Can saving $100 a month make you a millionaire?

Last modified: 2022-05-17

Everyone dreams about becoming a millionaire… well, maybe apart from billionaires :) For many, it appears as an almost impossible task, and they are destined for a middle-class lifestyle.

In this article, we will explain, using simple math, how saving 100 a month could make you a millionaire. Of course, not overnight, but persistence pays off. So even a tiny amount of money, like 100 bucks, regularly over a long period could turn you into a millionaire.

The reports below will analyze potential scenarios of regular savings of $100 for many years. We will examine cases of simple saving into a bank account and different possibilities of saving and investing at various average interest rates.

Finally, we will tell you precisely what criteria you need to meet to turn $100 into one million dollars before you reach retirement age. It will be difficult but still possible for everyone since $100 is not a lot, and everyone can afford to put away a similar amount of money every month.

All the calculations presented in this article are performed using saving calculators available here on Calcopolis. You can use these tools to simulate your scenario.

Saving 100 dollars a month in a savings account.

First, we will analyze the scenario of saving 100 a month without investment. We will calculate what would happen if you save 100 bucks a month.

This case is so easy that there is no need to use any advanced tools like our regular savings calculator. You can calculate it using any calculator.

For this scenario, we assume you will save $100 monthly on a regular savings account with no interest. Well, the answer is… $1,000,000 / $1,200 = 833 years

Yep, that's 833 years. It's not a viable scenario, but don't worry. Compound interest is your ally.

Saving 100 a month and compounding

The power of compound interest makes saving way easier. As you see below, it's a true game changer. Below we will show how regular saving and investing can drastically change the outcome of the whole idea of saving $100 per month.

