Margin After Discount Calculator

Boost Your Sales: Master Discounting with Calcopolis

Table of Contents

- What is the Margin After Discount?

- How to Use the Tool?

- Understanding the Results

- Things to Watch Out For

- Sales Tax Considerations

- Negative Margin After Discount Indicates Loss

- Low Margins and Overall Profitability

- How to Calculate Margin After Discount on Your Own

- Margin After Discount Formula

- Example Calculation:

- How to Run a Successful Discount Campaign?

- Related tools

Understanding profit margins is a critical aspect of a successful sales campaign, especially after applying discounts. This is where the Margin After Discount Calculator becomes an invaluable tool for businesses. It’s a specialized calculator designed to assess the profitability of a product after a discount has been applied, ensuring that businesses can make informed pricing decisions.

Discounts are a common tactic used to attract customers and increase sales volume, but they can also significantly impact profit margins.

Our Margin After Discount Calculator helps businesses navigate this delicate balance. The tool provides a clear picture of how discounts affect the bottom line by inputting the original selling price, the cost of goods, and the discount percentage. This enables businesses to strategize effectively, ensuring that promotional activities do not inadvertently erode their profits.

What is the Margin After Discount?

To fully appreciate the functionality of the Margin After Discount Calculator, it's essential to understand two key concepts: 'margin' and 'discount' in the context of sales and retail. The margin is the difference between the selling price of a product and its cost, typically expressed as a percentage of the selling price. It represents the profit made on each sale. On the other hand, a discount is a reduction in the selling price of a product, often used as a marketing strategy to increase sales volume or clear inventory.

Calculating the margin after a discount involves determining the new selling price post-discount and then assessing the profit made at this reduced price. This calculation is critical in pricing strategies as it directly impacts how much profit a business can expect from its sales, especially during promotional periods.

The Margin After Discount Calculator simplifies this complex calculation, providing businesses with quick and accurate insights into their pricing strategies. Understanding and utilizing this tool can be the key to maintaining healthy profit margins while also offering competitive pricing and attractive discounts to customers.

How to Use the Tool?

Understanding the inputs of the Margin After Discount Calculator is crucial for leveraging it effectively. These inputs play a significant role in determining the final margin and profitability of a product.

Selling Price Before Discount

The 'Selling Price Before Discount' refers to the original price of the product before any reductions are applied. This figure serves as the baseline from which discounts are calculated. In the context of the Margin With Discount Calculator, this selling price is essential for establishing the starting point of the calculation. It represents the potential revenue per unit without any sales promotions. This price is pivotal in understanding the amount of profit that could be made before any discounts influence the sales strategy.

Cost of Goods

The 'Cost of Goods' is a critical input that directly affects the gross profit margin. It represents the total cost incurred to produce or acquire the product being sold. This cost includes manufacturing, labor, materials, and any other direct expenses. By inputting the cost of goods into the calculator, businesses can determine their gross profit margin – the profit made on each product before accounting for discounts. Understanding this margin is vital for businesses as it sets the boundary for how much they can discount a product without incurring a loss.

Discount Percentage

The 'Discount Percentage' is the rate at which the selling price is reduced. Varying this percentage can significantly impact the final margin. The Margin With Discount Calculator uses this percentage to calculate the reduced sale price and, subsequently, the margin after the discount. Businesses must carefully consider the discount percentage, as a high discount rate might attract more customers but could also substantially reduce the profit per unit sold.

Understanding the Results

Once the key inputs are entered, the calculator provides valuable outputs that guide decision-making.

Price After Discount

The 'Price After Discount' is the new selling price of the product after applying the discount percentage. This price is crucial as it directly influences consumer perception and sales volume. A lower price may entice more customers but can also reduce the total revenue. The calculator helps determine this price, enabling businesses to find a balance between attractive pricing and maintaining revenue.

Margin Before Discount

Understanding the 'Margin Before Discount' is essential as it provides a benchmark against which the impact of the discount can be measured. This figure represents the amount of profit that would have been made per unit sold without any discounts. It serves as an indicator of the product’s profitability under normal pricing conditions.

Margin After Discount

Finally, the 'Margin After Discount' is the key output that reveals the real impact of the discount on profitability. This figure shows the new profit margin after accounting for the reduced sale price and the cost of goods. It is a critical metric for businesses as it directly reflects the effectiveness of discount strategies in maintaining profitability.

Things to Watch Out For

While the Margin After Discount Calculator is a powerful tool for pricing strategy, there are several factors that users need to be cautious about to ensure accurate and meaningful results.

Sales Tax Considerations

One of the common pitfalls when calculating margin is the incorrect handling of sales tax. Users must be consistent in how they input prices - either all net (excluding tax) or all gross (including tax). Mixing net and gross prices can lead to skewed results.

For example, if the selling price before discount is input as a gross figure (including sales tax) and the cost of goods sold (COGS) is input as a net figure (excluding tax), the calculated margin will be inaccurately inflated.

This is because the revenue side of the calculation is overstated when compared to the cost side. Users need to ensure consistency in their price inputs to obtain reliable margin calculations.

Negative Margin After Discount Indicates Loss

A negative margin after a discount is a clear indication of a loss. This means that the selling price after applying the discount is not sufficient to cover the cost of goods sold, leading to a loss on each unit sold.

