Install CalcoPolis as App Add Calcopolis icon to homescreen and gain quick access to all calculators. Click here to see how »

Finding Balance Between Passions and Practicality with Barista FIRE

Table of Contents

- What Is Barista FIRE?

- Why It Matters

- The Role of the Barista FIRE Calculator

- Why Our Barista FIRE Calculator Stands Out

- 1. It Starts with Your Current Situation

- 2. It Understands Retirement Is a Different Phase

- 3. It Calculates the Impact of Inflation (Properly)

- 4. It Visualizes Your Path to Freedom

- 5. It Helps You Plan Smartly, Not Just Dream Boldly

- How to Use the Barista FIRE Calculator Like a Pro

- Step 1: Enter Your Current Finances Honestly

- Step 2: Define Your Future Lifestyle

- Step 3: Adjust for Inflation and Risk

- Step 4: Explore the Roadmap

- Step 5: Refine Your Plan Over Time

- Best Practices for Reaching Barista FIRE

- 1. Update Your Data Regularly

- 2. Balance Lifestyle and Savings

- 3. Reassess Asset Allocation as You Progress

- 4. Use Inflation and Taxes to Your Advantage

- 5. Keep Learning and Adapting

- Why This Calculator Is a Game Changer

- Frequently Asked Questions about Barista FIRE

- What makes Barista FIRE different from traditional FIRE?

- How does the Barista FIRE Calculator work?

- Can I use different assumptions for my working years and retirement years?

- How is inflation handled in the Barista FIRE Calculator?

- What’s the ideal withdrawal rate for Barista FIRE?

- Can I plan for career growth or salary increases?

- Does the calculator show how my lifestyle will change after reaching Barista FIRE?

- What savings goal should I set for Barista FIRE?

- Is Barista FIRE realistic for average earners?

- How often should I update my data?

- What’s the main benefit of using this specific calculator?

- Can I save simulation results?

- Can I share my result?

Ever dream of waking up without an alarm clock, enjoying your morning coffee slowly, and working only on things that actually excite you? That’s the essence of Barista FIRE — financial independence with a part-time twist. You’re not escaping work entirely; you’re simply escaping the grind.

Most people think early retirement requires millions in savings and years of relentless frugality. But that’s not the only route. Barista FIRE lets you reach financial freedom sooner by combining smart investing, strategic saving, and a bit of meaningful part-time income — whether it’s at a café, freelancing, or running your own small business.

This idea has exploded in popularity in communities like r/BaristaFIRE and lifestyle blogs such as Julie De Vivre. It’s a movement for those who crave freedom but also value purpose.

What Is Barista FIRE?

In short, Barista FIRE means reaching a financial point where your investments cover a large chunk of your expenses, while part-time or passion-driven work covers the rest. It’s named after the idea of working as a barista for health insurance and side income — though your “barista job” could be anything: photography, tutoring, or running an online shop.

Unlike Lean FIRE (extreme frugality) or Fat FIRE (luxurious full retirement), Barista FIRE sits comfortably in the middle. You still enjoy life while gradually buying your freedom one month at a time. It’s financial independence with a dash of reality — and it’s attainable.

Why It Matters

Barista FIRE isn’t about quitting everything. It’s about gaining control. You decide what kind of work you do, when you do it, and how it fits your ideal lifestyle. You lower stress, keep purpose, and maintain social connections — all while your money continues to work for you in the background.

Barista FIRE isn't just about quitting your job and living off your savings forever. It's smarter and, dare I say, a bit more fun.

The Role of the Barista FIRE Calculator

That’s where our Barista FIRE Calculator steps in. This isn’t your average “plug in numbers and get a result” type of tool. It’s an intelligent, interactive planner that mirrors how finances work in real life.

Most online FIRE calculators stop at a single formula. Ours goes deeper — analyzing your full financial picture, projecting realistic timelines, and showing visually how your journey to financial independence unfolds.

Think of it as your personal FIRE strategist: detailed, visual, and smarter than your spreadsheet.

Why Our Barista FIRE Calculator Stands Out

Most FIRE calculators are like fast food—quick, simple, and satisfying for a moment. Ours is more like a chef-crafted meal: detailed, balanced, and built for long-term results. The Barista FIRE Calculator goes beyond generic regular savings math—it understands your full financial life and simulates how it evolves year by year.

1. It Starts with Your Current Situation

The calculator doesn’t assume a “one-size-fits-all” path. It analyzes your current income, expenses, savings, and investment structure to build a personalized financial snapshot. It takes into account:

- Your salary and how much you can realistically save monthly

- Your spending habits and lifestyle choices

- Current investments and total net worth

- Asset allocation — how much you have in stocks, bonds, and cash

- Taxes and their impact on your real growth rate

This makes your projection grounded in reality, not just optimistic assumptions.

