Could saving $200 a month give you financial freedom?

Last modified: 2022-05-23

In this article, we will analyze using simple math how saving 200 dollars per month could give you financial freedom. Since $200 is not a lot of money, almost everyone can save such a sum regularly, but somehow only a handful of people are doing it.

That's probably because most people do not expect that that small amount of money could be turned into a small fortune if you are patient enough and make wise decisions upfront.

The report below will show the potential outcomes of a regular saving of $200 for several decades. We will discuss several scenarios: saving into a bank account and investing.

Finally, we will tell you precisely what criteria you need to meet to turn $200 into one million dollars so you can retire before you reach the official retirement age. To be frank, it will be difficult but possible - the key is persistence.

All the simulations you see in this article are performed using saving calculators available on Calcopolis. You can use these tools to perform your calculations.

Saving $200 every month on a savings account.

Let's start with an analysis of saving $200 a month with no interest on a regular bank account. We will calculate how long it will take to reach one million dollars in savings in a bank account.

Since we are assuming no interest rate, the calculation is very simple and the answer is… $1,000,000 / ($200 * 12) = 416 years

416 years! For sure, it is discouraging, but don't worry. There are better ways of accumulating wealth than savings accounts.

Saving $200 a month and compounding

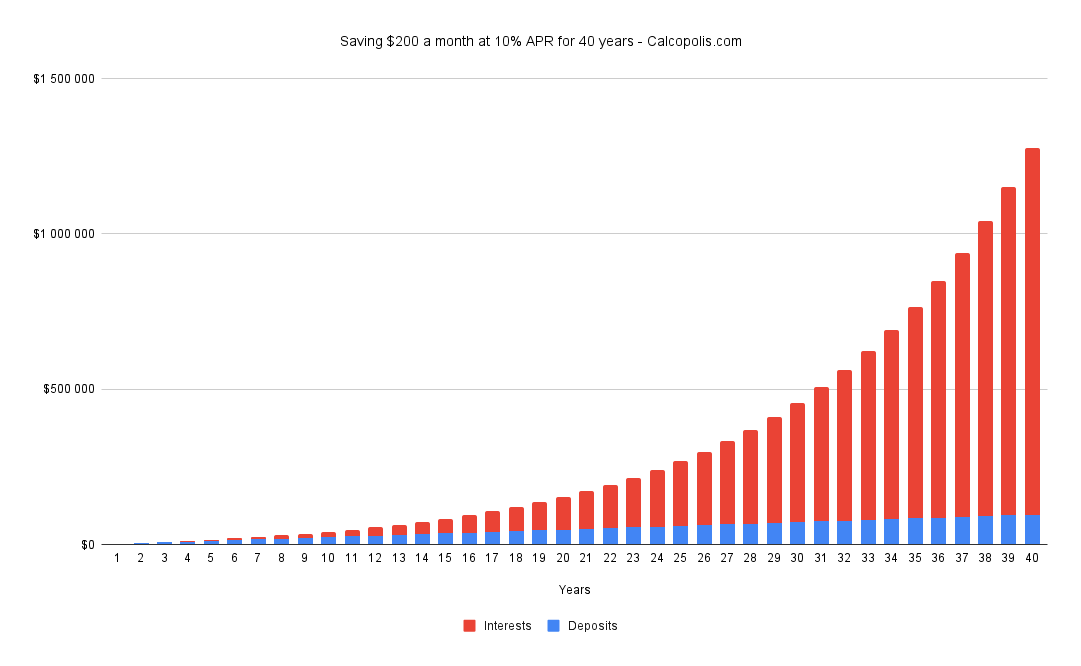

Compound interest makes saving a lot easier. As you see on the chart below, it's a real game changer. Below we will calculate how regular saving and investing with decent interest rates can drastically change the final result.

Saving 200 a month at 10% APR

Let's analyze what would happen if you invested $200 monthly into the American stock market. The long-term average APR for the S&P500 index is nearly 8%. Below you can see how your savings could grow in this scenario.

