payments.

List of Related Calculators

To provide a full suite of tools for comprehensive financial analysis, consider these related calculators:

-

Future Value of Annuity Calculator - Calculates what future payments from an annuity will be worth at a future date.

-

NPV Calculator - Evaluates the profitability of an investment by calculating the difference between the present value of cash inflows and outflows over a period of time.

-

IRR Calculator - Finds the discount rate that makes the net present value (NPV) of all cash flows (both positive and negative) from a particular investment equal to zero.

-

Annuity Payment Calculator - Determines the payment amount per period on an annuity.

-

Compound Interest Calculator - Computes the interest earned on an investment or paid on a loan over a period where the interest is compounded.

-

Inflation Calculator - Estimates how the value of money will change over time with inflation, helping adjust future value or present value calculations.

Each of these tools addresses different aspects of financial planning and investment analysis, providing you with a robust framework for making informed decisions based on comprehensive financial data.

Whether adjusting for inflation, dealing with variable annuities, or evaluating different financial products, these calculators can enhance your ability to navigate financial planning with precision and foresight.

Summary

Understanding and utilizing the Present Value of Annuity Calculator is not just about keeping up with financial jargon; it's about unlocking a crucial tool for savvy financial planning.

This calculator doesn't merely simplify numbers; it clarifies the worth of future payments in today’s terms, helping you make well-informed decisions that affect your financial health and future stability.

The ability to calculate the present value of an annuity is indispensable in a world where financial choices abound. Whether you’re deciding on retirement plans, comparing investment options, or planning long-term financial commitments, knowing the present value of future cash flows helps you:

- Understand the true cost or benefit of financial products.

- Compare financial options on a level playing field.

- Plan more effectively for future financial needs.

Make CalcoPolis a Part of Your Financial Toolkit

We encourage you to make this website a regular part of your financial reviews. With each use, you gain deeper insights into the dynamics of time value of money and how best to maneuver your financial resources for maximum benefit.