PVIFA Calculator

Future Finances, Today's Decisions: Master PVIFA for Smart Planning

The Present Value Interest Factor of Annuity (PVIFA) is a fundamental concept in the world of finance, serving as a cornerstone in the realms of financial planning and investment analysis. This concept is particularly crucial for understanding the value of money over time, especially when dealing with regular payments or receipts – known as annuities. PVIFA is pivotal in determining how much a series of future payments is worth in today's dollars, an essential calculation for anyone involved in financial planning, whether for personal or professional purposes.

The importance of PVIFA in financial planning and investment analysis cannot be overstated. It allows individuals and businesses to assess the present value of investments that yield returns over multiple periods. This is particularly relevant in scenarios like retirement planning, loan repayment schedules, and any situation where financial outcomes stretch into the future.

Before diving into the specifics of PVIFA, it's essential to grasp two key concepts: Present Value and Annuity.

-

Present Value: This refers to the current worth of a future sum of money or stream of cash flows, given a specified rate of return. Present Value calculations consider the time value of money, which posits that a dollar today is worth more than a dollar tomorrow due to its potential earning capacity.

-

Annuity: An annuity is a series of equal payments made at regular intervals. Examples include regular deposits to savings, monthly home mortgage payments, or regular insurance payments.

What is PVIFA?

PVIFA stands for Present Value Interest Factor of Annuity. It is a factor used to calculate the present value of a series of annuities. PVIFA is particularly useful in determining the present value of a series of future annuity payments.

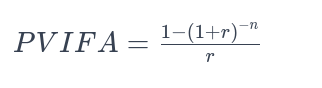

The formula for calculating PVIFA is:

Where:

- represents the interest rate per period.

- is the number of periods.

In this formula:

- The interest rate per period () plays a crucial role, as it affects the discounting rate used to calculate the current worth of future payments.

- The number of periods () signifies the total number of future payments.

By using the PVIFA formula, one can easily determine how much a series of future annuity payments is worth in today's money, accounting for interest and the time value of money. This calculation is essential in a variety of financial planning and investment scenarios, providing a clear picture of the value of future cash flows.

Applications of PVIFA

The Present Value Interest Factor of Annuity (PVIFA) is utilized in various real-world scenarios, each highlighting its versatility and importance in financial planning and analysis.

-

Retirement Planning: In retirement planning, PVIFA is used to calculate the current worth of a series of future pension payments. By understanding the present value, individuals can make informed decisions about retirement savings and investment strategies.

-

Loan Analysis: PVIFA is crucial in analyzing the total cost of a loan. It helps in determining the present value of all future loan repayments, aiding borrowers and lenders in understanding the true cost of a loan.

-

Investment Decisions: Investors use PVIFA to evaluate the attractiveness of annuity investments. By calculating the present value of future cash flows, investors can determine whether the investment aligns with their financial goals.

Advantages of Using a PVIFA Calculator

Using a PVIFA calculator simplifies these complex calculations and offers several benefits:

- Simplicity and Ease of Use: Our PVIFA calculator allows users to easily input variables and quickly calculate the PVIFA, making complex calculations accessible to all.

- Accuracy: The calculator minimizes human error, ensuring that the calculations are precise and reliable.

- Efficiency: It significantly speeds up the process, allowing for quick financial analysis and decision-making.

Comparison with Future Value Interest Factor of Annuity

Understanding the differences between PVIFA and Future Value Interest Factor of Annuity (FVIFA) is crucial for financial analysis:

- PVIFA vs. FVIFA: While PVIFA calculates the present value of an annuity, FVIFA calculates its future value. PVIFA discounts future cash flows to present value, whereas FVIFA compounds present cash flows to their future value.

- Situational Analysis: The choice between PVIFA and FVIFA depends on the financial goal. Use PVIFA to understand the current value of future cash flows, particularly useful for valuing annuities or comparing investment options. FVIFA is more suited for scenarios where you want to calculate the future value of current investments or savings.

The value of PVIFA in various financial contexts—especially in retirement planning, loan analysis, and investment decisions—cannot be overstated. By using our PVIFA calculator, individuals and businesses can accurately calculate the PVIFA for different interest rates and periods, aiding in strategic financial planning and decision-making.

Things to Watch Out For.

When utilizing the Present Value Interest Factor of Annuity (PVIFA), it's important to consider the impact of fluctuating interest rates and inflation:

- Varying Interest Rates: Changes in interest rates can significantly affect PVIFA calculations. A higher interest rate increases the discount rate, thereby lowering the present value of future annuities. Conversely, lower interest rates increase the present value.

- Inflation: Inflation erodes the purchasing power of money over time. When calculating PVIFA, considering the inflation rate is crucial to ensure that the present value reflects true future purchasing power.

Understanding the limitations and assumptions behind PVIFA is also vital. PVIFA calculations assume fixed interest rates and regular payment intervals. In reality, interest rates can fluctuate, and payments might not always be consistent, which can affect the accuracy of PVIFA calculations.

Case Studies

To illustrate the practical application of PVIFA, consider these examples:

-

Retirement Planning: An individual planning for retirement uses PVIFA to determine the present value of their pension annuity. By inputting their expected monthly pension and the interest rate, they can assess how much their future pension is worth today.

-

Loan Repayment: A borrower calculates the present value of their mortgage payments using PVIFA. This helps them understand the true cost of the loan and compare it with other financing options.

Conclusion

The significance of the Present Value Interest Factor of Annuity in financial decision-making is profound. It provides a clear understanding of the present worth of future annuities, an essential aspect of financial planning. PVIFA calculations help in evaluating investment opportunities, planning for retirement, analyzing loans, and much more.

We encourage individuals and financial professionals alike to utilize the PVIFA calculator for personal and professional financial planning. It's a valuable tool that simplifies complex calculations, ensuring accurate and efficient financial analysis and decision-making. Embracing this tool can lead to more informed, strategic, and confident financial choices, paving the way for a secure and well-planned financial future.

Related tools

- Present Value Calculator: Calculates the current worth of a future lump sum of money or stream of cash flows.

- Future Value Calculator: Estimates the future value of an investment based on periodic, constant payments and a constant interest rate.

- Annuity Calculator: Helps determine the payment amounts for an annuity based on factors like principal, interest rate, and time.

- Retirement Goal Calculator: Estimates the amount of savings required for retirement, considering current savings and future retirement goals.

- ROI Calculator: Helps calculate the potential return on investment for various investment options.

- Inflation Calculator: Projects the impact of inflation on the value of money over time.

- Compound Interest Calculator: Calculates the interest earned on an investment or paid on a loan, where the interest is compounded over time.

- Bond Yield Calculator: Determines the yield of a bond based on its current price and other factors like face value and coupon rate.