Average Variable Cost Calculator

Keep your variable costs in check with Calcopolis.

Table of Contents

- What are variable costs?

- What does the average variable cost mean?

- How to calculate AVC?

- AVC formula

- How can this AVC calculator help you?

- Cost Control and Average Variable Costs

- Techniques for Managing and Reducing AVC

- Continuous Monitoring and Adjustment

- Break-Even Analysis and AVC

- AVC and Economies of Scale

- Average Variable Cost vs. Total Variable Cost

- See also

This handy online AVC calculator helps you balance your company's costs by helping you find the average variable cost per unit of your product or service.

In this article, we explain the most fundamental concepts of cost management:

- What are variable costs?

- Why are they so important?

- How can you use this knowledge to expand your business?

What are variable costs?

Variable costs represent all the costs that change with your production volume - for example, materials, transportation costs, electricity, commission fees, piece rate labor, etc.

What does the average variable cost mean?

The average variable cost (AVC) represents the total variable cost per unit of your company's product or service. By determining your AVC value, you could calculate how much your entire company's costs will change if you increase your production volume by X units.

Average variable cost is strictly connected with the average fixed cost of your production. See the AFC calculator for more details.

How to calculate AVC?

The calculation of average variable cost is pretty straightforward.

- Sum up all your variable costs.

- Check out the total quantity of produced units.

- Substitute the values to the AVC formula.

Alternatively, you may use our variable cost per unit calculator, available above the article.

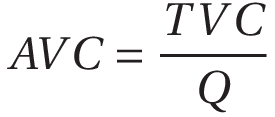

AVC formula

If you wish to calculate the average variable cost, use the following equation:

Where:

- TVC - total variable costs of your company

- Q - the quantity of the production or the number of serviced customers.

How can this AVC calculator help you?

Keeping AVC in check helps you better plan and optimize your company's profitability in terms of accounting profit or profit margin.

The AVC value should never exceed the selling price of your goods or services. Moreover, an extra margin should always cover fixed costs and leave room for profit.

For example, if you offered your service for $100, and your initial variable costs had grown from $60 to $100, then your business becomes unprofitable.

Since variable costs are composed of many factors that may vary over time, it is crucial to evaluate them regularly and calculate gross margins whenever they change.

The variable costs should be checked when you prepare a discount policy (see markdown calculator for details).

Cost Control and Average Variable Costs

Cost control is essential for businesses aiming to maintain profitability and competitive pricing for their goods and services.

Understanding and managing the average variable cost is a pivotal strategy for business owners. Here's a look at some best practices and the significance of regular monitoring.

Techniques for Managing and Reducing AVC

-

Detailed Analysis of Costs: It's essential first to identify all variable costs associated with the production. By doing this, businesses can pinpoint areas where costs may be reduced without compromising the quality of the goods or services.

-

Volume Discounts with Suppliers: As production scales up, businesses can negotiate volume discounts with suppliers, ensuring the average variable cost declines with increased production levels.

-

Efficient Production Techniques: Adopting advanced production methods or technologies can reduce wastage and ensure that resources are utilized optimally. This efficiency can reduce additional variable costs for every subsequent unit produced.

-

Regular Training for Staff: Ensuring that employees are well-trained can increase production efficiency, thereby reducing mistakes that might increase variable costs.

-

Outsourcing Non-core Activities: Sometimes, outsourcing specific tasks or processes can be more cost-effective than maintaining them in-house.

Continuous Monitoring and Adjustment

The business landscape is dynamic, meaning costs can change due to factors like market fluctuations, changes in supplier pricing, or technological advancements.

It's crucial to continuously monitor AVC to ensure it remains in line with business objectives.

When businesses calculate average variable costs routinely, they're better equipped to make informed decisions about pricing, production levels, and overall strategy.

If there's an unexpected increase in AVC, prompt adjustments can be made to control the variable cost and ensure profitability.

Tools like the AVC calculator and other tools from Calcopolis can be invaluable for managers. This tool not only helps in determining the current AVC but also aids in forecasting future costs based on various production scenarios.

Break-Even Analysis and AVC

Understanding break-even analysis is crucial for businesses to determine the level of sales or production at which they neither make a profit nor a loss.

The average variable cost (AVC) is pivotal in this calculation, providing insights into the cost structure and guiding management decisions.

The Relationship Between Total Cost and AVC

Every business incurs costs to produce goods or offer services. The total cost a company faces is the sum of fixed costs (those that remain constant regardless of the production level) and variable costs (those that vary directly with the volume of production).

The variable cost formula helps businesses ascertain these fluctuating expenses. When you calculate the average variable cost, you're essentially determining the cost incurred for producing each unit, making it a crucial part of the break-even analysis.

Incorporating Marginal Cost

Marginal cost is the expense of producing one additional unit of a product. It is essential in decision-making, especially when determining pricing or production levels.

Understanding both the AVC and marginal cost provides businesses with a comprehensive view of their average cost for each product, ensuring they're pricing products optimally to cover these costs and generate a profit.

Navigating the Cost Structure

A company's cost structure is primarily made up of its fixed and variable costs. As production levels change, AVC offers insights into how variable expenses will shift.

Understanding how AVC and fixed costs interact is vital in the context of break-even analysis. Once a business covers its fixed costs, every additional unit sold contributes to covering the variable costs and, subsequently, to generating profit.

Using AVC in Break-Even Calculations

To determine the break-even point, businesses must first identify both their fixed and variable costs. By using the AVC, companies can accurately gauge the costs incurred per unit of production.

When the total revenue generated equals the total cost (fixed costs + the product of AVC and the number of units sold), the business reaches its break-even point.

The AVC is an indispensable tool in break-even analysis. It helps businesses understand their expense patterns, cost structure, and the impact of production changes, ensuring they're well-equipped to make informed strategic decisions.

AVC and Economies of Scale

As businesses scale, they often encounter the principle of economies of scale. This phenomenon describes the cost advantages businesses reap when they increase the output produced.

The relationship between average variable cost (AVC) and economies of scale becomes evident as a firm changes its output levels.

-

Decrease in Costs with Increased Output: Generally, as the number of units produced rises, the costs per unit of output decrease. This is largely because as a company manufactures more goods or offers more services, it can distribute certain costs, like raw materials or bulk orders, over a larger number of items.

-

Raw Materials and Bulk Purchasing: With a rise in the number of goods produced or services rendered, companies often have the leverage to negotiate better deals for raw materials. Buying in bulk usually results in cost savings, which, when spread over the increased output, reduces the AVC.

-

Efficient Use of Human Labor: As output level surges, human labor can be utilized more efficiently. Workers develop expertise with repetitive tasks, leading to faster production times and fewer errors. Consequently, the cost of human labor per unit or service produced often falls, contributing to a decreased AVC.

-

Reduced Costs per Unit of Output: Economies of scale enable a reduction in the costs associated with each unit of output produced. This not only pertains to tangible goods produced but also to services. As a firm scales its services, it can optimize processes, utilize technology better, and achieve a lower AVC.

Average Variable Cost vs. Total Variable Cost

Average and Total Variable Costs (TVC) are crucial in business financial analysis but offer different perspectives.

-

Average Variable Cost: This represents the variable cost per unit of production. It provides insights into the incremental costs of producing one additional unit.

-

Total Variable Cost TVC sums up all variable costs for a specific production volume. It gives a holistic view of costs that change directly with production numbers.

While AVC emphasizes the cost for each additional unit produced, TVC gives an overview of the total varying costs for the entire production.

Understanding both metrics aids in making informed production and pricing decisions.

See also

Visit the economic profit calculator to understand the profitability of your business better.