2. It Understands Retirement Is a Different Phase

Most calculators treat accumulation and retirement as the same—ours doesn’t. When you hit your Barista FIRE target, your financial life shifts. You may work part-time, lower expenses, or rebalance your investments for safety.

Our tool lets you model that. It asks for your expected cost of living in retirement, your Barista income, and your planned withdrawal rate. It also lets you use different asset allocations for the retirement phase—like shifting from 80/20 stocks-bonds to a safer 50/50 or even including cash buffers.

That’s what makes this calculator feel “alive.” It doesn’t just calculate a static number—it adapts as your life does.

3. It Calculates the Impact of Inflation (Properly)

Inflation silently eats away at your purchasing power, and many tools underestimate it. Our calculator adjusts every projection for expected inflation so your retirement plan stays realistic.

You’ll clearly see how your standard of living might change over time, how much of your income will go to essentials, and how to protect your future comfort level.

4. It Visualizes Your Path to Freedom

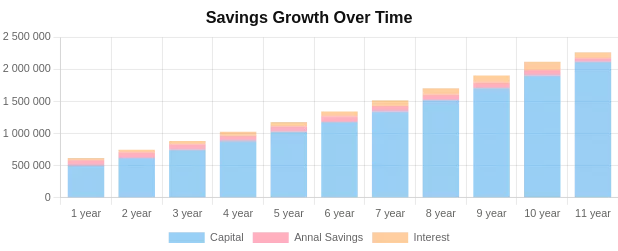

Numbers are useful, but visuals tell the real story. The Barista FIRE Calculator presents your journey in interactive charts and tables. You’ll see:

- Your year-by-year net worth growth

- Your FIRE target and projected date

- Your estimated income and expenses before and after FIRE

- Your purchasing power adjusted for inflation

It’s like watching your financial independence unfold before your eyes—a roadmap that shows exactly when you can start living life on your own terms.

5. It Helps You Plan Smartly, Not Just Dream Boldly

The calculator allows you to test multiple “what-if” scenarios. What if you save 5% more? What if you switch your portfolio to more bonds? What if inflation spikes? Every change updates your timeline and charts instantly, giving you the power to fine-tune your plan dynamically.

That’s the beauty of the Barista FIRE Calculator—it’s not just a tool; it’s a simulator for your financial freedom journey.

How to Use the Barista FIRE Calculator Like a Pro

Using this calculator isn’t just about typing numbers and hoping for magic. It’s about understanding how every choice you make — savings, lifestyle, investments — moves you closer to financial independence. Here’s how to get the most out of it.

Step 1: Enter Your Current Finances Honestly

Start by filling in your real income, spending, and savings numbers. The calculator will instantly estimate your current savings rate and project how your investments may grow over time. You can also add your existing assets and define how much you hold in stocks, bonds, and cash.

Don’t worry if your finances aren’t perfect — the whole idea is to see where you stand and what levers you can pull to speed up progress.

Step 2: Define Your Future Lifestyle

Next, imagine your ideal Barista FIRE lifestyle. Will you move to a smaller city, travel more, or simply work 20 hours a week doing something you enjoy? Enter your expected retirement cost of living, your planned part-time income, and your desired withdrawal rate.

The calculator adjusts your financial plan for this new phase — showing how long your savings can sustain you and what level of comfort you can expect.

Step 3: Adjust for Inflation and Risk

Play with the inflation slider to see how rising prices could affect your purchasing power. You’ll instantly see how your standard of living in retirement changes in both nominal and real terms.

Then test different asset allocations for your retirement phase. Maybe you’ll prefer a 60/40 portfolio now and a 40/60 later. The charts will update instantly, helping you visualize the trade-offs between growth and safety.

Step 4: Explore the Roadmap

Once you’ve entered your details, the calculator creates a complete FIRE roadmap — a chart and table showing your yearly progress toward financial independence. You’ll see:

- Your estimated FIRE date

- Yearly growth of your investments

- Your net worth milestones

- Your expected income and spending balance in retirement

- How inflation shapes your purchasing power over time

It’s like watching a time-lapse of your future — motivating, visual, and practical.

Step 5: Refine Your Plan Over Time

Life changes. Salaries rise, expenses shift, markets fluctuate. The calculator is designed to evolve with you. Revisit it every few months to update your data, re-test assumptions, and see how new habits affect your timeline.

This dynamic approach turns your plan into a living document — one that grows more accurate as you do.

Best Practices for Reaching Barista FIRE

Achieving Barista FIRE is like training for a marathon — you don’t need to sprint, but you must keep a steady pace. Here’s how to make your journey smoother and more rewarding.

1. Update Your Data Regularly

Your financial situation changes constantly — promotions, rent increases, new investments. Keeping your calculator data up to date ensures you always know where you stand. The more accurate your inputs, the more useful your projections.

2. Balance Lifestyle and Savings

Don’t fall into the trap of over-optimization. You’re not trying to live like a monk; you’re building a sustainable path to freedom. Spend consciously, save consistently, and remember — Barista FIRE is about living better sooner, not later.

