Present Value Calculator

Determine The Current Value of Future Money with Calcopolis.

Table of Contents

- What is Present Value?

- The Time Value of Money

- Understanding the Present Value Formula

- The Basic Present Value Formula

- Where:

- The Present Value Formula for Different Compounding Periods

- Applications of the Present Value Calculator

- Evaluating Investment Opportunities

- Comparing Different Financial Products

- Planning for Retirement or Educational Expenses

- Advanced Considerations in Using the Present Value Calculator

- Adjusting for Varying Interest Rates and Inflation

- Impact of Changing Market Conditions on Present Value Calculations

- Using Present Value in Personal vs. Business Finance

- Present Value vs. Future Value

- When to Use Each Calculator

- Related Tools

- Summary

This tool reveals the worth of future money in today's terms. In other words it allows you evaluate the real-time value of future cash—like knowing exactly how much a promised hundred bucks next year is worth today.

Why should you care? Because whether you're eyeing an investment or comparing loan offers, understanding the present value of future money can make or break your financial decisions. This calculator simplifies these decisions by stripping down the complex calculations to a few easy steps.

What is Present Value?

Present Value (PV) is a foundational concept in finance that represents the current value of a future amount of money, discounted to reflect its value today. It’s based on a straightforward principle: a dollar in your hand today is worth more than a dollar promised tomorrow. Why? Because that dollar today can be invested, earning more dollars, which you wouldn’t have otherwise.

The Time Value of Money

The time value of money is a principle suggesting that money available now is worth more than the identical sum in the future due to its potential earning capacity. This is the backbone of the present value concept. For instance, if you were given the choice between receiving $1,000 now or $1,000 five years from now, taking the money now is a no-brainer because you could invest that $1,000 and watch it grow.

Understanding present value and the time value of money helps investors and savers make informed decisions. For example, if you're considering a job offer with a future bonus, the Present Value Calculator can show you what that bonus is worth in today’s dough. This way, you're not just guessing; you're making smart, calculated financial choices.

Understanding the Present Value Formula

Grasping the Present Value formula is like learning a secret handshake that unlocks the true value of future cash flows. It's not magic, but it’s pretty close when it comes to financial forecasting.

The Basic Present Value Formula

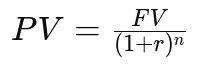

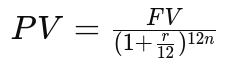

The Present Value (PV) formula is typically expressed as:

This formula helps you figure out how much a future amount of money is worth in today's terms.

Where:

-

FV (Future Value): This is the amount of money you expect to receive in the future. It’s the payoff you’re eyeing down the road—like the final prize in a long game show.

-

r (Discount Rate): Think of this as the reverse of an interest rate. Instead of growing your money, it shrinks the future value down to size, reflecting what it’s worth today. It accounts for the risk and the lost opportunity of not having the money now.

-

n (Number of Periods): This is how many periods (usually years) over which the money will be compounded. Longer periods mean more shrinking—like watching a balloon slowly deflate over time.

The Present Value Formula for Different Compounding Periods

The compounding period can dramatically affect the present value. Here’s how the formula adjusts based on the frequency of compounding:

-

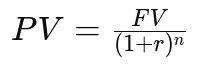

Annually: This is the simplest form, where the discount rate is applied once per year.

-

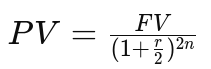

Semi-annually: If compounding occurs twice a year, the discount rate is halved and the number of periods is doubled.

-

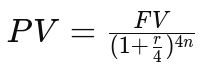

Quarterly: Here, the rate is divided by four, and periods are multiplied by four.

-

Monthly: This breaks the rate down even further to a monthly basis and multiplies the number of periods by twelve.

Each variation offers more precision by accounting for how frequently the discount rate impacts the future value. This is crucial for financial scenarios like adjusting a large future lump sum or regular investment returns, giving a clearer picture of what those future dollars are really worth today.

By mastering these concepts and variations, you can navigate the financial landscape like a pro, ensuring every investment or financial decision is grounded in solid, mathematical reasoning.

Applications of the Present Value Calculator

The Present Value Calculator isn't just a cool financial toy—it's a crucial tool in a savvy investor's arsenal. Let’s explore how this calculator can be applied in real-world financial scenarios:

Evaluating Investment Opportunities

Imagine deciding whether to invest in a new business venture that promises to pay $100,000 in five years. By using the Present Value Calculator, you can determine what that future $100,000 is worth in today's dollars, considering a discount rate that reflects the risk and opportunity cost. This can help you decide if the investment beats other opportunities with similar risks.