Businesses must monitor this metric closely. A negative margin might be acceptable in specific strategic scenarios, like clearing out old inventory, but it's unsustainable in the long run and can lead to financial strain.

Low Margins and Overall Profitability

Even if the margin after the discount is positive, it's important to consider whether it's high enough to sustain the business. A low positive margin may not be sufficient to cover the fixed and variable costs of running the business, such as rent, utilities, salaries, and marketing expenses.

For instance, if a product has a margin of 5% after a discount, but the overall operating costs require a minimum margin of 10% to break even, then the discount campaign would render the business unprofitable. Businesses need to understand their break-even point and ensure that their pricing strategies, even after applying discounts, keep them above this threshold.

How to Calculate Margin After Discount on Your Own

Understanding how to manually calculate the margin after discount can be invaluable for businesses. It allows for a deeper comprehension of the pricing dynamics and can be useful in situations where a calculator is not readily available.

Margin After Discount Formula

Before diving into the margin after the discount, it's essential to understand the original margin formula. The original margin is calculated as:

This formula gives the profit margin as a percentage of the selling price.

To derive the margin after the discount formula, we adjust the selling price to reflect the discount:

-

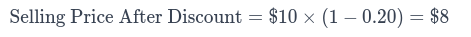

Calculate the selling price after discount:

-

Then, use this adjusted selling price in the margin formula:

Example Calculation:

Let's calculate the margin after a discount for a product with the following details:

- Original product net price (Selling Price): $10

- Net COGS: $5

- Discount: 20%

-

Calculate the selling price after a 20% discount:

-

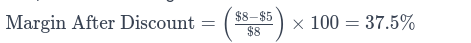

Now, calculate the margin after discount:

So, the margin after applying a 20% discount to a product that originally costs $10 and has a COGS of $5 is 37.5%. This calculation helps businesses understand the profitability of a product after discounts are applied.

How to Run a Successful Discount Campaign?

Effective discount campaigns are not just about crunching numbers but also understanding consumer psychology. Our calculator is crucial for the financial aspects, but incorporating elements of urgency and limited availability can significantly enhance the campaign's effectiveness.

1. Setting Clear Objectives with Psychology in Mind: Establish the goals of your discount campaign, whether it’s clearing inventory, attracting new customers, or enhancing brand visibility. Your objectives should consider not just the financials but also the psychological impact on consumer behavior.

2. Understanding Market Dynamics and Consumer Psychology: Analyze market trends and consumer behavior. The Margin After Discount Calculator helps in simulating financial scenarios, but also considers psychological factors like consumer response to price reductions and sales promotions.

3. Calculating Optimal Discount Rates: Use the calculator to find the right balance between attractive discounts and profitable margins. Remember, the perceived value of a discount can often have a greater impact on consumer behavior than the actual numbers.

4. Creating a Sense of Urgency and Scarcity: Discounts are more effective when they feel exclusive or time-limited. Incorporate urgency and limited availability in your campaign to prompt quicker buying decisions. This strategy can be as crucial as the discount itself in driving sales.

5. Strategic Marketing of Discounts: Integrate your discounts with compelling marketing efforts. Highlight the exclusivity and time-sensitivity of the offer. Use the calculator to anticipate the impact of these psychological tactics on sales and margins.

6. Time-Frame and Urgency: Decide on the campaign duration with both profitability and psychological impact in mind. Short, time-limited campaigns can create a sense of urgency, while longer campaigns might offer sustained visibility but potentially less immediate impulse buying.

7. Adjustments Based on Real-Time Data and Consumer Response: Monitor the campaign's performance not just in terms of sales and margins but also customer engagement and behavior. Be prepared to make adjustments that respond to both the financial data and consumer feedback.

8. Post-Campaign Analysis for Holistic Insights: After the campaign, evaluate its success using both the Margin After Discount Calculator and an analysis of consumer behavior during the campaign. This will provide a more comprehensive understanding of what worked and what can be improved.

While the usage of Calcopolis is vital for ensuring the financial viability of discount campaigns, understanding and leveraging consumer psychology is equally important. A successful campaign combines the science of numbers with the art of psychology, creating offers that are financially sound and irresistibly attractive to consumers.

Related tools

At Calcopolis you can find several other calculators that can be useful for you.

-

Break-Even: Helps determine the point at which total cost and total revenue are equal, meaning there is no net loss or gain.

-

Gross Profit Margin: Calculates the gross profit margin, showing the proportion of money left over from revenues after accounting for the cost of goods sold.

-

Net Profit Margin: Used to calculate the percentage of profit generated from revenue after accounting for all expenses, taxes, and costs.

-

Markup: Useful for determining the selling price of products based on a desired markup percentage on the cost of the product.

-

Discounted Cash Flow (DCF): Helps in investment and business valuation by calculating the present value of expected future cash flows using a discount rate.

-

Inventory Turnover Ratio: Assists in understanding how frequently a business replenishes its inventory over a specific period.

-

Return on Investment: Measures the efficiency of an investment or compares the efficiency of several different investments.

-

Cash Flow: Useful for managing cash flow of a business, calculating inflows and outflows of cash over a certain period.

-

Debt-to-Equity Ratio: Provides insights into a company's financial leverage by comparing its total liabilities to its shareholders' equity.

-

Price Elasticity of Demand: Helps understand how the quantity demanded of a product changes as its price changes, which is crucial for pricing strategies.