After 40 years of investing $200 monthly at 10% APR your savings will reach $1,275,356. Yes, that's right, over one million dollars, but there is more to that:

- The total portfolio value will be $1,275,356 out of $96,000 invested (it's over 12 times more)

- The portfolio will give you over $123,182 in interest each following year.

- The compound interest is the main motor of growth for that portfolio.

- Over 90% of the accumulated value comes from earned interests.

How long will it take to turn $200 savings per month into $1,000,000?

The simple answer is 38 years. After that time of saving and investing $200 monthly, your portfolio will exceed $1,000,000. Primarily due to investments in stock with 10% APR. This is still a very long period. However, it is achievable for most people in their twenties to accumulate considerable wealth for retirement.

Simulations of saving 200 per month for different APR

As you have seen before, compound interest drastically speeds up wealth accumulation. However, the previous example still requires several decades of persistence and self-discipline.

The table below shows how much you could save over time with different interest rates.

|

Years |

||||

|

APR |

10 |

20 |

30 |

40 |

|

0% |

$24 000 |

$48 000 |

$72 000 |

$96 000 |

|

2% |

$26 588 |

$59 058 |

$98 709 |

$147 132 |

|

4% |

$29 548 |

$73 599 |

$139 273 |

$237 180 |

|

6% |

$32 940 |

$92 870 |

$201 908 |

$400 290 |

|

8% |

$36 833 |

$118 589 |

$300 059 |

$702 856 |

|

10% |

$41 310 |

$153 139 |

$455 865 |

$1 275 356 |

|

12% |

$46 468 |

$199 830 |

$705 983 |

$2 376 484 |

|

14% |

$52 418 |

$263 269 |

$1 111 411 |

$4 523 037 |

|

16% |

$59 294 |

$349 892 |

$1 774 095 |

$8 754 030 |

|

18% |

$67 252 |

$468 697 |

$2 865 058 |

$17 169 707 |

|

20% |

$76 473 |

$632 296 |

$4 672 160 |

$34 034 926 |

Key takeaways:

- The interest rate has the most significant impact on the final value of savings.

- For small sums of money like $200, you need many years before your savings exceed $1 million.

- Over time, $200 could be turned into a large amount of money.

- Time is as crucial as a high-interest rate. For 10% APR each decade, you triple the portfolio value.

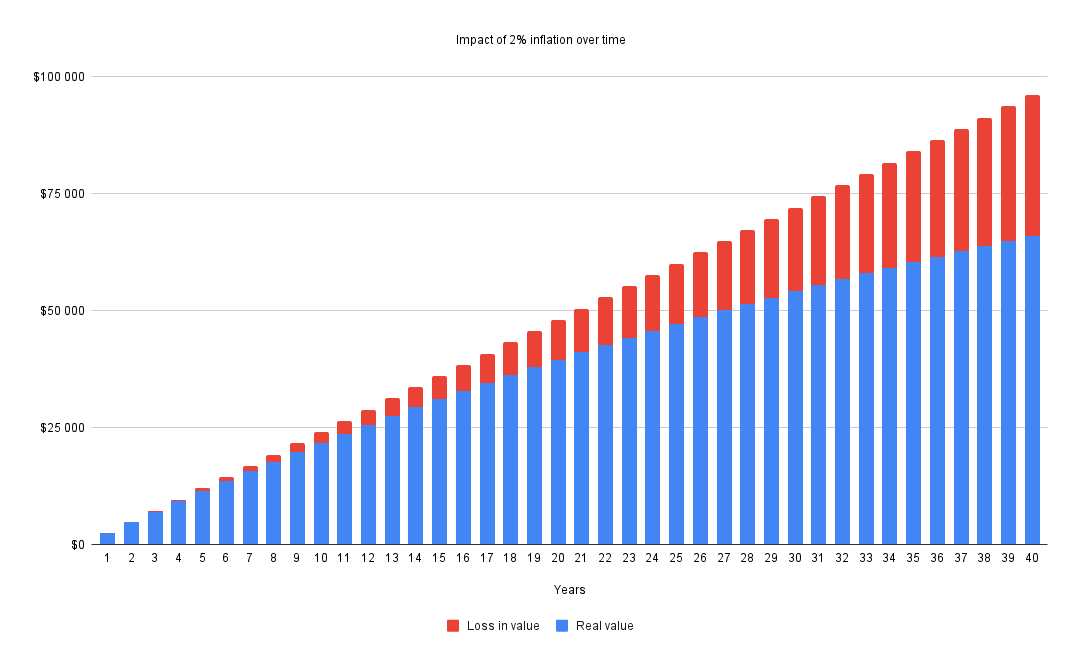

How does inflation impact the return rate of saving $200 per month?

