Price Elasticity of Demand Calculator

Mastering Pricing with Price Elasticity of Demand

Table of Contents

- What is the Price Elasticity of Demand?

- Factors Influencing PED

- The Midpoint Formula For Calculating Price Elasticity of Demand

- Interpreting the Results

- Elastic, Inelastic, and Unitary Elasticity

- Implications of Different Elasticity Values

- Maximizing Revenue and Profits with a PED Calculator: Practical Strategies

- Step-by-Step Approach to Using a PED Calculator

- Real-Life Examples of Applying PED

- Example 1: Consumer Electronics Company

- Example 2: Pharmaceutical Company

- Example 3: Online Subscription Service

- Key Considerations

- Limitations of Our PED Calculator

- FAQ

- 1. What does the price elasticity of demand measure?

- 2. What is cross-price elasticity?

- 3. How does elasticity affect a company's pricing policy?

- 4. What are the major determinants of price elasticity of demand?

- 5. How is the price elasticity of demand measured?

- 6. How do I calculate the price elasticity of demand from the demand function?

- 7. How is total revenue related to the price elasticity of demand?

- 8. Can price elasticity change over time?

- 9. How does the concept of elasticity apply to luxury goods versus essential goods?

- 10. Is price elasticity of demand always constant for a product?

- 11. How do businesses use elasticity data in market segmentation?

- 12. What is the significance of unitary elasticity for a business?

In the ever-evolving landscape of business and economics, understanding and adapting to market conditions is not just an advantage – it's a necessity. At the core of this adaptive strategy lies a fundamental concept: Price Elasticity of Demand (PED). This powerful tool is more than just an economic jargon; it's the pulse that keeps businesses thriving in competitive markets.

Price Elasticity of Demand is a measure that reflects the responsiveness, or elasticity, of the quantity demanded of a product or service to a change in its price. Simply put, it gauges how sensitive consumers are to price changes. In a world where a small pricing misstep can mean the difference between profit and loss, mastering PED is crucial for businesses aiming to optimize their pricing strategies and stay afloat in the tide of market changes.

What is the Price Elasticity of Demand?

Price Elasticity of Demand is defined as the percentage change in quantity demanded in response to a percentage change in price. This concept reveals how much a product's demand will fluctuate with its price. For instance, a high elasticity implies that consumers are highly sensitive to price changes, whereas a low elasticity indicates that the demand for a product is relatively unaffected by price variations.

Factors Influencing PED

Several factors can influence the elasticity of a product, including:

- Substitutability: The availability of close substitutes makes a product more elastic.

- Necessity vs Luxury: Necessities tend to have lower elasticity compared to luxury goods.

- Proportion of Income: Products that consume a larger portion of the consumer's income are generally more elastic.

- Time Period: Over time, consumers find alternatives, making demand more elastic.

Understanding these factors is essential for businesses to predict how changes in pricing strategies will impact demand for their products.

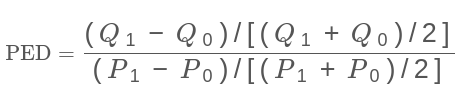

The Midpoint Formula For Calculating Price Elasticity of Demand

The Price Elasticity of Demand is calculated using the following formula:

- P0 – Initial price of the product;

- P1 – Final price of the product;

- Q0 – Initial demand;

- Q1 – Demand after the price change

This formula serves as a crucial tool for businesses and economists alike, enabling them to quantify demand responsiveness and make informed pricing decisions.

Interpreting the Results

Interpreting the outcomes of a Price Elasticity of Demand (PED) calculation is crucial for making informed business decisions. Understanding whether demand is elastic, inelastic, or unitary is key to anticipating how a price increase or decrease can affect sales volume.

Elastic, Inelastic, and Unitary Elasticity

- Elastic Demand: A scenario where the PED is greater than 1, indicating that a price change will cause a significant change in demand. For example, if the price of a luxury good is increased, its demand is likely to decrease substantially.

- Inelastic Demand: When the PED is less than 1, it suggests that demand is relatively insensitive to price changes. Essential goods often fall into this category; even with a price increase, consumers still purchase them out of necessity.

- Unitary Elasticity: This occurs when the PED is exactly 1, meaning that the percentage change in price is exactly offset by an equal percentage change in quantity demanded.

Implications of Different Elasticity Values

- Price Increase in Elastic Demand: Can lead to a significant drop in sales, potentially harming revenue.

- Price Decrease in Elastic Demand: May increase total revenue due to a proportionally larger increase in quantity demanded.

- Price Increase in Inelastic Demand: Likely to increase total revenue as the reduction in quantity demanded is proportionally smaller.

- Price Decrease in Inelastic Demand: May not significantly boost sales and could reduce total revenue.

Maximizing Revenue and Profits with a PED Calculator: Practical Strategies

Using a Price Elasticity of Demand (PED) calculator effectively can be a game changer for businesses seeking to increase revenue and profits. By accurately gauging the relationship between the price of the product and demand for the product, companies can make strategic decisions to optimize their pricing. Here's how to leverage a PED calculator in real-life scenarios:

Step-by-Step Approach to Using a PED Calculator

- Gather Data: Collect historical sales data that shows how changes in price have affected the quantity sold.

