Install CalcoPolis as App Add Calcopolis icon to homescreen and gain quick access to all calculators. Click here to see how »

Crunch the Numbers, Craft the Future: MRR Calculation Made Easy!

Table of Contents

- What is MRR?

- How can this Monthly Recurring Revenue Calculator help you?

- Make the business plan.

- Prepare forecast

- Make decisions based on data.

- How to use the MRR Calculator?

- Monthly Recurring Revenue Calculation (step-by-step)

- MRR formula for SaaS (examples)

- How to compute MRR in subscription business

- What are the most common mistakes while calculating MRR?

- Benefits of MRR

- Limitations of MRR

- MRR vs. ARR

- Factors Affecting MRR

- Real-Life Examples: Using MRR Calculation to Guide Strategy

- Case Study A: Pricing Uplift with Churn Guardrails

- Case Study B: Freemium to Paid Conversion

- Real-Life Example: Using MRR Calculation to Decide on Subscription Pricing

- FAQ: MRR for SaaS

- What is a good churn rate impacting MRR?

- How does MRR differ from ARR?

- How to compute MRR in subscription business with multiple tiers?

- Should trials be included in a monthly recurring revenue calculation?

- Similar tools

What is MRR?

Monthly Recurring Revenue (MRR) is the total predictable subscription revenue your business earns each month. In practice, it reflects the average revenue per customer multiplied by the number of paying customers — a simple snapshot of the engine that powers most subscription models.

MRR helps you understand average revenue per user (ARPU), forecast near-term revenue, and track momentum in a way that one-off sales cannot. For SaaS and other subscription businesses, MRR is a core indicator of financial health and growth potential.

How can this Monthly Recurring Revenue Calculator help you?

Use this online MRR Calculator to conduct a monthly recurring revenue calculation, forecast subscription turnover, and pressure-test your assumptions. It’s not only about prediction — it’s a tool for optimization and “what-if” analysis.

Make the business plan.

Calculating monthly recurring revenue is a first step when planning a new SaaS venture. It gives perspective on potential cash-generating capacity and revenue scale under different acquisition and churn assumptions.

Prepare forecast

Future MRR is a strong proxy for future profitability. If your subscription business has baseline data, you can project MRR for upcoming periods and set realistic targets for growth and retention.

Make decisions based on data.

The MRR calculator supports pricing experiments and new plan structures. Change the price, new-customer run-rate, or churn and immediately see how each lever shifts your forward MRR.

How to use the MRR Calculator?

The calculator is straightforward, but interpreting fields correctly prevents misreads and over-optimism.

Subscription price

The monthly price of your subscription. If you offer multiple plans, enter the average paid price.

New customers

The number of new paying customers you add each month (exclude trials until they convert).

Churn

The number of customers that cancel each month. To deepen retention analysis, see the churn rate calculator.

Period

The number of months you want to project.

The result

You’ll see the projected MRR after the selected period and the total number of active customers at that time.

Monthly Recurring Revenue Calculation (step-by-step)

- Calculate the average monthly revenue from a single customer.

- Estimate how many new paying customers you gain each month.

- Estimate monthly churn (customers canceling their subscriptions).

- Choose the projection length in months.

- Enter these values above or use the formula below.

MRR formula for SaaS (examples)

MRR = Price * NewCustomers*Months - Price*Churn*(Months-1)

Where:

- Price – the average monthly cost of the subscription

- new customers – the number of new subscriptions each month

- Churn – the number of customers who quit each month

- Months – the period you wish to calculate MRR for

How to compute MRR in subscription business

Start with conservative inputs (price, new customers, churn), then iterate monthly. Compare projected MRR to actuals and refine assumptions — a practice recommended by SaaS analytics providers (source).

What are the most common mistakes while calculating MRR?

Although MRR looks simple, three errors frequently distort results and decisions:

- Confusing MRR with cash flow – MRR ignores one-off fees, invoices paid in advance, refunds, and payment timing.

- Counting trials as paying customers – include users only after conversion to paid.

