Marginal Cost Calculator

Introduction to Marginal Cost and Its Significance in Economics

Table of Contents

- What is Marginal Cost?

- Marginal Cost Formula

- Role in Business Decision-Making

- The Marginal Cost Calculator

- Why Marginal Cost Matters?

- Impact on Pricing Strategies

- Influence on Production Decisions and Profit Maximization

- Marginal Cost in Various Economic Scenarios

- Examples: Application of Marginal Cost Calculator

- Case Study 1: Electronics Manufacturer

- Results and Decision

- Case Study 2: Local Bakery

- Results and Decision

- Conclusion

- Limitations of Our Tool

- Importance of Contextual Understanding

- Complementary Tools and Methods

- Summary

Welcome to the fascinating world of economics, where understanding costs is not just about accounting but also about strategic decision-making. Among the various cost concepts, marginal cost stands out as a pivotal element in both microeconomic theory and practical business decision-making.

This article will delve into what marginal cost is, its importance in economic analysis, and introduce the marginal cost calculator as an indispensable tool for businesses and economists.

What is Marginal Cost?

Marginal cost is a fundamental concept in economics that refers to the additional cost incurred by producing one more unit of a good or service. It's the cost of expanding production by a small amount, and it changes with the level of production. This concept is central to economic theory as it helps in understanding how to allocate resources efficiently.

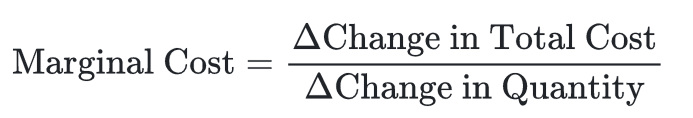

Marginal Cost Formula

Calculating marginal cost involves understanding how total costs change with variations in production output. It's computed by taking the change in total cost and dividing it by the change in quantity produced. Mathematically, it's expressed as:

This calculation provides insights into the cost behavior of production as output levels vary.

Role in Business Decision-Making

In business, marginal cost is crucial for several reasons:

- Pricing Strategy: Understanding marginal cost helps businesses in setting prices that can cover costs and yield profits.

- Optimal Production Level: It informs businesses of the point at which producing additional units is no longer profitable.

- Profit Maximization: Businesses can use marginal cost to determine the level of production that maximizes their profits.

The Marginal Cost Calculator

With the complexity of calculating marginal cost, especially when dealing with large quantities and varying costs, the marginal cost calculator emerges as a vital tool.

It simplifies this calculation, allowing businesses and economists to quickly determine the cost associated with producing one additional unit. This tool is not only a time-saver but also enhances accuracy in these crucial calculations.

Why Marginal Cost Matters?

Marginal cost is more than just a metric; it's a vital compass guiding businesses through the complex terrain of economic decisions. Understanding how to calculate the marginal cost, which involves assessing the additional cost of producing one more unit, is crucial for several strategic aspects of a business, from pricing to scaling production. Let's delve into why marginal cost holds such importance in business economics.

Impact on Pricing Strategies

Balancing Costs and Pricing: The marginal cost of production plays a critical role in determining the pricing of products. By understanding the cost incurred per additional unit, businesses can set prices that not only cover these costs but also contribute to profit margins.

Dynamic Pricing Decisions: In markets where prices are highly competitive or fluctuate frequently, knowing the marginal cost helps businesses adjust their pricing strategies dynamically to stay competitive while maintaining profitability.

Influence on Production Decisions and Profit Maximization

Assessing Cost Structures: Marginal cost involves both variable and fixed costs. While fixed costs remain constant regardless of the production volume, variable costs fluctuate with changes in output. Calculating the marginal cost helps businesses understand how their cost structure behaves as they increase production.

Optimizing Production Levels: By comparing the marginal cost with marginal revenue, businesses can determine the most profitable level of production. The ideal scenario is when the marginal revenue equals the marginal cost, indicating the point of maximum profitability.

Marginal Cost in Various Economic Scenarios

Scale Economies: In situations where increasing production leads to lower average costs (economies of scale), understanding marginal costs is essential. It helps businesses identify the point where increasing the production volume further may not lead to significant cost benefits.

