Living Off Savings Calculator

Table of Contents

- How much money do you need not to have to work anymore?

- Is one million dollars enough to take early retirement?

- How much money do you need to have $5,000 in interest per month?

- The 4% rule

- How to become a rentier?

- Step 1. Estimate your needs

- Step 2. Create your plan

- Step 3. Execute the plan

- How to save a million dollars?

- Join the FIRE movement

How much money do you need not to have to work anymore?

Many people want to become financially independent. Early retirement is becoming an increasingly popular goal for young and ambitious people. However, the question is - how much money do you need for early retirement?

This website allows you to calculate how much capital you need to live on your savings.

Key functionality:

-

The calculator takes into account dividends and interests from assets you have accumulated;

-

In the form, you enter the monthly withdrawal you want to pay out for a living;

-

The program takes into account of the rising level of inflation;

-

And the taxes that need to be deducted from your capital gains.

-

As a result you will see for how many years a certain amount of money will be enough.

Is one million dollars enough to take early retirement?

A $1,000,000 may seem like a huge amount of money. But is it really enough to safely retire early?

The amount of money required to retire depends on several factors.

First of all, you should estimate how much money you need per month for a comfortable life.

Consider not only your current life situation, but the future one as well. If you plan to start a family or buy a house your monthly bill will go up. Likewise, if your kids are about to move out and live on their own your monthly spendings might decrease.

Second, use our calculator to verify if your expected savings amount will last for the rest of your life.

Our website takes into account the projected increase in inflation over the years. This will give you a clear idea of how much money you need to live freely on your savings in retirement.

The table below shows sample scenarios of how long your savings will last with different withdrawal rates. The example assumes an average inflation level of 2% and 15% capital gains tax.

|

Initial balance |

APR |

Monthly withdrawal |

Savings will last for |

Link to simulation |

|---|---|---|---|---|

| $1,000,000 | 6% | $2,000 | over 100 years | link » |

| $1,000,000 | 6% | $3,000 | 62 years | link » |

| $1,000,000 | 6% | $4,000 | 33 years | link » |

| $1,000,000 | 6% | $5,000 | 23 years | link » |

| $1,000,000 | 6% | $6,000 | 18 years | link » |

As you can see, your monthly needs have a considerable impact on your chances to retire early. Albeit, it is worth noting that is not the only variable worth considering.

Annual interest rate is another factor that impacts your retirement plan. The table below shows different scenarios with the same withdrawals of $4,000 per month (like before we took 2% inflation and 15% tax into account).

| Initial balance | APR | Monthly withdrawal | Savings will last for | Link to simulation |

| $1,000,000 | 3% | $4,000 | 22 years | link » |

| $1,000,000 | 4% | $4,000 | 24 years | link » |

| $1,000,000 | 5% | $4,000 | 28 years | link » |

| $1,000,000 | 6% | $4,000 | 33 years | link » |

| $1,000,000 | 7% | $4,000 | 43 years | link » |

Of course future return rate is the factor that is impossible to predict so it is wise to be a little bit pessimistic about it since it would be better to be positively surprised by the performance of your future investments than the opposite.

How much money do you need to have $5,000 in interest per month?

With constantly increasing average lifespan it is wise not to burn your savings. That is why many people plan to live from interests only. This leads to the question of how much money you need to be able to earn $5000 per month in interest.

Unfortunately there is no easy answer, because much depends on future return rates, but the table below shows you a few possible scenarios.

| Monthly withdrawal (after 15% tax) | APR | Required balance | Link to simulation |

| $5,000 | 3% | $2,000,000 | link » |

| $5,000 | 4% | $1,500,000 | link » |

| $5,000 | 5% | $1,200,000 | link » |

| $5,000 | 6% | $1,000,000 | link » |

| $5,000 | 7% | $857,143 | link » |

You can analyze different scenarios using our compound interest calculator. To be as realistic as possible you should take into account inflation as well. You can do this with the help of our inflation calculator.

The 4% rule

Since the problem of uncertainty of the future level of return applies to all investors, the safe level of payouts has been analyzed many times in the past.

To solve this issue the informal rule of thumb was presented by Bill Bengen. He claims that a 4% withdrawal rate allows one to enjoy retirement without worry of running out of money.

The idea assumes that the capital is invested in assets that not only give a protection against inflation, but also allow to achieve real profits. For example, a mix of stocks and bonds.

According to the author, if you don’t exceed 4% withdrawals your portfolio is safe from inflation and potential crisis on the market.

Of course there are critics of this rule. They suggest that nothing is written in stone and applying this rule does not guarantee anything. With increasing life expectancy the investors are advised to be careful on any assumption here).

We suggest using our calculator to find the best withdrawal rate for you. Below you can see few examples:

| Savings | APR | Monthly interests | Tax (15%) | Safe monthly withdrawal | Link |

| $1 000 000 | 4% | $3 333 | $500 | $2 833 | |

| $2 000 000 | 4% | $6 667 | $1 000 | $5 667 | |

| $3 000 000 | 4% | $10 000 | $1 500 | $8 500 | |

| $4 000 000 | 4% | $13 333 | $2 000 | $11 333 | |

| $5 000 000 | 4% | $16 667 | $2 500 | $14 167 |

How to become a rentier?

Step 1. Estimate your needs

To estimate how much money you will need to join the ranks of rentiers, you need to calculate your current expenses. Determine how much money you spend each month on living.

Next, write down your expenses. It's best if you divide them into two lists:

- necessary expenses,

- optional expenses.

