Average Fixed Cost Calculator

Keep your fixed costs under control with Calcopolis.

Thanks to this AFC calculator, you can find the average fixed cost per unit of a manufactured product or serviced customer. It is vital information for every business owner who wants to optimize his company's profitability.

In this article, we explain:

- What are fixed costs?

- Why are they important?

- How can you optimize them to increase your profits?

What are fixed costs?

Fixed costs represent all expenses that are independent of your sales volume. In other words, you have to pay them even when you don't sell anything.

What are examples of fixed costs?

The most common fixed costs include rent, salaries, loan installments, lease expenses, etc.

What's more, there are types of costs that could be assigned to this category depending on the payment model.

For example, an outdoor marketing campaign that costs you a fixed amount of money, regardless of the generated sales, will be classified as a fixed cost. In contrast, the commission fee on the Amazon FBA program will be classified as a variable cost because its cost depends on generated sales volume.

What does the average fixed cost mean?

The average fixed cost (AFC) represents the total fixed cost per unit of your company's product or service.

The average fixed cost value decreases once your sales volume increases. Thanks to this, with the growth of your business, you will make more profit from each transaction.

By calculating the AFC value for your target sales volume, you can estimate how the cost structure will change once you grow your business.

Average Fixed Cost and Average Variable Cost are crucial for constructing an effective price list and growth plan for your business. See the AVC calculator for more details.

How do you calculate the average fixed cost?

If you wish to find the average fixed cost of your company, follow the procedure.

- Sum up all your fixed costs.

- Check out the total quantity of sold units.

- Substitute the values to the AFC formula.

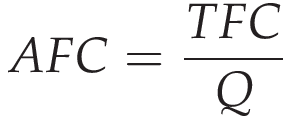

The average fixed cost formula

Where:

- TFC - total fixed costs of your company

- Q - the sold product quantity

How can this AFC calculator help you?

Knowing your fixed cost value is the first step to profit optimization. Once you calculate its value, you can write down all of its components and think about what you can do to decrease its value.

Look for costs that you could reduce, or maybe you could completely cut them off.

Keeping fixed costs low is one side of the medal. Since the AFC drops with your sales growth, consider more aggressive expansion.

For example, marketing campaigns that generate low profits at the current level of your sales could turn into very lucrative investments once bigger sales decrease the share of fixed costs in your company's cost structure.

Lowering average fixed costs will increase your gross margin and the accounting profit of your company.

Difference between Fixed and Variable Costs

To truly understand the fixed cost definition, it's essential to understand its specifics when comparing it with variable costs.

Fixed costs, like rent or salaried wages, don't vary with the production volume. So, regardless of whether a company manufactures one unit or a thousand, the fixed cost per unit can be determined using a fixed cost calculator. This value remains constant because, by definition, these costs don't change based on production levels.

In contrast, variable costs shift based on the number of units produced. The more units a company manufactures or sells, the higher the variable cost.

Imagine raw materials for a product; the more you produce, the more raw materials you need, causing the cost to rise in tandem with production. This inherent flexibility of variable costs, responding directly to production numbers, sets them apart from the stable nature of fixed costs.

While it's straightforward to calculate average fixed cost – simply divide the fixed cost of the company by the number of units produced – the variable costs would require a more dynamic approach since they fluctuate with production.

One crucial point of difference is how fixed costs, when spread out over production, can decrease on a per-unit basis with increased production. This isn't the case for variable costs, which vary directly with the number of units produced.

Understanding the stark differences between fixed and variable costs is essential for businesses, especially when making production, pricing, and profit estimation decisions. It guides the way in which they budget, forecast, and strategize for the future.

See also

Visit the economic profit calculator to understand the profitability of your business better.