Comparing Different Financial Products

When choosing between financial products like loans, savings accounts, or bonds, the Present Value Calculator shines. For instance, suppose you’re comparing two bonds: one pays a lump sum in five years, and another pays in ten. By calculating the present value of both bonds' future payouts at your personal discount rate, you can see which bond offers better value today.

Planning for Retirement or Educational Expenses

Planning for future expenses like retirement or college fees involves forecasting the needed corpus to cover these costs. By reversing the present value formula to solve for the rate or the period, you can determine how much you need to invest today to ensure you meet these future expenses.

Advanced Considerations in Using the Present Value Calculator

Using the Present Value Calculator effectively requires more than just plugging in numbers. Here’s what else to consider:

Adjusting for Varying Interest Rates and Inflation

Interest rates and inflation can fluctuate, affecting the discount rate used in present value calculations. An adjustable-rate loan or a bond’s return might change with market conditions, so regularly updating these figures in your calculations can provide a more accurate present value.

Impact of Changing Market Conditions on Present Value Calculations

Economic shifts can dramatically alter investment outcomes. For instance, during a market downturn, future cash flows from investments might be less secure, suggesting a higher discount rate might be prudent. This would reduce the present value, reflecting increased risk.

Using Present Value in Personal vs. Business Finance

In personal finance, present value calculations can help individuals make informed decisions about mortgages, car loans, or education funding. In business finance, these calculations are crucial for capital budgeting decisions, assessing project viability, and strategic financial planning. Each context demands slightly different considerations for what constitutes an appropriate discount rate, reflecting the varying levels of risk and types of cash flows involved.

Present Value vs. Future Value

The Present Value Calculator and the Future Value Calculator are two sides of the same coin:

- Present Value Calculator helps determine what a future amount of money is worth today, considering factors like inflation and interest rates.

- Future Value Calculator, on the other hand, projects the future worth of current investments based on expected growth rates.

When to Use Each Calculator

- Use the Present Value Calculator when you need to assess the current worth of future payouts or costs. It’s ideal for deciding on investments, comparing financial products, or evaluating any scenario where future cash flows back to the present is necessary.

- Use the Future Value Calculator when planning savings for future goals, like retirement or education. It’s perfect for situations where you know the present amounts and are aiming to grow them over time through investments.

Both calculators provide pivotal insights, but the choice of which to use depends on the direction of your financial assessment—looking forward from today or backward from a future date.

Related Tools

Here’s a list of related calculators that can be instrumental in various financial scenarios:

-

Compound Interest Calculator - Calculates the interest earned on an initial principal, which includes accumulated interest from previous periods.

-

Present Value of Annuity Calculator - Determines the present value of a series of future annuity payments, considering a constant interest rate.

-

Future Value of Annuity Calculator - Calculates what the total value of a series of regular payments will be worth at a future date.

-

Net Present Value Calculator - Used in capital budgeting to analyze the profitability of a projected investment or project by calculating the difference between the present value of cash inflows and outflows over a period of time.

-

Internal Rate of Return Calculator - A financial tool used to estimate the profitability of potential investments by finding the discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero.

-

Loan Amortization Calculator - Helps you determine the schedule for repaying a loan, displaying how payments are split into interest and principal amounts over the life of the loan.

-

Mortgage Calculator - Calculates your monthly mortgage payments based on the home's sale price, the term of the loan desired, buyer's down payment percentage, and the loan's interest rate.

-

Return on Investment Calculator - Used to evaluate the efficiency of an investment or to compare the efficiency of several different investments by calculating the ratio of profit or loss made in relation to the initial investment.

-

Payback Period Calculator - Used to determine the amount of time it takes to recover the cost of an investment, helping you understand when a project will break even.

Each of these calculators serves unique purposes in different financial decision-making scenarios, from personal finance management to complex investment analysis in business contexts.

Summary

The Present Value Calculator is not just a financial tool; it's a lens through which to view the future in today’s terms.

Understanding and utilizing this calculator is crucial for anyone serious about making savvy financial decisions.

It ensures that you’re not just guessing the worth of future money but actually grounding your financial plans in solid, calculable figures.