Install CalcoPolis as App Add Calcopolis icon to homescreen and gain quick access to all calculators. Click here to see how »

How to Use a Fixed Deposit Calculator to Maximize Your Savings

Table of Contents

- Definition and Purpose of Fixed Deposits

- Functionality of the FD Calculator

- Significance of Interest Rates in FDs

- Calculation of FD Maturity Amount

- Distinction Between Simple and Compound Interest

- Monthly Interest Payouts in FDs

- Online FD Calculators: Reliability and Usage

- Comparison with Other Financial Tools

A Fixed Deposit Calculator is a digital tool specifically designed to assist users in estimating the returns on their fixed deposit investments. Fixed deposits, often abbreviated as FDs, stand as time-bound financial instruments. These are offered by banks and financial institutions, ensuring investors a predetermined fixed deposit interest rate.

Definition and Purpose of Fixed Deposits

A Fixed Deposit (FD) is a financial arrangement wherein an individual or entity deposits a sum of money with a bank or financial institution for a specified period. The allure of FDs primarily lies in their safety and the predictable returns they offer. With diverse tenure options available, they cater to a wide range of investment durations.

Functionality of the FD Calculator

The core operation of the FD Calculator revolves around several parameters. It considers the principal amount, the duration of the deposit, and the applicable interest rate. By processing these inputs, the calculator projects the maturity amount. This amount encompasses both the principal and the accrued interest.

Advanced versions of the FD calculator may also factor in the frequency of interest compounding, be it quarterly or annually. Furthermore, they can provide a detailed breakdown, offering insights into the returns over the deposit tenure.

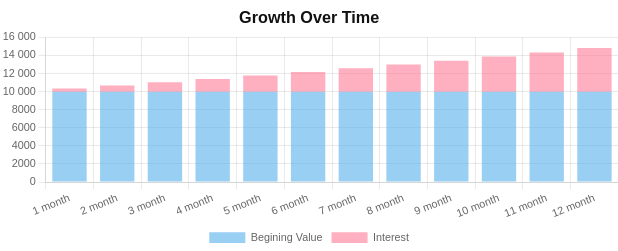

Beyond just numerical estimations, this calculator offers a comprehensive visual representation of an investment's journey. Through its dynamic charts, one can easily track the growth of their deposit over time, witnessing not just the principal's ascent but also the accruing interest.

This visualization paints a clear picture of the fixed deposit maturity, allowing investors to anticipate the culmination of their investment.

Complementing this visual aid, the calculator provides detailed tables that meticulously break down the month-by-month progression.

These tables elucidate both the balance and interest growth, offering a granular insight into the deposit's evolution. For those keen to calculate fixed deposit growth, this tool is indispensable. It factors in varying interest rates and maturity periods, ensuring a holistic understanding of the potential returns. By the end of the FD tenure, investors can easily discern the maturity value, which encapsulates both the initial deposit and the total interest amount accrued.

This dual representation, both visual and tabular, ensures that investors have a thorough understanding of their investment trajectory.