- Mis-pricing the average – mixed plan tiers, coupons, and discounts can skew the “Price” input if you don’t use an actual paid average.

Avoid these pitfalls to get decision-ready projections.

Benefits of MRR

Predictable Revenue Stream

MRR clarifies expected monthly revenue, improving budgeting, hiring plans, and runway visibility.

Growth Tracking

Month-over-month MRR growth highlights the balance between acquisition, expansion, contraction, and churn.

Enhanced Decision Making

With forward MRR, you can model pricing, packaging, and marketing efficiency before committing budget.

Performance Indicator

MRR is a key performance indicator that reflects whether your product and pricing resonate with your market.

Limitations of MRR

Not a Cash Flow Indicator

MRR is accrual-style and excludes one-time payments and non-recurring expenses; it’s not a substitute for cash flow statements.

Variance in Subscription Models

Mixed tiers, discounts, and promotions require careful averaging to avoid overstating “Price”.

Over-reliance

MRR alone can mislead. Pair it with churn rate, customer lifetime value (LTV), payback period, and gross margin for a complete view.

MRR vs. ARR

While MRR focuses on average monthly revenue, ARR (Annual Recurring Revenue) provides a yearly lens on the same recurring base. Use MRR for tactical, month-to-month steering and ARR to communicate the annualized scale of your subscription business.

Short-term spikes in MRR can be informative, but ARR smooths seasonality and offers a clearer read of longer-term trajectory.

Segmented MRR

Segmented MRR breaks your monthly recurring revenue into components so you can diagnose why MRR changes — not just how much.

- New MRR: Added by newly acquired paying customers in the month.

- Expansion MRR: Upsells, cross-sells, or higher-tier upgrades from existing customers.

- Contraction MRR: Downgrades and reduced usage that lower monthly spend.

- Churned MRR: Lost revenue from cancellations.

- Reactivation MRR: Revenue from previously churned customers who return.

Tracking these segments clarifies your revenue mechanics, guides retention and pricing strategy, and explains fluctuations in total MRR (see practical breakdowns).

Factors Affecting MRR

Customer Acquisition

The pace and quality of new paying customers directly drives MRR growth.

Churn Rate

High churn can erase acquisition gains. Improving onboarding, product value, and support reduces churn.

Pricing Changes

Discounts, promotions, and list-price updates shift ARPU — model them before launch.

Subscription Upgrades/Downgrades

Plan migrations influence expansion and contraction MRR.

Seasonal Trends

Sector seasonality can cause predictable peaks and troughs in acquisition and churn.

Real-Life Examples: Using MRR Calculation to Guide Strategy

Below are two short case studies showing how a monthly recurring revenue calculation can improve decisions.

Case Study A: Pricing Uplift with Churn Guardrails

A B2B SaaS raises price from $30→$36 (+20%). Assumptions: new customers = 400/mo, churn increases from 2.0%→3.2%. Net: expansion boosts ARPU, but higher churn trims customer count. Modeling shows MRR still rises after month 3; leadership proceeds and invests in onboarding to pull churn back below 2.5%.

Case Study B: Freemium to Paid Conversion

A productivity app moves trials off the paid count and tracks true conversion. Conversion improves from 8%→11% after paywall changes; “Price” input shifts to the actual paid average (post-discount). The revised MRR formula for SaaS inputs reveal a cleaner growth curve and more accurate payback calculations on ad spend.

