Graham Number Calculator

Unlocking the Secrets of the Graham Number for Smart Investors

The Graham Number is a popular financial metric derived to assess the true value of a stock. It is designed to provide a simple yet effective way for investors to determine a fair price for a stock based on its earnings and book value.

Developed by Benjamin Graham, the renowned investor and economist, this concept has stood the test of time. Initially crafted in the mid-20th century, it emphasized the importance of an investment's intrinsic value and provided a safeguard against market speculation and volatility. Today, the Graham Number remains relevant as it helps modern investors navigate complex and often overvalued markets, offering a timeless approach to value investing.

This formula integrates two key financial indicators: earnings per share (EPS) and book value per share (BVPS). It mathematically balances these components to calculate a stock's maximum fair price. While the original formula has seen various adaptations to suit contemporary market conditions and different sectors, its core principles remain integral to value investing strategies.

The Graham Number Formula

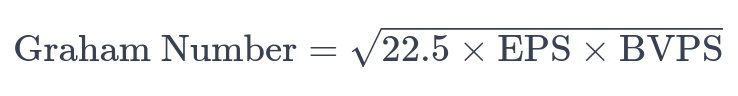

The Graham Number formula is

Where:

- EPS (Earnings Per Share) reflects a company's profitability, calculated as net income divided by the number of outstanding shares.

- BVPS (Book Value Per Share) indicates a company's book value (assets minus liabilities) on a per-share basis.

This formula encapsulates Benjamin Graham's investment philosophy, emphasizing the importance of a company's earnings and intrinsic value in stock valuation.

Interpreting the Results

The Graham Number is a formula that provides a simplistic approximation of a stock's fair value. When interpreting it, it's essential to understand that it represents an estimate of the maximum price that a defensive investor should pay for the stock. It's not a prediction of future market prices but a conservative guideline for value investment.

- Conservative Value Estimate: If a stock's current market price is below the Graham Number, it may be undervalued or priced conservatively relative to its earnings and book value.

- Potential Overvaluation: Conversely, if the market price is significantly above the Graham Number, it might suggest overvaluation, indicating a higher level of risk for the investor.

Assessing Stock Valuation: Cheap or Expensive?

- Cheap (Undervalued): A stock is often considered cheap or undervalued if its current market price is substantially below its Graham Number. This suggests that the stock is trading at less than its estimated intrinsic value, providing a margin of safety for the investor.

- Expensive (Overvalued): If a stock's market price greatly exceeds its Graham Number, it could be considered expensive or overvalued. In such cases, the stock might be trading at a premium compared to its fundamental value, indicating a smaller margin of safety and potentially higher risk.

Formula Requirements

- High P/E Ratio: The Graham Number may not be entirely reliable for companies with high price-to-earnings (P/E) ratios. High P/E often indicates growth expectations, which the Graham Number doesn't account for. In such cases, the formula might undervalue stocks with high growth potential.

- High Price-to-Book Ratio: Similar to high P/E ratios, a high price-to-book (P/B) ratio can indicate that the market values the company's future growth prospects or intangible assets (like brand value or intellectual property) highly. The Graham Number may undervalue such companies as it primarily focuses on tangible book value and historical earnings.

- Negative or Low Earnings: The Graham Number is not applicable for companies with negative earnings or extremely low EPS. It is designed for companies with positive earnings and a stable financial history.

- Sector-Specific Variations: Certain industries or sectors, like technology or biotech, where growth prospects and intangibles play a significant role, may not fit well with the conservative valuation approach of the Graham Number.

Comparative Analysis: Graham Number vs. Other Valuation Methods

The Graham Number, developed by Benjamin Graham, is a formula used to estimate the fair value of a stock. It's particularly valued for its simplicity and conservative approach. However, like any valuation method, it has its strengths and weaknesses when compared to other methods.

Advantages:

- Simplicity and Accessibility: The Graham Number formula is straightforward and easy to calculate, making it accessible to both professional and amateur investors.

- Conservatism: It focuses on a company's earnings and book value, providing a conservative estimate of stock value. This conservative approach helps investors avoid overpaying for a stock.

- Risk Mitigation: By emphasizing financial stability and soundness (via earnings and book value), the Graham Number can help identify companies that are less likely to face financial distress.

Disadvantages:

- Limited Scope: The Graham Number primarily considers only earnings and book value. It overlooks other factors like growth potential, market conditions, and sector-specific variables.

- Outdated in Fast-Paced Markets: In rapidly changing markets or industries, such as technology, the Graham Number may not accurately reflect a company's current or future potential.

- Not Suitable for All Companies: It may not be applicable to companies with negative or very low earnings, and it may undervalue high-growth companies.

Suitability for Different Investment Strategies

Value Investing: The Graham Number is ideally suited for value investing strategies. Value investors seek to find stocks that are undervalued compared to their intrinsic value, and the Graham Number provides a conservative estimate of this value.

Growth Investing: For growth investors who focus on companies with high growth potential, the Graham Number might be less relevant. It tends to undervalue such companies as it doesn't consider growth factors.