Inflation is the greatest enemy of investors. Below we present how even low inflation of 2% will affect a savings plan of $200 per month.

To better illustrate the problem, we will analyze two cases. First, how does 2% inflation impacts capital on a savings account, and second what is the impact of 2% inflation over an investment with an average annual return rate of 10%?

Saving $200 monthly in an inflationary environment.

As you see on the chart below, a savings account doesn't protect the capital from inflation.

Unfortunately, even moderate inflation of just 2% wreaks havoc on the savings account, and saving $200 per month in a bank is a huge mistake. Over time inflation will take away most of the value of the savings.

During 40 years of saving $200 monthly, you will have $96,000 accumulated in your savings account. Although, due to inflation will have the same purchasing power as $66,006 today. Take note that all this loss in value was caused by a low inflation rate of just 2%, and as history shows, periods of much higher inflation are widespread.

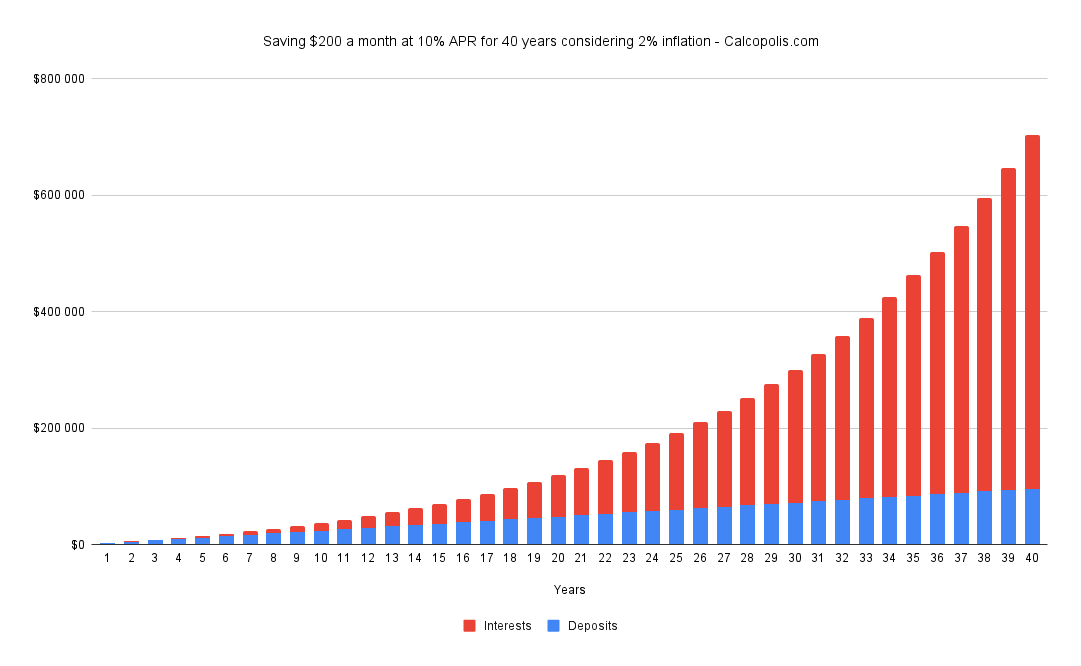

Investing $200 per month in an inflationary environment.

A good investment plan with broad asset class diversification will protect you from inflation and decrease your portfolio's overall risk and fluctuation.

The chart below illustrates the impact of moderate 2% inflation on the investment portfolio build of regular investments of $200 per month.

After 40 years, the real value of the accumulated capital will reach $702 856. Not as much as over one million we calculated before, but still a lot of money!

