Rule of 72 Calculator

Unlocking Financial Freedom: Master the Rule of 72

Table of Contents

- What is the Rule of 72?

- Rule of 72 Formula

- Importance in Wealth Accumulation and Early Retirement

- Practical Examples: The Rule of 72 in Action

- Case Study 1: The Stock Market Investor

- Case Study 2: The Savings Account Scenario

- Case Study 3: The Aggressive Investor

- Tips for Maximizing the Benefit of the Rule of 72

- Advanced Considerations: Beyond the Basics

- Limitations of the Rule of 72

- The Impact of Inflation

- Summary

- Related Calculators

The rule of 72 is a simple principle that stands the test of time, proving invaluable for those on the path to wealth accumulation and early retirement. This rule is not just a mathematical formula; it's a gateway to understanding how investments can work in your favor, a crucial piece of knowledge for anyone aspiring to achieve financial independence at an early age.

What is the Rule of 72?

At its core, the Rule of 72 is a straightforward calculation that estimates the time it takes for an investment to double in value, given a fixed annual rate of return. By dividing 72 by the annual rate of return, you get an approximate number of years it will take for your initial investment to grow twofold.

But why 72? This number strikes a perfect balance between accuracy and ease of calculation, making it a favorite in the financial world. Its origins trace back to the rule's use in the Renaissance by Luca Pacioli, a contemporary of Leonardo da Vinci, highlighting its longstanding significance in financial planning.

Rule of 72 Formula

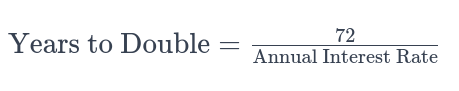

The Rule of 72 is a remarkably simple yet effective formula used to estimate the number of years required to double the value of an investment at a fixed annual rate of return. The formula is as follows:

Key Components of the Formula:

- 72: This is a constant number used in the formula, chosen for its divisibility by many numbers, which simplifies mental calculations.

- Annual Interest Rate: This is the fixed annual rate of return on an investment, expressed as a percentage.

Applying the Formula: To use the formula, divide 72 by the annual interest rate of your investment. For instance, if you have an investment that yields an 8% annual return, it would take approximately 9 years for your investment to double (72 ÷ 8 = 9).

The elegance of the Rule of 72 lies in its ability to provide a quick, ballpark estimate of investment growth without the need for complex calculations or financial calculators. It's a handy tool for investors and savers alike to gauge their investments' potential and make informed decisions about their financial future.

Importance in Wealth Accumulation and Early Retirement

For those dreaming of early retirement, the Rule of 72 is more than just a mathematical curiosity - it's a practical tool for strategic planning. It helps in assessing the potential growth of various investment vehicles, from stocks to bonds to savings accounts, providing a clear picture of how each option can contribute to achieving financial goals.

In the context of wealth accumulation, this rule serves as a guide to making informed decisions about where and how to invest. It emphasizes the power of compound interest, encouraging investors to seek opportunities that yield higher returns, thereby reducing the time it takes to double their money. Understanding and applying the Rule of 72 empowers individuals to create effective investment strategies that align with their aspirations for early retirement, ensuring that every financial move is a step closer to freedom and stability.

In the following sections, we delve deeper into the mechanics of the Rule of 72, its practical applications, and how it integrates into a comprehensive approach to financial planning, especially for those eyeing early retirement.

Practical Examples: The Rule of 72 in Action

Case Study 1: The Stock Market Investor

Meet Alex, a savvy investor who allocated $10,000 in a mutual fund with an average annual return of 8%. Using the Rule of 72, Alex calculates the years it will take to double the investment: 72 divided by 8 equals 9 years. Indeed, in approximately 9 years, Alex's initial principal of $10,000 grows to $20,000, demonstrating the rule's accuracy and its power in predicting wealth growth in the stock market.