Saving 100 a month at 8% APR

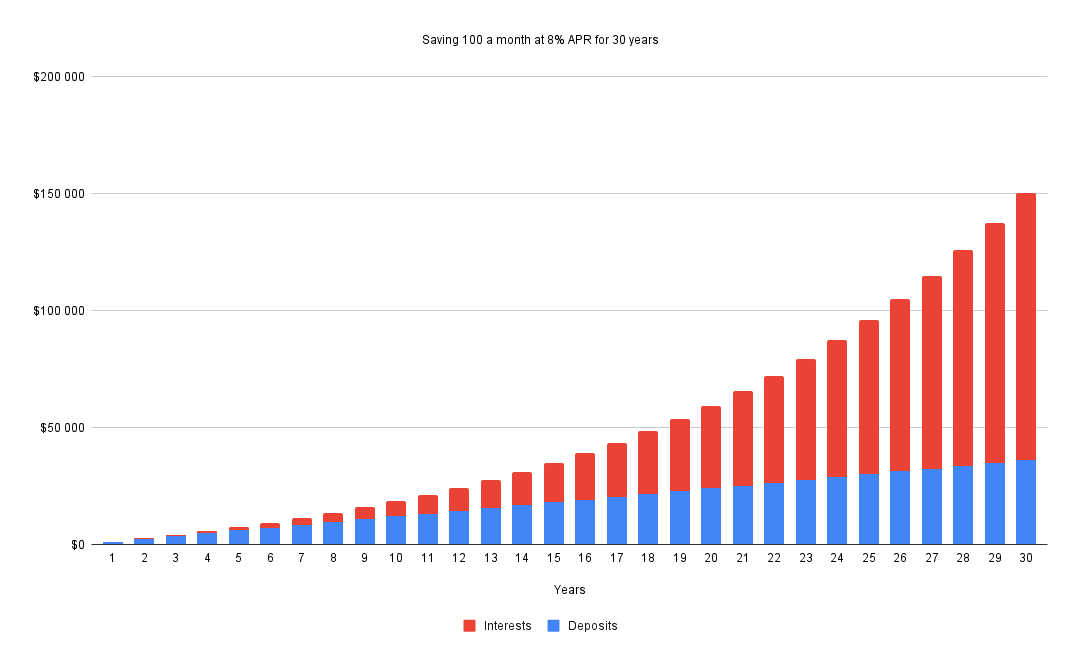

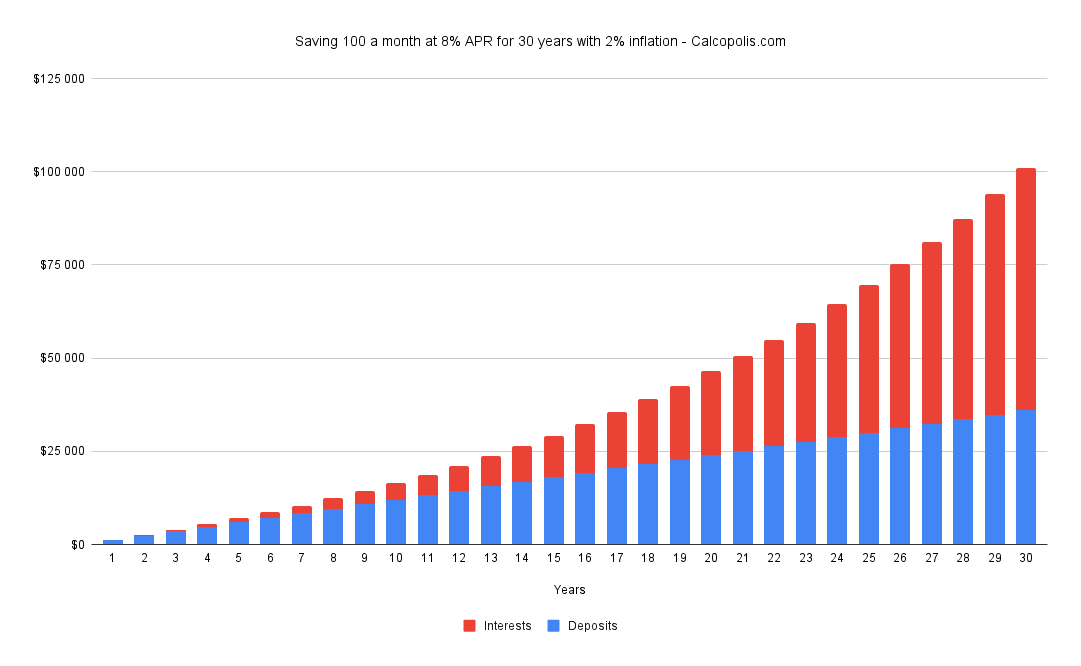

Let's analyze what would happen if you invest $100 monthly in stocks. The long-term average APR for the SP500 index is 8%. The chart below shows how much you make, saving 100 a month for 30 years.

After 30 years of investing $100 per month at 8% APR your savings will reach $150 030. Still far from one million dollars, but:

- The total portfolio value is $150,030, but the amount invested is just $36,000

- The accumulated amount of interest reached $114,030 and almost tripled the amount of invested capital.

- The amount of interest snowballs, dwarfing the money invested.

So clearly, compound interest helps your portfolio grow over time, but you probably wonder how long you need to wait till you reach one million due to regular savings of $100.

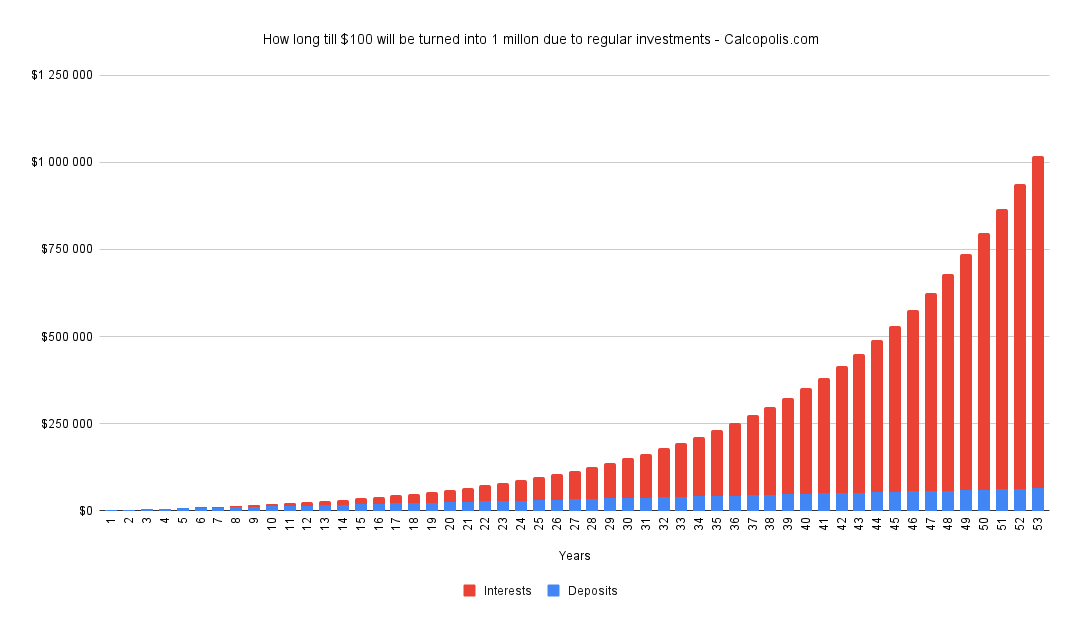

The chart below shows how many years of saving $100 monthly needs to pass till you reach 1 million dollars if you achieve an 8% annual return rate.