You can perform your own simulation using our inflation calculator.

Benefits of saving $200 a month

If you still have doubts that regulars saving os 200 per month is a good idea, please read the following report about what saving 200 dollars each month does to your financial situation.

What can saving 200 dollars a month do?

A $200 is not a lot, but intelligent investments with decent return rates could turn it into a large amount of money. The amount that will make a difference in your finances.

Saving $200 per month can be a game changer for your finances. Here are three reasons why:

Over time, saving $200 a month will accumulate into a large amount.

Because $200 is not a lot, it is often underrated, but it could turn you into a rich man almost effortlessly in the long run. You could save such an amount each month without having to deny yourself everything.

As we calculated before adjusting for inflation, it could turn into over $700,000. It will put you among the wealthy people!

The accumulated amount will give a decent interest monthly.

Saving for 23 years at 10% APR will let you reach $200k in savings - it could give you over $20,514 interest annually and make a fundamental change to your budget.

Interest and pension will increase your living standard on retirement.

While $20,514 is not enough for comfortable living anywhere in the United States, having that amount at the top of your pension will improve your retirement lifestyle.

If you are in your mid-twenties, you still have plenty of time to accumulate even more for your retirement and live an even higher standard of life.

Saving $200 a month for retirement

Although $200 is not a large amount of money, as you have seen before, it could grow over time into serious capital. The capital will generate over $100k in interest annually (see the table above).

However, this scenario is possible. It requires a lot of persistence and self-discipline. Being so persistent for several decades appears to be a very challenging task. On top of that, even low inflation will consume much of that money.

Luckily, it is not as demanding in practice because your income will also grow over time, so you can increase the amount you save each month. During the first years, it could be $200, but over time it could grow.

If you are investing strongly into raising your skills, your salary will grow accordingly, and after a few pay-rises, you will be able to save a lot more than just $200 monthly. This naturally will lead to a higher saving rate and shorter time needed to achieve your goals.

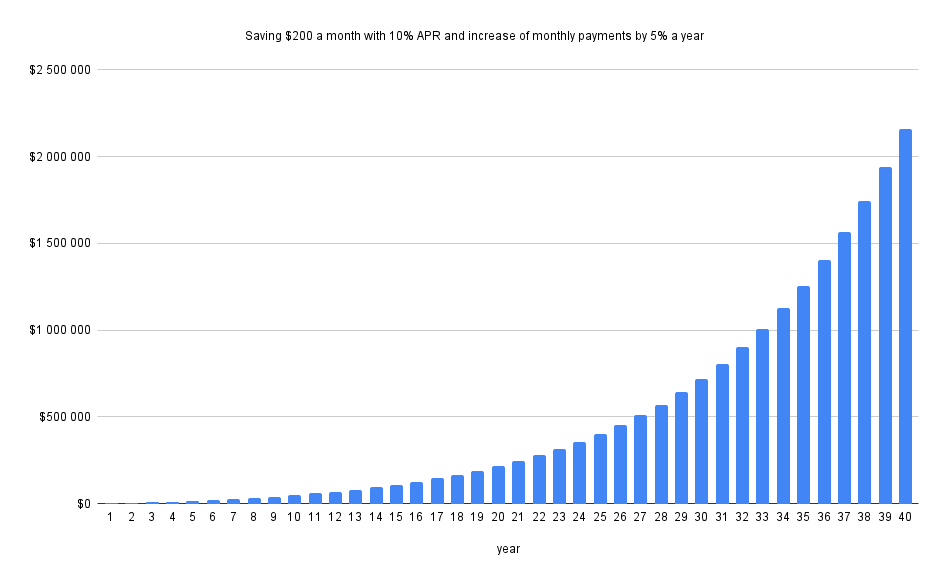

21-year-old saving $200 a month for retirement

For the following analysis, we will use a regular savings calculator available on Calcopolis. Still, we will use an extra feature that will increase the monthly payment by 5% each year. This will not only counteract inflation but will simulate future pay rises.

The chart below will show the case of saving $200 a month with a 10% APR and the continuous monthly payments increase by 5% each year.

