Profitability Index Calculator

Maximize Your Returns: Mastering the Profitability Index for Smarter Investments!

Table of Contents

Investment analysis involves assessing various investment opportunities to determine their potential profitability and suitability within an investor's portfolio. This process is not just about picking winners; it's a meticulous evaluation of risks, returns, and the alignment of investments with strategic goals.

Amidst various analytical tools, the Profitability Index (PI) emerges as a key player. Often overshadowed by its more famous cousins like Net Present Value (NPV) and Internal Rate of Return (IRR), PI offers a unique perspective in investment decision-making. It is a ratio, but not just any ratio. It tells us the bang for the buck, the value you get for every unit of currency invested. In essence, PI helps in determining the desirability of an investment.

What is the Profitability Index?

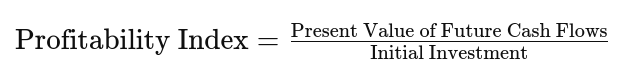

The Profitability Index is defined as the ratio of the present value of future cash flows to the initial investment. Mathematically, it's expressed as:

This straightforward formula belies the powerful insight it offers - a direct measure of the investment’s efficiency.

Why PI Matters in Investment Decisions

The importance of PI in investment decision-making cannot be overstated. It serves as a crucial tool for comparing projects of different scales and helps in identifying investments that yield the most value relative to their cost. A PI greater than 1 indicates a potentially lucrative investment, while a value less than 1 signals a warning. This simplicity in interpretation makes PI a favored tool among financial analysts.

When stacked against other investment appraisal techniques, such as NPV and IRR, PI holds its ground by providing a relative measure of profitability, unlike the absolute figures given by NPV. It also avoids some of the pitfalls of IRR, particularly in dealing with non-standard cash flows.

Profitability Index Formula

Present Value of Future Cash Flows

A pivotal component in calculating PI is the present value of future cash flows. This involves projecting the cash that an investment will generate and then discounting it to its present value. This discounting accounts for the time value of money – a dollar today is worth more than a dollar tomorrow.

Initial Investment

The initial investment is the starting point of any project or investment, representing the total of all costs incurred to commence the venture. This can range from purchasing equipment to initial research and development costs. Handling different types of initial investments requires understanding their nature – whether they are one-time costs, recurring expenses, or a mix of both.

Calculating the Profitability Index

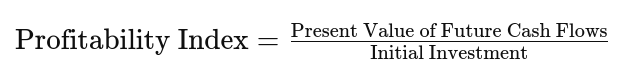

Calculating the Profitability Index (PI) is a straightforward process but requires meticulous attention to detail. The formula is:

-

Estimate Future Cash Flows:

Begin by projecting the cash flows that the investment is expected to generate in the future. This involves analyzing market trends, historical data, and any other relevant factors. -

Calculate Present Value:

Discount these future cash flows to their present value. This is done using a discount rate, which could be the cost of capital or any other rate appropriate to the risk of the investment. -

Determine Initial Investment:

Ascertain the total initial outlay required for the investment. This includes all costs that are necessary to start the project. -

Calculate PI:

Divide the present value of future cash flows by the initial investment to arrive at the PI.

Examples in Different Scenarios

- Scenario 1: A small-scale investment with low initial costs and steady cash flows.

- Scenario 2: A large project with significant initial investment but higher future cash flows.

- Scenario 3: An investment with irregular cash flows.

Each scenario will demonstrate how PI varies with different investment scales and cash flow patterns.

Avoiding Common Pitfalls

- Overestimating Cash Flows: Avoid overly optimistic projections.

- Inaccurate Discount Rate: Ensure the discount rate reflects the investment’s risk.

- Ignoring Hidden Costs: Factor in all costs, not just the obvious ones.

Interpreting the Profitability Index

Understanding PI Values

- PI > 1: The investment is expected to generate more value than its cost.

- PI < 1: Indicates that the investment may not cover its costs.

- PI = 1: The investment is expected to break even.

Decision Rules Based on PI

- Select Investments with PI > 1: Prioritize projects that offer higher returns relative to their costs.