The simple answer is 53 years. That long it takes on average to turn $100 into $1,000,000 due to investments in stock with 8% APR. Although it is way better than 833 years of saving with no interest, it is still too long to be a viable option.

Saving 100 per month at 10% apr

As you have seen before, the combination of saving and investing could drastically speed up capital accumulation. However, the previous example still requires too much time, which can be discouraging.

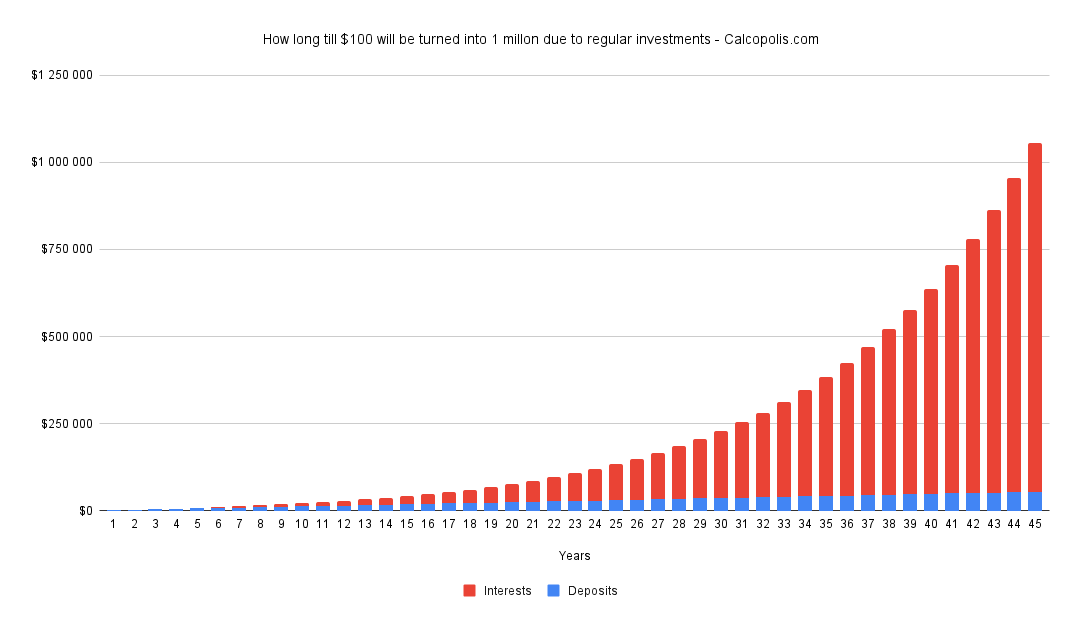

Let's analyze a slightly more optimistic but still possible scenario. The average annual interest rate will be 10%.

This time we can notice a significant improvement:

- After 30 years, the amount of savings will reach $227,933 instead of $150,030 before

- You will get to $1,000,000 eight years earlier, after 45 years instead of 53 years

Take note of how much impact the interest rate has over time. Later, the $100 you put down monthly could be neglected entirely without affecting the outcome.

The lesson from this is that time, apart from the interest rate, has the most significant impact on the accumulated amount. You probably wonder what might have happened when I began saving 100 dollars a month at age 20. You can calculate it for yourself using our regular savings calculator and see, for example, a chart of saving 100 dollars a month at age 21.

It is essential to point out that the effective interest rate is as important as the time of investment. A low return rate may lead to very low results. Let's analyze a similar case for a much lower interest rate of 2%. How does this affect the results of saving $100 per month?

How much money would I have in 40 years, saving 100 a month at 2 percent APR?

This time the difference will be spectacular:

- With 8% APR, you may have $381,850 after 40 years.

- With 2% APR, it will be just $73,566 after 40 years.

So after 40 years, a 4x higher interest rate will bring over five times higher return. Later on, the difference will be even more significant.

