Marginal Revenue Calculator

Introduction to Marginal Revenue and Its Role in Business

Table of Contents

- What is Marginal Revenue?

- Marginal Revenue Formula

- The Significance of Marginal Revenue in Business Decision-Making

- Our Marginal Revenue Calculator

- Marginal Revenue and Its Business Implications

- The Role of Marginal Revenue in Pricing and Product Strategies

- Impact on Market Demand and Profitability

- Marginal Revenue in Business Scenarios

- Practical Applications of Marginal Revenue Calculation

- Case Study: ABC Electronics

- Using the Marginal Revenue Calculator

- Analysis and Decision

- Outcome

- Conclusion

- Limitations of Marginal Revenue Calculator

- Potential Limitations

- Importance of Contextual Understanding

- Complementary Tools and Methods

- Summary

In the intricate world of business economics, the concept of marginal revenue stands as a key pillar for successful financial management and strategic planning. This article is dedicated to demystifying the concept of marginal revenue, highlighting its critical role in business operations, and introducing the marginal revenue calculator as an essential financial tool.

What is Marginal Revenue?

Marginal revenue is a crucial concept in both economics and business, defined as the additional revenue that a company generates from selling one more unit of a product or service. It represents the revenue variation attributed to the sale of an incremental unit.

This concept is indispensable for comprehending how changes in sales volume can impact a company’s overall revenue stream.

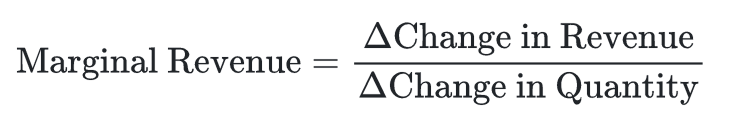

Marginal Revenue Formula

Calculating marginal revenue involves understanding how revenue changes with an alteration in output quantity. The formula for marginal revenue (MR) is:

This calculation is done by measuring the change in total revenue that results from selling an additional unit of a product or service. It provides essential insights into the revenue implications of varying production and sales levels.

The Significance of Marginal Revenue in Business Decision-Making

Marginal revenue is a cornerstone in strategic business decision-making:

Pricing Decisions: It aids businesses in setting optimal prices by evaluating how selling prices affect revenue for each additional unit sold.

Production Planning: Understanding marginal revenue helps in determining the most profitable production levels, balancing the cost of production against revenue gains.

Market Positioning: Analyzing marginal revenue assists in adapting to market dynamics, understanding consumer behavior, and responding effectively to competitive pressures.

Our Marginal Revenue Calculator

In order to make the complex calculations of marginal revenue more accessible, especially in diverse and dynamic business scenarios, the marginal revenue calculator serves as an indispensable tool. This calculator streamlines the process of determining the revenue impact of additional unit sales, facilitating informed decisions about pricing and production.

In the following sections, we will explore the functionalities of the marginal revenue calculator, its practical applications, and how it can provide valuable insights for effective economic analysis and decision-making in the ever-evolving landscape of business economics.

Marginal Revenue and Its Business Implications

Marginal revenue is more than just a microeconomic concept; it is a crucial indicator in the world of business, influencing key strategic decisions. Understanding the interplay between change in revenue and change in quantity and how it relates to marginal cost is vital for businesses operating in diverse market scenarios, including perfectly competitive markets.

The Role of Marginal Revenue in Pricing and Product Strategies

Dynamic Pricing: Marginal revenue analysis allows businesses to adjust their pricing strategies. In a perfectly competitive market, for instance, the ability to understand how changes in price per unit can affect overall revenue is crucial for maintaining competitiveness and profitability.

Product Line Decisions: Decisions about expanding or reducing product lines hinge on understanding marginal revenue. If the revenue generated by selling one more unit of a product outweighs the marginal cost, it can justify the introduction of new products or variations.

Impact on Market Demand and Profitability

Profit Maximization: One of the fundamental principles in microeconomics is that profit maximization occurs when marginal revenue equals marginal cost. Businesses use this principle to determine the most profitable level of output.

Demand Curve Insights: The marginal revenue curve provides valuable insights into market demand. It helps businesses understand how selling additional units impacts revenue, particularly in markets where increasing supply may not correspond to an increase in overall revenue.

Marginal Revenue in Business Scenarios

Market Saturation: In scenarios where a market is nearing saturation, the marginal revenue of additional units may decrease, indicating a need to diversify products or find new markets.

Competitive Pricing Strategies: Marginal revenue is crucial for developing pricing strategies in competitive environments. Businesses must consider how lowering or raising prices per unit will impact their marginal revenue and overall market position.

