Contribution Margin Calculator

Maximizing Profits: How to Analyze Contribution Margin for Business Success

Table of Contents

- What is Contribution Margin?

- Contribution Margin vs. Gross Margin

- Its Role in Business Decision-Making

- The Formula and an Example

- Calculating Contribution Margin Ratio

- Definition of Contribution Margin Ratio

- Formula for Calculating the Ratio

- Practical Example

- Understanding Generated Profit

- Calculating Generated Profit

- The Relationship with Sales and Profit

- Benefits of Contribution Margin Analysis

- Insights into Cost Structure and Profitability

- Role in Pricing Strategies and Cost Control

- Implementing Contribution Margin Analysis in Small Businesses

- Practical Tips for Using the Calculator

- Case Studies and Examples

- Integrating Contribution Margin Analysis into Business Reviews

- Summary

Nowadays, while the market is full of competitors, both big and small but innovative, it is crucial for small business owners to optimize their business models to stay competitive. Among the various financial metrics, one stands out for its direct relevance to profitability and decision-making: the Contribution Margin. This often-overlooked metric can be a game-changer in how you view your costs, revenues, and overall financial strategy.

What is Contribution Margin?

Contribution Margin is a critical financial metric that helps business owners understand how much of their sales revenue is available to cover fixed expenses and generate profit. It's calculated by subtracting variable costs (costs that change with the level of output) from the sales revenue. The result is the amount that contributes to covering the fixed costs and, subsequently, to the profit.

Contribution Margin vs. Gross Margin

While it might sound similar to gross margin, contribution margin differs in its approach and utility. Gross margin subtracts both fixed and variable costs from sales revenue, providing a broader picture of profitability. In contrast, contribution margin focuses solely on variable costs, offering a more nuanced view of how each product or service contributes to covering fixed costs and generating profit.

Its Role in Business Decision-Making

Understanding the contribution margin of your products or services can guide critical decisions such as pricing, product mix, and cost management. It helps in identifying which products are more profitable and which might be draining resources, enabling more informed strategic decisions.

How to Calculate Contribution Margin

The Contribution Margin Calculator is a powerful tool that simplifies this critical calculation. Designed with business owners in mind, it takes into account various factors such as sales revenue, variable costs, and the number of units sold to provide a clear picture of your contribution margin.

To use the calculator, you'll input your total sales revenue, variable costs per unit, and the total number of units sold. The calculator then processes these inputs to deliver not just the contribution margin but also the contribution margin ratio and the total profit generated.

The Formula and an Example

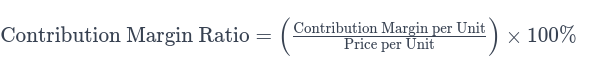

The formula for calculating the contribution margin is:

For example, if your business sells a product for $100 per unit, and the variable cost per unit is $40, then for each unit sold, the contribution margin is $60. This $60 contributes towards covering the fixed costs and, after those are covered, to the profit.

By understanding and utilizing the contribution margin, small business owners can make more informed decisions about pricing, product development, and cost management, ultimately steering their business toward greater profitability and success.

Calculating Contribution Margin Ratio

Definition of Contribution Margin Ratio

The Contribution Margin Ratio is a key financial metric that offers insights into the efficiency of your product line and sales strategy. It is expressed as a percentage and illustrates what portion of each sales dollar contributes to covering fixed costs and generating profit. This ratio is particularly useful in evaluating the profitability of different products or services within your business.

Formula for Calculating the Ratio

The Contribution Margin Ratio is calculated using the formula:

This formula reveals the percentage of each sales dollar that remains after variable costs are subtracted.

Practical Example

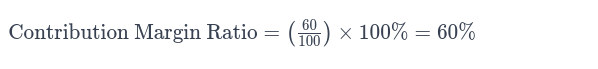

Let's consider a practical scenario. Assume your business sells a product for $100 per unit (price per unit) and the variable cost per unit is $40. Using the contribution margin formula, the contribution margin per unit is $60 ($100 - $40). Therefore, the Contribution Margin Ratio would be calculated as:

This means that for every dollar of goods sold, 60 cents contribute to covering fixed costs and profit.