Saving $100 with different interest rates

The table below shows how much you could save over time with different interest rates.

|

Years |

||||

|

APR |

10 |

20 |

30 |

40 |

|

0% |

$12 000 |

$24 000 |

$36 000 |

$48 000 |

|

2% |

$13 294 |

$29 529 |

$49 355 |

$73 566 |

|

4% |

$14 774 |

$36 800 |

$69 636 |

$118 590 |

|

6% |

$16 470 |

$46 435 |

$100 954 |

$200 145 |

|

8% |

$18 417 |

$59 295 |

$150 030 |

$351 428 |

|

10% |

$20 655 |

$76 570 |

$227 933 |

$637 678 |

|

12% |

$23 234 |

$99 915 |

$352 991 |

$1 188 242 |

|

14% |

$26 209 |

$131 635 |

$555 706 |

$2 261 518 |

|

16% |

$29 647 |

$174 946 |

$887 048 |

$4 377 015 |

|

18% |

$33 626 |

$234 349 |

$1 432 529 |

$8 584 853 |

|

20% |

$38 236 |

$316 148 |

$2 336 080 |

$17 017 463 |

Key takeaways:

- The interest rate has the most significant impact on the final value of savings

- For small savings like $100 per month, you need several decades before your savings exceed 1 million dollars.

- Over a long period, you could turn 100 bucks into a considerable amount of money, but it requires persistence and a lot of self-discipline.

How will inflation impact the real return rate of saving $100 per month?

Inflation is the biggest enemy of everyone who saves money. Below we will calculate how moderate inflation of 2% will affect a savings plan of $100 per month.

To give you a better overview, we will analyze two cases. First, how does 2% inflation impact regular savings on bank accounts, and second, what is the impact of 2% on a diversified portfolio of American stocks? Let's dive in…

Saving $100 per month in an inflationary environment.

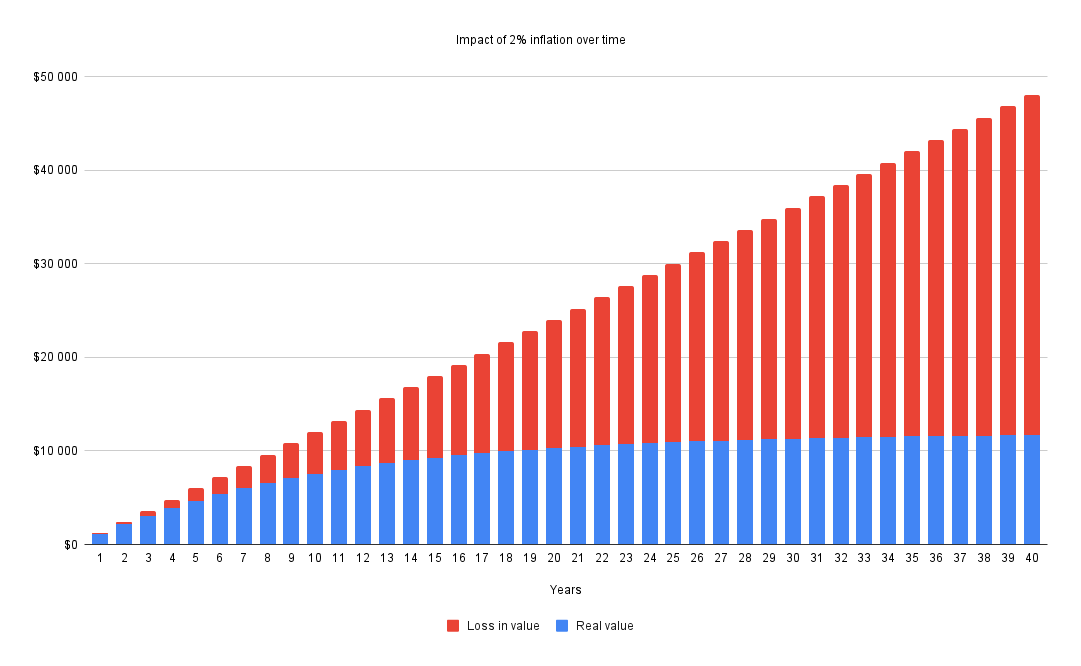

As you see on the chart below, keeping money in the bank doesn't protect the value of savings from inflation.

In the analyzed scenario saving $100 per month on a savings account is pointless. Over time inflation will eat most value from the money, you accumulate from your regular savings of $100 monthly.

During 30 years of saving $100 monthly, you will have $36,000 saved in your bank account. Unfortunately, due to inflation, it will have the same purchasing power as $13,559 today. Take note that all this damage was caused by a low inflation rate of just 2%, and as history shows, periods of much higher inflation are prevalent.