- Use PI in Conjunction with Other Metrics: PI should be one of several factors in the decision-making process.

Limitations and Considerations

- PI does not provide absolute profitability figures.

- It may not be as effective for comparing projects of vastly different scales.

Profitability Index in Real-world Scenarios

Case Studies in Business Decisions

- Manufacturing Industry: How a manufacturing firm used PI to decide between two expansion projects.

- Technology Sector: Application of PI in evaluating a new tech startup's funding round.

Industry-Specific Applications

Different industries have varying risk profiles and investment scales, influencing how PI is used in investment appraisal.

Comparative Analysis

PI vs. NPV and IRR

- While NPV gives the absolute value of an investment’s profitability, PI offers a relative measure.

- IRR, on the other hand, indicates the rate of return, but can be misleading for non-conventional cash flows – a gap that PI fills.

Effectiveness of PI

- PI is particularly effective in resource allocation when capital is limited.

- It is also useful when comparing projects of similar scale but different capital outlays.

Advanced Considerations

Adjusting for Risk and Inflation

- Modifying the discount rate to account for risk and inflation can provide a more accurate PI.

- Sensitivity analysis can help understand how changes in assumptions impact PI.

PI in Portfolio Management

- Understanding the role of PI in balancing risk and return in a portfolio.

- Its utility in determining the composition of a diversified investment portfolio.

This part of the article delves into the practical aspects of calculating and interpreting the Profitability Index, providing readers with a comprehensive understanding of its application in real-world scenarios and comparative analysis with other investment appraisal methods.

Summary

In conclusion, PI Calculator stands as an invaluable tool in the arsenal of financial analysis, offering a nuanced perspective in investment decision-making. Through its simple yet effective ratio, PI aids in discerning the relative profitability of various investment opportunities, providing a clear benchmark for comparison. Whether it is for a small-scale project or a large corporate investment, the PI's adaptability to different scenarios and its ability to complement other financial metrics like NPV and IRR makes it a versatile and indispensable method in financial analysis.

However, as with any analytical tool, the key to harnessing the full potential of the Profitability Index lies in its careful application. Accurate estimation of future cash flows, prudent selection of a discount rate, and thorough consideration of all initial investment costs are critical to deriving a meaningful PI. Moreover, understanding the limitations and context-specific nuances of the PI ensures that it is employed effectively, avoiding the pitfalls of misinterpretation.

In a world where investment decisions can make or break financial success, the PI serves not just as a calculator of potential returns but as a beacon guiding investors towards more informed, strategic, and ultimately profitable investment choices. Its role in portfolio management, particularly in resource allocation and risk assessment, further underscores its relevance in the dynamic landscape of finance.

By integrating the Profitability Index into their analytical framework, investors and businesses can navigate the complex waters of investment opportunities with greater confidence, making decisions that are not only financially sound but also aligned with their long-term strategic objectives. As the financial world continues to evolve, the PI remains a timeless and essential tool, illuminating the path to prudent and profitable investments.

Related tools

Net Present Value (NPV) Calculator: Since PI is closely related to NPV, an NPV calculator can help in determining the absolute profitability of an investment.

Internal Rate of Return (IRR) Calculator: Useful for comparing the profitability of different investments, an IRR calculator can supplement the relative measure provided by the PI.

Discounted Cash Flow (DCF) Calculator: This tool is vital for calculating the present value of future cash flows, a key component in PI calculation.

Payback Period Calculator: This calculator helps to determine the time it will take for an investment to recover its initial costs, providing a simple measure of investment risk.

Cash Flow Calculator: Since accurate cash flow projection is crucial for PI, a cash flow calculator can assist in estimating and organizing future cash inflows and outflows.

Break-Even Calculator: This tool can help in understanding the point at which an investment will start to generate a profit, complementing the PI's profitability assessment.

Inflation Calculator: Inflation can significantly impact the real value of future cash flows; thus, an inflation calculator can be helpful in adjusting cash flow projections.