Market Competition: In competitive markets, businesses must be adept at controlling costs to maintain a competitive edge. Knowing the marginal cost helps in making strategic decisions about whether to match or undercut competitors’ pricing, or whether to focus on niche markets where competition is less intense.

Product Development and Innovation: For new products or innovation-driven markets, the calculation of marginal cost is essential for determining at what point the product can be profitably introduced or scaled up in the market.

Marginal cost is a cornerstone in the architecture of business economics. Calculating the marginal cost and understanding its implications on pricing, production, and profit maximization is essential for businesses to thrive in various economic landscapes. Whether it's about making decisions to increase production, adjusting prices, or navigating competitive markets, the insights derived from marginal cost calculations are invaluable.

In the following sections, we will explore how a marginal cost calculator simplifies this complex calculation, enabling businesses to make swift, informed decisions in today's fast-paced economic environment.

Examples: Application of Marginal Cost Calculator

Let's explore two hypothetical case studies that demonstrate the practical application of a marginal cost calculator in business, focusing on how it helps in decision-making regarding production changes and cost management.

Case Study 1: Electronics Manufacturer

An electronics manufacturer is producing 15,000 units monthly at a total cost of $750,000. They are considering increasing production by 3,000 units, expecting the total costs to rise to $840,000.

- Initial Data: Current production is 15,000 units at a total cost of $750,000.

- Proposed Change: The company considers producing a total of 18,000 units, with anticipated total costs of $840,000.

- Marginal Cost Calculation: The calculator is used to determine the marginal cost of the additional 3,000 units.

Results and Decision

- Marginal Cost Per Unit: The increase in total costs is $90,000 ($840,000 - $750,000). Dividing this by the additional 3,000 units gives a marginal cost of $30 per unit.

- Outcome: Since the selling price per unit is $55, the marginal cost of $30 per unit makes increasing production profitable. The company decides to proceed with the production increase.

Case Study 2: Local Bakery

A local bakery produces 2,000 loaves of bread monthly at a total cost of $10,000. They are considering producing an additional 500 loaves, but this would increase total costs to $13,000.

- Initial Data: The bakery is currently producing 2,000 loaves at a total cost of $10,000.

- Proposed Change: An increase to 2,500 loaves is considered, with total costs expected to rise to $13,000.

- Marginal Cost Analysis: The marginal cost for the additional production is calculated.

Results and Decision

- Marginal Cost Per Unit: The increase in total costs is $3,000 ($13,000 - $10,000). This, divided by the additional 500 loaves, results in a marginal cost of $6 per loaf.

- Outcome: Given that the selling price per loaf is $5, the marginal cost of $6 per unit renders the additional production unprofitable. Therefore, the bakery decided against increasing production.

Conclusion

These case studies illustrate how a marginal cost calculator can be crucial in making informed production decisions. By accurately determining the incremental cost per unit for the proposed production changes, businesses can assess the profitability of scaling their production and make strategic decisions that align with their financial goals.

Limitations of Our Tool

While our calculator is a valuable tool for businesses, it's crucial to acknowledge their limitations and the need for contextual understanding.

It uses static models that might not account for all the complexities of real-world scenarios, such as fluctuating market conditions or variable cost structures.

The accuracy of the calculator's output is highly dependent on the accuracy of the input data. Any errors or outdated information can lead to incorrect calculations.

Marginal cost calculators primarily focus on production costs and do not account for other essential business factors like market demand, competitor actions, or broader economic trends.

Importance of Contextual Understanding

The results from a marginal cost calculator should be interpreted within the broader context of the business environment. Understanding market dynamics, customer behavior, and internal business capabilities is crucial for making informed decisions.

While numbers are informative, they don’t tell the whole story. Decision-makers should use the calculator as a guide rather than a definitive answer, applying their judgment and experience to interpret the results.

Complementary Tools and Methods

Alongside marginal cost calculators, businesses should employ other tools and methods for more comprehensive cost analysis, like break-even analysis, market trend analysis, and scenario planning.

Continually update and review the data used in these calculators to ensure they reflect current market conditions and business realities.

Summary

Throughout this article, we've explored the concept of marginal cost, its importance in business decision-making, and how a marginal cost calculator can simplify its calculation. These tools are invaluable for assessing the profitability of increasing production and making informed pricing decisions.