Investing $100 per month in an inflationary environment.

A wise investment plan gives strong protection from inflation. Although, to be frank, in this case, inflation also causes some damage to the potential return rate.

The chart below illustrates the impact of 2% inflation over the investment of $100 monthly in American stocks. This time the real value of the accumulated amount will be $100,954. Much less than the $150,030 we calculated before, but way better than just $13,559 we estimated for saving $100 a month on a bank account.

You can run your simulation using our inflation loss calculator.

Benefits of saving $100 a month

If you still have doubts that saving 100 a month is a good idea, please read the following report about what saving 100 dollars a month does to your financial situation.

What can saving 100 dollars a month do?

A $100 is not a lot, but if it is wisely invested, the compound interest and time will turn it into serious capital. The capital that will make a difference in your financial situation.

Saving $100 per month can be a game changer for your finances. Here are three reasons why:

Over time-saving $100 will turn into a considerable amount.

Because $100 is not a lot, regular savings of that amount will not be a big deal for a family budget. So it can be done almost effortlessly.

As we calculated before adjusting for inflation, it could turn into over $100,000. It is more savings than most people have!

The accumulated amount will give a decent interest monthly.

Once your savings reach $100k, it could give you over $660 interest monthly, and you could withdraw that money without decreasing the accumulated amount. It will be a significant and, more importantly, a regular influx of cash.

Interest and pension will increase your living standard on retirement.

While $660 is not enough for comfortable living anywhere in the United States, having that amount at the top of your pension will improve your retirement income.

Saving $100 a month for retirement

Although $100 is not a lot, as you have seen before, it could be turned into a large amount if you are patient. Persistent investors can accumulate $637,678 over 40 years, thanks to 8% APR.

However, this scenario is possible. It may seem like a highly daunting task. Being that persistent for four decades appears to be an impossible task. On top of that, inflation will eat some of that sum, leaving the investor with some extra cash each month, but this is not something that could turn your life by 180 degrees.

Fortunately, it is not as demanding in practice since your income will grow over time, so that you can increase the monthly payments. If you are young at the beginning of your career, saving $100 bucks each month may be challenging, but once you gain experience, your salary will grow accordingly. This naturally will lead to a higher saving rate, and your goal could be reached faster. How fast? Let's see an example.