Cost-Benefit Analysis: By comparing the change in revenue to the change in quantity produced, businesses can conduct a cost-benefit analysis to determine whether increasing production is financially viable, especially when considering the associated marginal costs.

Marginal revenue serves as a key indicator in strategic business decisions, guiding pricing, production, and market strategies. Its importance in understanding and responding to market dynamics, combined with its role in profit maximization, makes it an indispensable concept in the arsenal of business tools.

In the next section, we will delve into the functionalities of the marginal revenue calculator and how it aids in simplifying and applying these concepts in practical business scenarios.

Practical Applications of Marginal Revenue Calculation

To demonstrate the practical utility of a marginal revenue calculator in business decision-making, let's explore a hypothetical case study. This example will utilize the marginal revenue formula.

Case Study: ABC Electronics

ABC Electronics, a mid-sized manufacturer of consumer electronics, is considering increasing the production of its popular model, the XPhone. Currently, they produce 10,000 units per month, generating a revenue of $2,000,000.

The management wants to assess the profitability of increasing the production by 1,000 units. They estimate that this increase in production could potentially raise the total revenue to $2,150,000.

Using the Marginal Revenue Calculator

Initial Data:

Current production: 10,000 units.

Current revenue: $2,000,000.

Proposed Change:

Increase production to 11,000 units.

Anticipated new revenue: $2,150,000.

Marginal Revenue Calculation:

Change in Quantity: 11,000 - 10,000 = 1,000 units.

Change in Revenue: $2,150,000 - $2,000,000 = $150,000.

Marginal Revenue: MR = $150,000 / 1,000 = $150 per unit.

Analysis and Decision

Marginal Cost Consideration: The marginal cost of producing one additional XPhone is $100 per unit.

Profitability Analysis: Since the marginal revenue ($150) is greater than the marginal cost ($100), the increase in production is potentially profitable.

Decision: ABC Electronics decides to increase production, expecting a positive impact on overall profitability.

Outcome

After implementing the production increase, ABC Electronics observes a rise in profits, validating the decision informed by the marginal revenue calculator. The additional units sell well, with the revenue increase outweighing the costs.

Conclusion

This case study exemplifies how a marginal revenue calculator can be a powerful tool in guiding production and pricing decisions. By quantifying the additional revenue per unit, it aids businesses in making informed decisions that align with their profitability goals.

The example illustrates the importance of balancing marginal revenue against marginal costs to maximize profits and highlights the calculator's role in simplifying complex financial calculations.

Limitations of Marginal Revenue Calculator

While marginal revenue calculators are invaluable tools for businesses, there are limitations and considerations to keep in mind when using them.

Potential Limitations

Static Calculations: These calculators often provide static results based on the inputted number of units sold and revenues. They may not account for dynamic market changes or complex cost structures that can impact marginal revenue over time.

Data Accuracy: The outputs are only as reliable as the data entered. Inaccurate or outdated data can lead to misleading results, affecting strategic decisions.

Narrow Focus: Marginal revenue calculators focus solely on the revenue aspect. They do not consider other vital factors like consumer behavior, competitor actions, or broader market trends.

Importance of Contextual Understanding

Beyond the Numbers: While calculators are excellent for quantifying data, interpreting these numbers within the broader business context is crucial. Users must consider external market factors and internal business strategies when analyzing the results.

Profit Maximization Point: Identifying the profit maximization point involves more than just calculating the marginal revenue. It requires a holistic understanding of the business's overall cost structure and market dynamics.

Complementary Tools and Methods

Integrated Revenue Analysis: Utilize other tools and methods alongside marginal revenue calculators for a more comprehensive revenue analysis. This can include market analysis tools, demand forecasting models, and break-even analysis.

Regular Reviews and Updates: Continuously review and update the business strategies based on current market conditions and regular financial analyses to ensure decisions remain relevant and effective.

Summary

Throughout this article, we've explored the concept of marginal revenue, its calculation, and the strategic role it plays in business decision-making. The marginal revenue calculator emerges as a crucial tool, simplifying the process of determining the additional revenue generated by selling extra units and aiding in identifying the profit maximization point.

We discussed how to calculate the marginal revenue and its importance in pricing strategies, production decisions, and understanding market demand.

Through a case study, we illustrated how businesses can use marginal revenue calculators to make informed decisions about increasing production and maximizing profits.

While these calculators are powerful, they should be used in conjunction with a broader understanding of market conditions and business strategies.

Marginal revenue calculators are invaluable for businesses looking to optimize their pricing and production strategies. However, it is essential to use these tools as part of a comprehensive approach to business analysis, combining them with market insights and financial acumen to make the most informed decisions possible.