Case Study 2: The Savings Account Scenario

Consider Jordan, who opts for a more conservative approach, placing $5,000 in a high-yield savings account with an annual interest rate of 2%. Applying the Rule of 72, it would take 36 years (72/2) for Jordan's money to double. This example highlights how lower risk often correlates with slower growth, a crucial factor in financial planning.

Case Study 3: The Aggressive Investor

Emily chooses a high-risk, high-reward investment, achieving an impressive 12% annual return. According to the Rule of 72, her investment would double every 6 years (72/12). This scenario showcases how higher returns can significantly shorten the time to double your money, albeit with increased risk.

Tips for Maximizing the Benefit of the Rule of 72

-

Seek Higher Returns: While higher returns often come with greater risk, they can drastically reduce the years to double your investment. Balancing risk and reward is key.

-

Start Early: The power of compounding is more effective the earlier you start. Even with a lower interest rate, starting early can yield significant growth over time.

-

Reinvest Earnings: Instead of cashing out your returns annually, reinvesting them can compound your gains, accelerating the doubling process.

-

Diversify Investments: Don't put all your eggs in one basket. Diversifying across different assets can balance your risk and still leverage the Rule of 72 effectively.

-

Stay Informed: Keep an eye on interest rates and market trends. A shift in the market can affect your investment's growth potential.

-

Avoid Common Pitfalls: Don't chase unrealistically high returns without understanding the risks involved. Similarly, be wary of investments with returns lower than the inflation rate, as they can erode your principal's value over time.

By applying these tips and understanding the practical implications of the Rule of 72, investors can make more informed decisions, strategically plan their finances, and move closer to their goal of wealth accumulation and early retirement.

Advanced Considerations: Beyond the Basics

Limitations of the Rule of 72

While the Rule of 72 is an invaluable tool for quick calculations, it's essential to acknowledge its limitations for more precise financial planning. The rule offers less accuracy with extremely high or low-interest rates. For instance, at very high rates (above 15%), the actual doubling time is slightly longer than the rule predicts. Conversely, at rates below 1%, the rule overestimates the doubling time. To adjust for these variances, some financial experts suggest tweaking the rule by using 69 or 70 instead of 72 for more accurate results at lower rates.

The Impact of Inflation

Inflation is a critical economic factor that must be considered when using the Rule of 72. Inflation reduces the purchasing power of money over time, meaning that while your investment might double in nominal terms, the actual value in terms of buying power could be less. It's important to calculate the 'real' rate of return by adjusting the interest rate to account for inflation. For instance, if your investment yields an 8% return annually but inflation is 3%, the real rate of return is 5%, which would change the doubling time.

Summary

The Rule of 72 is a powerful, simple tool that can offer valuable insights into the potential growth of investments. It allows investors to quickly estimate the doubling time of an investment, facilitating better and more strategic financial decisions. However, it's crucial to understand the rule's limitations and the impact of external factors like inflation.

For savvy individuals focused on wealth accumulation and early retirement, mastering the Rule of 72 is a step toward financial literacy and empowerment. It encourages a proactive approach to investment and provides a foundational understanding of how money can grow over time.

Related Calculators

Compound Interest Calculator: Helps to calculate the growth of an investment based on initial principal, interest rate, and compounding frequency. It's particularly useful for understanding how investments grow over time.

Return on Investment Calculator: This tool is designed to estimate the return on an investment over a specified period. It can be used to compare the potential returns of different investment options.

Inflation Calculator: Vital for understanding the impact of inflation on investments and savings. It helps to estimate the future value of money considering the average inflation rate.

Retirement Savings Calculator: Assists in planning for retirement by estimating how much you need to save to meet your retirement income goals, considering factors like age, income, and desired retirement age.

Annuity Calculator: Useful for those considering annuities as part of their retirement plan. It calculates the regular payments you can expect to receive from an annuity based on the principal and interest rate.

Savings Goal Calculator: Aids in setting and reaching savings goals. You input how much you want to save, the time frame, and the interest rate to see how much you need to save regularly.

Net Worth Calculator: Provides an overview of your financial health by calculating the difference between your assets and liabilities.