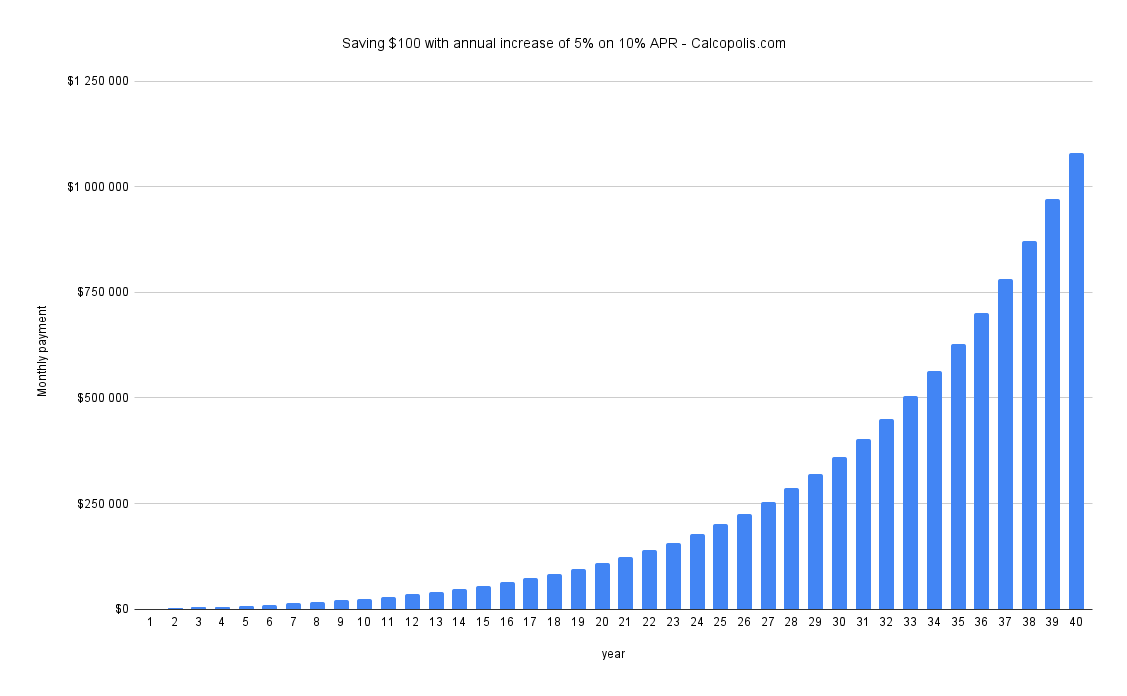

25-year-old saving $100 a month for retirement

As before, we will use our regular savings calculator, but this time we will use an extra feature that will increase the monthly payment by 5% each year. This will not only counteract inflation but will reflect future pay rises.

The chart below will show the case of saving $100 a month to retirement with a continuous payment increase of 5% each year and assuming a 10% APR.

Kee takeaways:

- Due to increased contributions, the accumulated amount is 50% higher than it was for a similar scenario with constant contributions of $1,080,553 vs. $637,678

- In the last year of saving, you will need to save $670 monthly, which may appear a lot, but there are plenty of salary increases ahead of you.

How to speed up the process of saving $100 a month?

You are serious about regularly saving $100, but you don't want to wait several decades to rip the benefits. There are several tips you could implement to achieve the results much faster.

Remember that you can analyze any scenario using calculators available on Calcopolis.

Some of the methods were mentioned briefly earlier but let's wrap them into one list.

Initial payment

If you already have some savings, it could be a game changer to the plan. Even small savings like $2000 or $3000 may speed up the process by several years. Please type different scenarios into our regular saving calculator and see for yourself.

Higher interest rate

If you are open to long-term investments, it is wise to pursue investments with significantly higher return rates than bonds or certificates of deposits. Over time, stocks give much higher returns with better protection from inflation. As you have seen before, a higher APR makes a big difference to the plan of saving $100 monthly.

An annual increase in the saved sum

This topic we covered extensively before, so we point out that you don't have to stick to saving just $100. A regular increase in monthly savings amount will make a big difference.

How long can you live from accumulated savings?

Over a long period, monthly contributions of $100 could be converted into a decent amount. In an optimistic scenario, those retirement savings will allow you to live off savings for over 20 years.

Below we are presenting how long you could live from the money saved from retirement. We will analyze two cases first, when you live only on interests earned from the savings, and second when you will be consuming a saved amount a little bit each month.

The first scenario. Living from interest.

In this case, you need to accumulate a large sum of money in a retirement account in order to have a decent standard of living on retirement.

The table below shows how much interest you could receive per month from your savings. Note that the most probable scenarios are in the first five rows. Over 30 to 40 years, it is relatively easy to turn $100 of monthly savings into up to $500k.

The last three rows are for people with luck in investments and those who will contribute more than just $100 per month.

As you see, the monthly payments are not very high, but you will never run out of money in this scenario.

|

Amount |

2% |

4% |

6% |

8% |

10% |

|

$100 000 |

$167 |

$333 |

$500 |

$667 |

$833 |

|

$150 000 |

$250 |

$500 |

$750 |

$1 000 |

$1 250 |

|

$227 933 |

$380 |

$760 |

$1 140 |

$1 520 |

$1 899 |

|

$352 991 |

$588 |

$1 177 |

$1 765 |

$2 353 |

$2 942 |

|

$500 000 |

$833 |

$1 667 |

$2 500 |

$3 333 |

$4 167 |

|

$1 000 000 |

$1 667 |

$3 333 |

$5 000 |

$6 667 |

$8 333 |

|

$1 432 529 |

$2 388 |

$4 775 |

$7 163 |

$9 550 |

$11 938 |

|

$2 336 080 |

$3 893 |

$7 787 |

$11 680 |

$15 574 |

$19 467 |

You could use our compound interest calculator to calculate different scenarios if you're interested. This calculator will not only calculate your case but also consider how much that money would be worth over time due to inflation.

Second scenario. Withdrawing accumulated capital

This scenario assumes that you will consume not only the interest earned each month but also the accumulated capital. This will lead to spending all the accumulated money eventually. Still, in parallel, it will allow the withdrawal of higher amounts each month, so the standard of living will be much higher than before.

All the calculations are performed using a living from savings calculator available on Calcopolis.

Alternative reports

If you are interested in achieving financial freedom faster, please read our reports on saving $300 per month or $500 monthly. You will see how higher savings goals affect the time needed to achieve early retirement.