Significance of Interest Rates in FDs

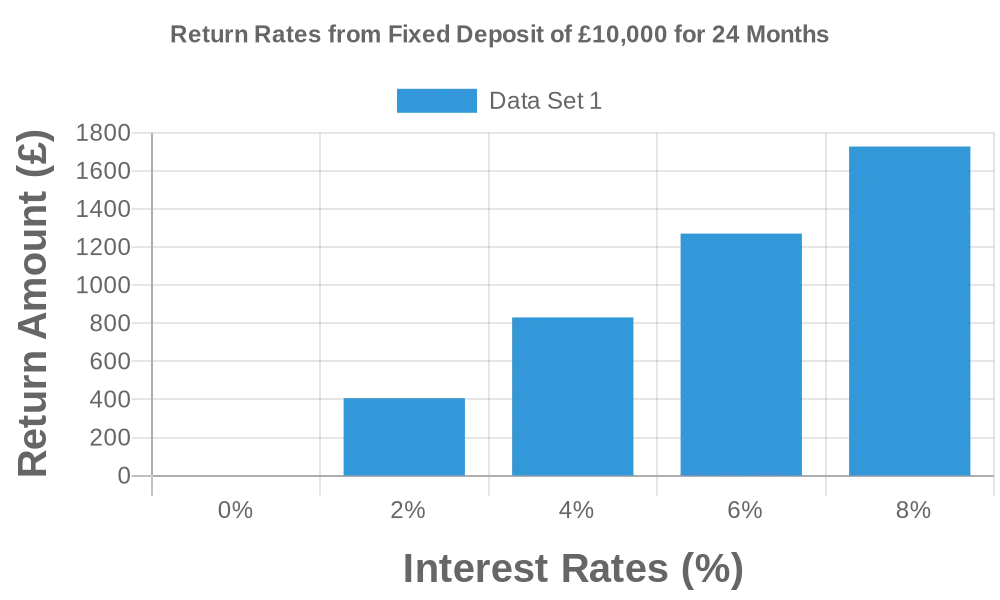

Interest rates serve as the backbone of the returns on fixed deposits. These rates, however, are not static. They can fluctuate based on various factors, including the specific bank, prevailing economic conditions, and the chosen tenure of the deposit.

Given that the FD interest rate is locked in at the deposit's inception and remains consistent until its maturity, it's pivotal for potential investors. With different banks potentially offering varying rates, tools like the FD interest calculator become indispensable. They allow investors to compare and gauge potential returns effectively.

Calculation of FD Maturity Amount

The FD's maturity amount signifies the total sum an investor is slated to receive at the deposit's conclusion. This sum is a culmination of the initial principal and the interest earned over the deposit's duration.

Utilizing the FD calculator, determining this amount becomes a streamlined process. By inputting essential details like the principal amount, rate of interest, and tenure, the calculator paints a clear financial picture for the investor.

Distinction Between Simple and Compound Interest

Interest, the reward for investment, can be categorized into two types: simple and compound.

Simple interest is computed solely on the principal amount. In contrast, compound interest is calculated on both the principal and the accumulated interest.

Most fixed deposits employ compound interest, leading to enhanced returns over time.

The FD calculator, recognizing this distinction, factors in the compounding frequency, ensuring accurate projections for the investor.

Monthly Interest Payouts in FDs

Certain FD schemes offer a unique feature: monthly interest payouts. Tailored for those seeking a regular income from their investments, this option ensures that interest is disbursed monthly. Only the principal amount matures at the deposit's end. This feature is especially beneficial for retirees or individuals seeking a consistent monthly income.

Online FD Calculators: Reliability and Usage

In the digital age, online tools, including the FD calculator online, have gained prominence. These calculators, updated with the latest interest rates, ensure users receive the most accurate projections. However, it's paramount to use a trusted and reputable platform to ensure the reliability of the results.

Comparison with Other Financial Tools

While the FD calculator is a potent tool for fixed deposits, several other financial calculators cater to different investment avenues. Each tool, whether it's an FD return calculator or a fixed deposit interest calculator, has its unique functionality. It's essential for investors to choose the right tool based on their specific investment needs and goals.

For those who are keen on setting aside a portion of their income regularly, the regular saving calculator is an invaluable asset. It aids in understanding how consistent savings can accumulate over time, factoring in variables like monthly contributions and interest rates.

While saving is crucial, it's equally important to account for the diminishing purchasing power of money. The inflation calculator steps in here, offering insights into how inflation can erode the value of savings over the years. It's a tool that brings to light the often overlooked aspect of financial planning.

For the modern-day individual aiming for financial independence and early retirement, the fire calculator (Financial Independence, Retire Early) is a must-use. It provides a roadmap, helping users determine how much they need to save to achieve their dream of early retirement.

Another tool that often piques the interest of retirees or those nearing retirement is the how long will savings last calculator. As the name suggests, it provides an estimate of the duration for which one's savings will sustain, considering factors like withdrawal rates and potential investment returns.

Lastly, for those seeking a straightforward budgeting guideline, the 50/30/20 rule calculator is a gem. It breaks down income allocation into essentials (50%), wants (30%), and savings (20%), offering a simple yet effective approach to managing finances.