- Input Data: Enter the price and quantity data into the PED calculator.

- Calculate the Price Elasticity: The calculator will provide the elasticity coefficient, indicating how sensitive the demand for your product is to price changes.

Real-Life Examples of Applying PED

Example 1: Consumer Electronics Company

- Situation: A company selling smartphones observes a sales drop after a price increase.

- Action: They use a PED calculator to understand the elasticity of their product.

- Finding: The demand is elastic (e.g., a coefficient greater than 1).

- Strategy: Knowing that consumers are price-sensitive, they reduce the price to a point where the increased volume of sales compensates for the lower price, thus maximizing revenue.

Example 2: Pharmaceutical Company

- Situation: A pharmaceutical company sells a unique, essential medication.

- Action: They calculate the price elasticity of their product.

- Finding: The demand is perfectly inelastic (a coefficient close to 0).

- Strategy: Due to the lack of substitutes and the necessity of the product, the company can increase the price without a significant drop in quantity demanded, thereby increasing revenue.

Example 3: Online Subscription Service

- Situation: An online streaming service plans to change its subscription fee.

- Action: They utilize the PED calculator to determine the elasticity of demand for their service.

- Finding: The demand is somewhat elastic.

- Strategy: The company introduces a tiered pricing model, offering various levels of service. This approach caters to different segments of their market, attracting price-sensitive customers with a lower-priced option while offering premium services at a higher price for less price-sensitive customers.

Key Considerations

- Perfectly Elastic and Perfectly Inelastic Scenarios: While rare, it's important to understand these extremes. Perfectly elastic demand means any price increase will drop demand to zero, while perfectly inelastic demand implies that price changes have no effect on the quantity demanded.

- Continuous Monitoring: Market conditions and consumer preferences change. Regularly calculate the price elasticity to stay aligned with current market dynamics.

- Comprehensive Strategy: While PED is a valuable tool, it should be used as part of a broader pricing strategy that considers other factors like market trends, competition, and production costs.

In summary, effectively using a PED calculator involves understanding how changes in the price of a product influence the demand for that product. By analyzing this relationship and applying the insights to pricing strategies, businesses can make informed decisions to increase their revenue and profits.

Limitations of Our PED Calculator

While useful, these calculators rely on historical data and assumptions, which may not always predict future trends accurately.

Market conditions, consumer trends, and unexpected events can influence elasticity, making it necessary to continuously monitor and adjust pricing strategies.

In conclusion, understanding and calculating price elasticity of demand is vital for strategic pricing decisions. Although a price elasticity of demand calculator is a powerful tool, it should be used alongside a comprehensive understanding of market dynamics and consumer behavior.

FAQ

1. What does the price elasticity of demand measure?

Price elasticity of demand measures the responsiveness of the quantity demanded of a product or service to a change in its price. It indicates how much the quantity demanded will vary as a result of a price change.

2. What is cross-price elasticity?

Cross price elasticity measures the responsiveness of the demand for one good to a change in the price of another good. It helps in understanding the relationship between two products, whether they are substitutes or complements.

3. How does elasticity affect a company's pricing policy?

Elasticity directly influences a company's pricing policy by indicating how consumers might react to price changes. If demand is elastic, significant price changes can lead to substantial changes in quantity demanded, guiding companies to set prices carefully.

4. What are the major determinants of price elasticity of demand?

Major determinants include the availability of substitutes, the necessity of the product, the proportion of income the product costs, and the time period considered.

5. How is the price elasticity of demand measured?

The price elasticity of demand is measured by dividing the percentage change in quantity demanded by the percentage change in price. This ratio provides the elasticity coefficient.

6. How do I calculate the price elasticity of demand from the demand function?

To calculate PED from the demand function, you first derive the demand curve to find the marginal change in quantity demanded for a marginal change in price. Then, divide this marginal change by the initial quantity and price to find the elasticity.

7. How is total revenue related to the price elasticity of demand?

Total revenue is closely related to PED. In cases of elastic demand, decreasing the price can lead to an increase in total revenue, while for inelastic demand, an increase in price might increase total revenue.

8. Can price elasticity change over time?

Yes, price elasticity can change over time as consumer preferences, income levels, and the availability of substitutes evolve.

9. How does the concept of elasticity apply to luxury goods versus essential goods?

Luxury goods generally have more elastic demand because they are not necessities and consumers can more easily reduce consumption when prices rise. Essential goods typically have inelastic demand as consumers continue to buy them even with price increases.

10. Is price elasticity of demand always constant for a product?

No, the elasticity of demand for a product is not always constant. It can vary depending on factors like changes in consumer preferences, economic conditions, or the introduction of new substitutes.

11. How do businesses use elasticity data in market segmentation?

Businesses use elasticity data to segment markets based on sensitivity to price changes. This helps in targeting different customer groups with tailored pricing strategies.

12. What is the significance of unitary elasticity for a business?

Unitary elasticity, where PED equals one, signifies that the percentage change in quantity demanded equals the percentage change in price. For businesses, this point is significant as it is where total revenue remains constant despite changes in price.