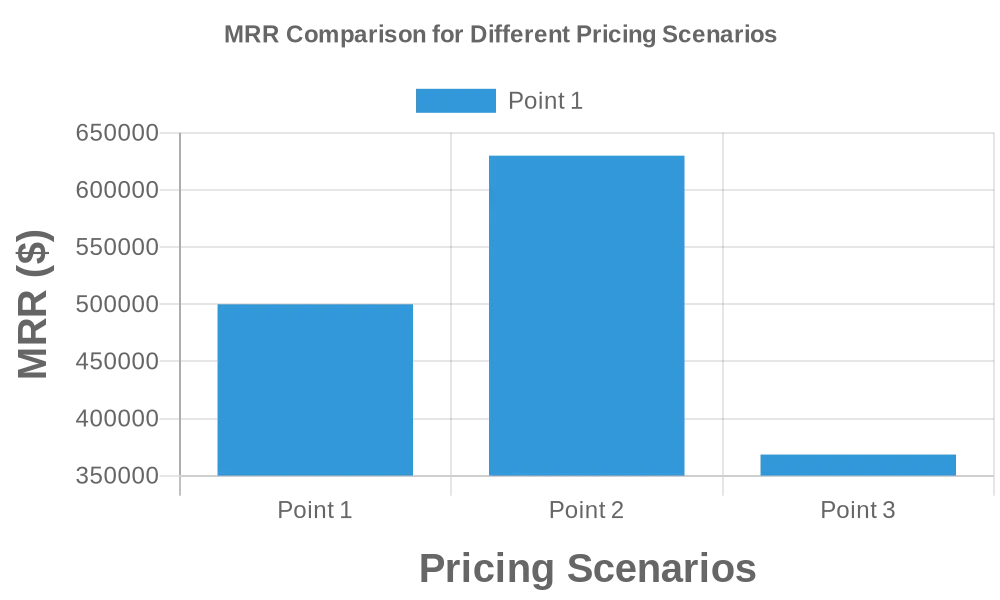

Real-Life Example: Using MRR Calculation to Decide on Subscription Pricing

Imagine a company named “StreamFlix,” an online streaming service deciding on a price change while managing churn and growth.

Initial Data:

- Current Subscription Price: $10/month

- Current MRR: $500,000 (from 50,000 subscribers)

- Churn Rate: 3% per month

Scenario 1: Increasing the Subscription Price

Price rises to $12/month; predicted churn rises to 5%.

MRR Calculation Post Price Increase:

- New Subscribers (assumption): 5,000

- Churned Subscribers: 5% of 50,000 = 2,500

- Total Subscribers after Churn: 50,000 + 5,000 − 2,500 = 52,500

- Projected MRR: 52,500 × $12 = $630,000

Scenario 2: Decreasing the Subscription Price

Price drops to $5.99/month; predicted churn drops to 1% and acquisition accelerates.

MRR Calculation Post Price Decrease:

- New Subscribers (assumption): 12,000

- Churned Subscribers: 1% of 50,000 = 500

- Total Subscribers after Churn: 50,000 + 12,000 − 500 = 61,500

- Projected MRR: 61,500 × $5.99 = $368,485

- Point 1: Original Price ($10) – $500,000

- Point 2: Higher Price ($12) – $630,000

- Point 3: Lower Price ($5.99) – $368,485

Decision

The higher price yields greater MRR immediately, while the lower price grows the subscriber base. Model both scenarios across multiple months to balance near-term revenue versus long-term share, upsell potential, and network effects.

FAQ: MRR for SaaS

What is a good churn rate impacting MRR?

For many B2B SaaS, monthly logo churn of 1–3% is a common target; lower is better. Churn tolerance depends on ACV, segment, and payback period.

How does MRR differ from ARR?

MRR measures monthly recurring revenue; ARR is the annualized view (often ~MRR × 12). Use MRR for tactical steering and ARR for long-term scale and investor communications.

How to compute MRR in subscription business with multiple tiers?

Calculate a weighted average price across active paying tiers (net of discounts), then apply the MRR formula for SaaS with your new customers, churn, and months assumptions.

Should trials be included in a monthly recurring revenue calculation?

No — count trials only after conversion to paid. Including trials inflates MRR and masks retention issues.

Similar tools

If you wish to expand your business, Calcopolis is right for you. On this website, you will find many useful tools for small business owners.

MRR analysis is particularly useful when you compare the results with the break-even point calculation or your margin of safety.

You may find ROAS Calculator very useful if you run an online business.

Calculating ROI or ROE may be very important for your business plan if you are just starting a new venture.