The pool of money necessary to get by should also include a financial cushion for unforeseen expenses. Sooner or later, you will be faced with circumstances such as car repair, medical treatment or home renovation.

For example, the amount necessary for a comfortable life can range from $3000 to $6000. It depends on your individual needs.

If you are planning a family or a costly hobby - the minimum monthly amount should increase accordingly.

Of course, you can plan for more comfort in your retirement life. Remember, however, that then you will have to wait a bit longer for a well-deserved retirement.

Step 2. Create your plan

If you have figured out the approximate monthly amount necessary for a comfortable life, you are well on your way to early retirement planning. Before continuing, however, there are a few tips that will help you with this.

- Pay off your debts

- Increase your earnings

- Save and invest

Step 3. Execute the plan

Investing is the most important step in the entire plan. Through the magic of compound interest, time works in your favor - as long as your investments beat inflation. Then all you need is consistency and persistence.

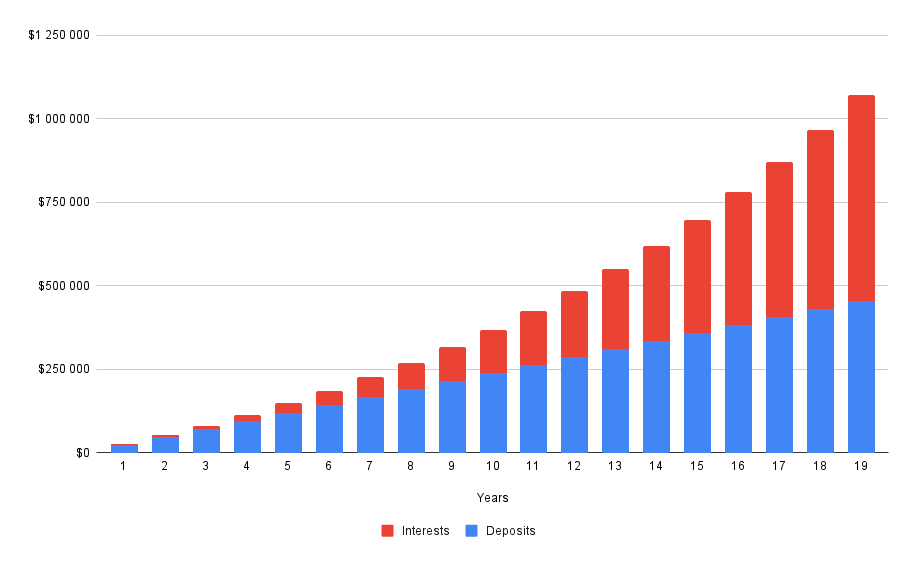

How to save a million dollars?

Putting aside a million dollars may sound like an impossible task. However, in practice, it is achievable by almost everyone.

Let’s analyze the following example:

Saving $2,000 per month for 19 years with 8% annual interest rate.

https://calcopolis.com/saving/saving/a_0-c_1200-d_1900-i_800-r_0-s_200000-t_0-m_22800

| Year | Sum of deposits | Sum of interests | Savings | Annual increase |

| 1 | $24 000 | $1 066 | $25 066 | |

| 2 | $48 000 | $4 212 | $52 212 | $27 146 |

| 3 | $72 000 | $9 612 | $81 612 | $29 399 |

| 4 | $96 000 | $17 451 | $113 451 | $31 840 |

| 5 | $120 000 | $27 933 | $147 933 | $34 482 |

| 6 | $144 000 | $41 278 | $185 278 | $37 344 |

| 7 | $168 000 | $57 721 | $225 721 | $40 444 |

| 8 | $192 000 | $77 522 | $269 522 | $43 801 |

| 9 | $216 000 | $100 958 | $316 958 | $47 436 |

| 10 | $240 000 | $128 331 | $368 331 | $51 373 |

| 11 | $264 000 | $159 969 | $423 969 | $55 637 |

| 12 | $288 000 | $196 224 | $484 224 | $60 255 |

| 13 | $312 000 | $237 480 | $549 480 | $65 256 |

| 14 | $336 000 | $284 152 | $620 152 | $70 672 |

| 15 | $360 000 | $336 690 | $696 690 | $76 538 |

| 16 | $384 000 | $395 581 | $779 581 | $82 891 |

| 17 | $408 000 | $461 352 | $869 352 | $89 771 |

| 18 | $432 000 | $534 573 | $966 573 | $97 222 |

| 19 | $456 000 | $615 864 | $1 071 864 | $105 291 |

Key takeaways:

-

Over time interests earned make an ever increasing impact on the saving rate

-

Starting from 9th year, the interests earned exceed annual deposits

-

It takes nearly 4 years to accumulate first 100k

-

From 19th year onward you save more money annually than you saved for the first 4 years

This is the magic of compound interest. If you give it some time, it can work wonders. If you are interested in your own custom scenario try out our savings calculator.

It is worth noting that the simulation above doesn’t count any rises and extra cash you may acquire along the way.

Join the FIRE movement

The FIRE movement, which consists in trying to save as much of one's own income as possible in order to achieve financial freedom quickly, is becoming more and more popular.

Followers of this method save as much as 70% of their income in order to achieve early retirement.

- Estimate how much money you need each month - simply put your spending into Excel.

- Calculate what amount of money will allow you to withdraw such an amount monthly - you can do this using this calculator.

- Calculate how much you have to save each month in order to reach your goal.

- Do not procrastinate! Start now :)

Are you dreaming of retiring early? We have just the tool for you - FIRE calculator. This powerful calculator will help you create a tailored financial independence plan that is perfect for your unique situation. Take control of your future and start planning for your retirement today!