Kee takeaways:

- Due to increased contributions, the accumulated amount is almost two times higher than it was for a similar scenario with constant contributions of $2,161,107 vs. $1,275,356

- In the last year of saving, you will need to save $1,408 monthly, which may appear a lot, but there are plenty of salary increases ahead of you :)

How to speed up the process of saving $200 a month?

If you are serious about saving $200 but don't want to wait 40 years to rip the benefits, there are some tips you could apply to achieve the results faster.

Remember that you can analyze your scenario using the calculators provided by Calcopolis.

Initial amount

When given time, the compound interest formula works best, so the money you invest early will provide you with the most interest.

Since everyone has some savings, it is a good idea to put it as a seed investment. Even small initial amounts like $5000 would significantly increase the outcome of your investment.

Putting a more significant amount, like $20k, in the beginning may shorten the time needed to save one million by a few years!

Higher APR

Newbie investors seek high-return investments, thinking that everything below 20% per year is a waste of time and money, so they gamble and run for fast returns using leverage or other "shortcuts".

They could not be more wrong, higher return rate means more often more risky investments and poses a threat of high losses instead of increased profits.

On the other hand, being too conservative may undermine your efforts. If you have several decades of investing ahead of you, it is good to accept a little bit of volatility that stocks have in exchange for higher returns.

Remember that a higher return rate of just 1% could make a massive difference in the long run.

Saving $200 a month over 40 years with a different annual interest rate

- 8.5% interest rate increase future balance to $813 451

- 9% interest rate increase future balance to $943 286

|

Sum of payments |

Interests |

Tax |

Final amount |

|

|

8% |

$96 000 |

$606 855 |

$0 |

$702 855 |

|

8.5% |

$96 000 |

$717 451 |

$0 |

$813 451 |

|

9% |

$96 000 |

$847 286 |

$0 |

$943 286 |

An annual increase in monthly savings

The table below shows how significant an impact a regular increase in your monthly savings has. Each row analyzes the case of increasing the monthly savings by a small percentage yearly.

How long can you live from accumulated savings?

After several decades of monthly contributions of $200, you could accumulate a small fortune. This money will let you live just from your capital for many years.

Let's analyze how long your savings will last if you start to withdraw an annuity each month.

The first scenario. Living from interest.

In this scenario, you need to accumulate a lot of money to have a decent standard of living once you retire.

The table below shows how much interest you could receive monthly from your savings. Note that the most probable scenarios are in the first five rows. Over 30 to 40 years, it is relatively easy to turn $200 of monthly savings between 1 and 2 million.

Monthly payments are not high, but you will never run out of money in this scenario and could even pass that money to your kids and grandkids.

|

Amount |

2% |

4% |

6% |

8% |

10% |

|

$300 000 |

$500 |

$1 000 |

$1 500 |

$2 000 |

$2 500 |

|

$600 000 |

$1 000 |

$2 000 |

$3 000 |

$4 000 |

$5 000 |

|

$800 000 |

$1 333 |

$2 667 |

$4 000 |

$5 333 |

$6 667 |

|

$1 000 000 |

$1 667 |

$3 333 |

$5 000 |

$6 667 |

$8 333 |

|

$1 500 000 |

$2 500 |

$5 000 |

$7 500 |

$10 000 |

$12 500 |

|

$2 000 000 |

$3 333 |

$6 667 |

$10 000 |

$13 333 |

$16 667 |

|

$2 500 000 |

$4 167 |

$8 333 |

$12 500 |

$16 667 |

$20 833 |

For your case, use our compound interest calculator. Using Calcopolis, you will calculate your case and determine how much that money would be worth over time due to inflation.

Second scenario. Withdrawing accumulated capital

This case analyzes how long your retirement savings would last if you consume both interests and accumulated capital. This will require the use of all the accrued money eventually. Still, in parallel, it will allow the withdrawal of higher amounts each month, so the standard of living will be much higher than before.

For more details, visit the living from savings calculator available on Calcopolis.

Alternative reports

If you are interested in achieving financial freedom faster, please read our reports on saving $500 per month or $700 monthly. You will see how higher savings goals affect the time needed to achieve early retirement.