3. Reassess Asset Allocation as You Progress

As you move from the accumulation phase to the semi-retired phase, your tolerance for risk will likely change. The calculator helps you visualize how shifting from a high-growth portfolio to a more conservative one affects your timeline and security.

Small tweaks today — such as increasing your bond or cash allocation closer to retirement — can protect decades of progress.

4. Use Inflation and Taxes to Your Advantage

Many ignore inflation and taxes until it’s too late. Use the calculator’s built-in simulations to test different tax brackets, inflation rates, and withdrawal strategies. You’ll quickly see how to keep more of what you earn and preserve purchasing power in retirement.

5. Keep Learning and Adapting

The FIRE movement is constantly evolving. Communities like r/BaristaFIRE and bloggers like Julie De Vivre are full of insights and real-world examples of people living this lifestyle. Learn from others’ paths, then fine-tune your own.

Why This Calculator Is a Game Changer

The Barista FIRE Calculator isn’t just another financial toy — it’s a simulation engine that helps you think and plan like a real financial analyst. It visualizes how every decision affects your independence date, your quality of life, and your future comfort level. It shows not only when you can retire — but how you can live once you do.

With detailed projections, inflation-adjusted charts, and customizable inputs for work income, retirement lifestyle, and asset allocation, it’s one of the most complete and realistic FIRE tools online. Whether you’re just starting your journey or already halfway there, it helps you answer the big question:

“When can I stop working for money — and start working for joy?”

So grab your coffee, open the calculator, and start mapping out your road to financial independence. Your future self — relaxed, balanced, and maybe sipping a latte on a beach — will thank you.

Frequently Asked Questions about Barista FIRE

What makes Barista FIRE different from traditional FIRE?

Barista FIRE focuses on reaching partial financial independence — where your investments cover most of your expenses, and you supplement the rest with a part-time or passion-based income. It’s designed for people who want freedom sooner without saving millions for full retirement.

How does the Barista FIRE Calculator work?

Our calculator analyzes your entire financial profile — income, spending, savings, investments, and taxes — to project a realistic path toward Barista FIRE. It also models how your finances will evolve after partial retirement, factoring in inflation, withdrawal rates, and part-time income.

Can I use different assumptions for my working years and retirement years?

Yes! The calculator lets you use separate asset allocations for each phase (for example, 80/20 during accumulation and 50/50 in semi-retirement). You can also define your expected cost of living and Barista income during retirement, creating a realistic plan that mirrors real-life transitions.

How is inflation handled in the Barista FIRE Calculator?

Inflation is automatically applied to your projections. The tool adjusts both your savings goals and your future spending power, showing how rising prices could affect your lifestyle. For a deeper understanding, explore our Inflation Calculator.

What’s the ideal withdrawal rate for Barista FIRE?

Since you’ll still earn some income, your withdrawal rate can be higher than the traditional 4% rule. The calculator allows you to experiment with different rates — from conservative to flexible — and instantly see how each affects your long-term sustainability.

Can I plan for career growth or salary increases?

Absolutely. The calculator includes an option to model future salary growth and higher savings contributions, helping you visualize how promotions or side hustles can accelerate your path to financial independence.

Does the calculator show how my lifestyle will change after reaching Barista FIRE?

Yes. It provides detailed charts and tables that display your net worth, spending power, and projected standard of living during retirement. You’ll clearly see how part-time income, inflation, and investment returns influence your comfort level over time.

What savings goal should I set for Barista FIRE?

That depends on your lifestyle, income, and how much you plan to work in semi-retirement. You can estimate your personal goal using this calculator and our complementary Savings Goal Calculator to fine-tune your targets.

Is Barista FIRE realistic for average earners?

Yes — that’s what makes it appealing. You don’t need an extreme income or lifestyle. With consistent saving, smart investing, and a willingness to earn part-time later, you can achieve a comfortable level of freedom far earlier than traditional retirement.

How often should I update my data?

We recommend reviewing your inputs every few months. Update your income, spending, savings, and portfolio values to keep projections accurate. The calculator instantly refreshes your results to reflect your current reality.

What’s the main benefit of using this specific calculator?

It’s far more advanced than most online FIRE tools. Instead of giving you a single “FIRE number,” it delivers a dynamic, inflation-adjusted roadmap — showing how your wealth, income, and lifestyle interact over decades. It’s not just about when you can retire; it’s about how comfortably you’ll live once you do.

Can I save simulation results?

Yes. Each simulation generates a unique URL that stores your inputs and results. Additionally, Calcopolis automatically saves your data in your browser cache, so when you revisit from the same browser, your previous calculations will be remembered.

Can I share my result?

Definitely! Each simulation includes a permalink below the results. You can share it with friends, financial advisors, or discussion groups to compare your FIRE strategies or get feedback.