Rounding Money Calculator

How can this rounding money calculator help you?

Table of Contents

- The functionality of this tool

- What is it, and how does it work?

- What are the methods of rounding money?

- What are the benefits of rounding to the nearest whole thousand?

- Errors and Mistakes Due to Rounding Money

- Compounding Errors

- Data Misrepresentation

- Budget Overlooks

- Missteps in Pricing

- Tax Complications

The functionality of this tool

Do you ever get confused when counting coins, decimals, or prices at the store? Or maybe you wonder why your friend’s total at the checkout looks different from yours? That’s where rounding money — also known as cash rounding or currency rounding — comes to the rescue!

With the CalcoPolis Rounding Calculator, even the trickiest decimals become simple and fun. Whether you’re learning decimals at school, managing allowance money, or exploring global currencies like the Euro, CHF, or British Pound, this tool helps you round in seconds — no stress, no mistakes.

This tool will allow you to:

- Round various currencies — Euro, CHF, British Pounds, Dollars, and more

- Round to the nearest penny or cent

- Round to the nearest dollar

- Round to the nearest hundred, thousand, or even million

What is it, and how does it work?

This calculator is super easy to use — just enter the number, choose the rounding level, and let the magic happen! Behind the scenes, it follows smart mathematical rules used in cash rounding worldwide, especially when coins smaller than 1 cent are no longer used (like in some countries using the Euro or Swiss franc).

Let’s take a peek at how rounding works in practice.

- Rounding to the nearest cent:

$4.2341 → $4.23

If the third decimal is 5 or more, add one to the second decimal. If it’s smaller, leave it as is. Simple and precise!

- Rounding to the nearest dollar:

$12.39 → $12

Look at the first decimal (the tenths place). If it’s 5 or more, round up the dollar amount; if it’s 4 or less, round down.

- Rounding to the nearest hundred:

$864 → $900

Check the tens digit. If it’s 5 or more, go up to the next hundred; if not, stay where you are.

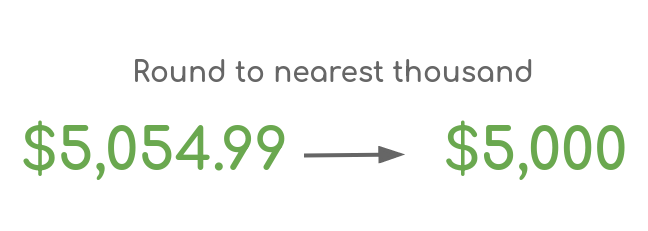

- Rounding to the nearest thousand:

$7392 → $7000

Now, look at the hundreds digit. Is it 5 or higher? Then round up! If it’s smaller, round down. This method is often used in currency rounding when dealing with big company figures or reports.

What are the methods of rounding money?

There are several rounding modes in mathematics and finance. The calculator can switch between them easily — so you can explore and compare! Let’s see what each one means:

a) Round half up – the most popular and fair rule. When the digit after your rounding place is 5 or higher, you round up:

$2.50 → $3

$2.51 → $3

$2.49 → $2

b) Round up (Ceiling) – always round toward the next higher number, no matter what:

$2.50 → $3

$2.49 → $3

c) Round down (Floor) – always round toward the lower number:

$2.50 → $2

$2.49 → $2

d) Round half to even – used often in banks and accounting (sometimes called “banker’s rounding”). When the number ends exactly in 0.5, it rounds to the nearest even number. It’s great for fair splits and shared payments.

$1.5 → $2

$2.5 → $2

What are the benefits of rounding to the nearest whole thousand?

Understanding rounding isn’t just for math class — it’s for life! Let’s explore how it helps in real-world situations.

1. Price negotiations:

Imagine you’re buying a bike that costs $9,370. Should you offer $9,000 or $9,800? Studies show that precise numbers are taken more seriously! Using the calculator, you can round strategically — to seem confident and well-prepared.

2. Salary negotiations:

Just got your first job? Congratulations! When negotiating your salary, being precise helps. Instead of saying “around $3,000,” try $3,050 or $3,075. Tools like this one help you calculate and round your number neatly — showing you know your worth!

Whether it’s a car, a job, or a classroom project, rounding money keeps your numbers clear, organized, and professional.

Errors and Mistakes Due to Rounding Money

Even tiny rounding differences can add up fast — especially in budgets, reports, or daily transactions. Let’s explore common rounding traps and how to avoid them.

Compounding Errors

Every small rounding change (like from $4.2341 to $4.23) creates a mini difference. When repeated hundreds of times, that difference can grow! This is why cash rounding rules are standardized in accounting — to make sure everyone calculates the same way. (read more)

Data Misrepresentation

If you always round down on financial reports, your totals may look smaller than reality. Over time, this can make your savings or earnings appear less than they are.

Budget Overlooks

Rounding carelessly can cause spending errors. If you round every price down “just to make it neat,” you might think you have more cash than you really do.

Missteps in Pricing

Setting product prices after rounding can affect your customers’ perception. Ending prices neatly at $10 instead of $9.75 might look better, but it could also affect total sales or taxes.

Tax Complications

Tax forms often require rounding to the nearest dollar. But if your method differs from what the tax office expects, it can trigger mismatches or corrections. Always check your country’s currency rounding standard before filing.

To stay safe, use the CalcoPolis rounding calculator with the correct rounding mode for your case. It’s like having a mini accountant who never forgets decimals! With a little practice, rounding money becomes not only easy — but actually fun.