Understanding Generated Profit

Calculating Generated Profit

Generated profit is the amount of money that remains after all costs, both variable and fixed, have been paid. It is the ultimate indicator of a business's financial health. The relationship between Contribution Margin, sales, and profit is crucial in understanding this.

The formula to calculate the generated profit is:

Where Total Contribution Margin is the sum of the contribution margins for all products sold.

The Relationship with Sales and Profit

To delve deeper into this relationship, let's consider the scenario where your business sells 500 units of the product mentioned earlier. The total sales revenue would be $50,000 (500 units x $100 price per unit). With a contribution margin per unit of $60, the total contribution margin is $30,000 (500 units x $60 contribution margin per unit). If your fixed costs are $20,000, the generated profit would be $10,000 ($30,000 total contribution margin - $20,000 fixed costs).

This example illustrates how understanding the contribution margin and contribution margin ratio can guide decisions related to pricing, product selection, and sales volume. For a small business owner, these insights are invaluable in achieving the break-even point and surpassing it towards profitability.

Benefits of Contribution Margin Analysis

Insights into Cost Structure and Profitability

Contribution margin metrics, like the contribution margin per unit and contribution margin ratio, offer profound insights into a company’s cost structure and profitability. By subtracting variable costs from the selling price per unit, these metrics highlight how much each product contributes to covering fixed costs and generating profit. This information, often detailed in an income statement, is crucial for evaluating the financial health of a business.

Understanding these metrics allows business owners to see beyond gross profit figures, diving into how individual products or services perform. This is particularly important for companies with diverse product lines, as it helps in identifying which items are the most and least profitable.

Role in Pricing Strategies and Cost Control

The calculation of the contribution margin is instrumental in shaping pricing strategies. By knowing the exact contribution of each product to the overall profit, businesses can make informed decisions about pricing adjustments. For instance, if a product has a high contribution margin, it might justify a higher selling price, while products with lower margins might need cost reductions or even discontinuation.

Moreover, these metrics play a crucial role in cost control. By analyzing the contribution margin, businesses can identify which costs are impacting their profitability the most and strategize accordingly to reduce these expenses.

Implementing Contribution Margin Analysis in Small Businesses

Practical Tips for Using the Calculator

For small business owners, effectively using a contribution margin calculator means regularly updating it with accurate data. Keeping track of changes in variable costs or selling prices per unit is essential for the accuracy of the calculation. Additionally, understanding the financial ratios that emerge from this analysis can guide strategic decisions.

Case Studies and Examples

Consider a small bakery that started analyzing its products using contribution margin analysis. By doing so, the bakery discovered that while its artisan bread had a lower selling price per unit compared to custom cakes, its contribution margin was higher due to lower variable costs. This insight led to a strategic shift in focus towards bread production, enhancing overall profitability.

Integrating Contribution Margin Analysis into Business Reviews

Regularly integrating contribution margin analysis into business reviews is crucial. This means not only looking at overall revenue and net profit but also examining the contribution margin of each product or service line. This practice can reveal trends and patterns, helping business owners make proactive adjustments in their operations, pricing, and marketing strategies.

In conclusion, the contribution margin and related metrics are more than just numbers on an income statement; they are powerful tools that, when used effectively, can significantly enhance a company’s financial performance and strategic direction. For small businesses, mastering this aspect of financial analysis is a step towards sustained growth and success.

Summary

Contribution Margin: A vital metric that reveals the amount each product contributes towards covering fixed costs and generating profit.

Contribution Margin Ratio: This ratio, expressed as a percentage, indicates the efficiency of your product line and its impact on overall profitability.

Generated Profit: Understanding this figure helps in evaluating the actual financial health of the business, guiding decisions from pricing to product development.

Usability in Business: These metrics are essential for insights into cost structure, profitability, pricing strategies, and cost control.

Implementation in Small Businesses: Regular use of a contribution margin calculator and integrating these analyses into business reviews can significantly enhance decision-making and strategic planning.