Income Investing: For income investors focused on steady dividends, the Graham Number can be a useful tool to assess the financial stability of a company, but it may not provide a complete picture regarding future dividend payouts.

Speculative Investing: Speculative investors who take on higher risks for potentially high rewards might find the Graham Number too conservative. It does not account for market sentiment or speculative elements that can influence stock prices in the short term.

The Graham Number is a valuable tool in an investor's arsenal, particularly for those with a conservative, value-oriented approach. Its simplicity and focus on financial soundness are its main strengths, but its limitations in assessing growth potential and its inapplicability in certain market segments make it less suitable for all investment strategies. As with any valuation method, it is most effective when used in conjunction with other analysis tools and within the context of a well-rounded investment strategy.

FAQ

What is the Graham Number?

The Graham Number is a figure that represents the maximum price one should pay for a stock, based on its earnings and book value. It is derived from a formula developed by Benjamin Graham, the father of value investing. This formula uses earnings per share (EPS) and book value per share (BVPS) to calculate a conservative estimate of a stock's intrinsic value.

How is the Graham Number calculated?

The Graham Number is calculated using the formula: . Here, 22.5 is a constant that comes from Graham's recommendation that the price-to-earnings ratio multiplied by the price-to-book ratio should not exceed 22.5.

What does the Graham Number indicate?

The Graham Number provides a conservative estimate of the fair value of a stock. If a stock's price is lower than the Graham Number, it might be undervalued, suggesting a potential investment opportunity. Conversely, if it's higher, the stock might be overvalued.

Is the Graham Number applicable to all stocks?

No, the Graham Number is not suitable for all stocks. It works best for companies with positive earnings and a stable financial record. It may not be appropriate for companies with negative earnings, high-growth companies, or those in rapidly changing industries.

Can the Graham Number be used as the sole basis for investment decisions?

It's not advisable to use the Graham Number as the sole criterion for investment decisions. While it provides a useful estimate of value, it should be considered alongside other factors and analysis methods for a comprehensive understanding of a stock's potential.

How does the Graham Number differ from other valuation methods?

Unlike methods that focus on future growth potential or market sentiment, the Graham Number is grounded in a company's current financials — specifically its earnings and book value. It offers a more conservative and tangible basis for valuation compared to methods that heavily weigh future projections or market trends.

Can the Graham Number predict stock market movements?

The Graham Number is not a tool for predicting stock market movements. It is a measure of intrinsic value that helps investors assess whether a stock is priced reasonably in relation to its fundamentals.

Is the Graham Number relevant for modern investing?

A8: While some aspects of the Graham Number may seem outdated in today’s fast-paced markets, it remains a valuable tool for value investors. Its focus on financial stability and conservative valuation is particularly relevant for investors seeking lower-risk investment opportunities.

How often should the Graham Number be recalculated for a stock?

It's wise to recalculate the Graham Number whenever there is a significant change in a company's earnings or book value, typically after new financial reports are released.

What are the limitations of the Graham Number?

The primary limitations of the Graham Number include its focus on historical data, which may not capture future growth prospects, and its inapplicability to companies with negative earnings or those in rapidly evolving industries. It also does not consider other factors like market trends, sector dynamics, or global economic conditions.

Related Calculators

In addition to the Graham Number, several other calculators and financial ratios are used in investment analysis to evaluate the worth and potential of stocks and businesses. Here's a list of some of these key calculators and what they represent:

-

EBITDA Multiple: This calculator measures a company's return on investment (ROI) and is used to determine the value of a company. It compares the company's value, including debt and liabilities, to its earnings before interest, taxes, depreciation, and amortization (EBITDA).

-

Enterprise Value to Sales (EV/Sales): This ratio compares the total valuation of a company (including debt and excluding cash) to its sales revenue. It's used to assess whether a stock is undervalued or overvalued relative to its sales.

-

Discounted Cash Flow (DCF): A valuation method used to estimate the value of an investment based on its expected future cash flows. The DCF analysis attempts to figure out the value of an investment today based on projections of how much money it will generate in the future.

-

Price-Earnings Ratio (P/E Ratio): This is a common valuation tool that compares a company's current share price to its per-share earnings. It's used to evaluate whether a stock is over or undervalued.

-

Price to Book Value Ratio (P/B Ratio): This ratio compares a firm's market capitalization to its book value. It provides insight into whether a stock is undervalued or overvalued compared to its actual net asset value.

-

Intrinsic Value Calculator: This tool helps estimate the true value of an investment based on its fundamental analysis. It's used to determine whether a stock is worth more or less than its market value.

-

Holding Period Return (HPR): This calculation measures the total return on an investment over the period it was held. It includes dividends, interest, and any other income received, as well as capital gains.

-

Present Value of Growth Opportunities (PVGO): This is a method to estimate the portion of a company's value that can be attributed to future growth opportunities. It's used to separate the company's earnings growth from its current earnings.

-

Capital Asset Pricing Model (CAPM): CAPM calculates the expected return on an investment and helps in making decisions about adding assets to a well-diversified portfolio.

-

Dividend Discount Model (DDM): This model calculates the value of a stock by considering the dividends expected to be paid in the future.

-

Net Present Value (NPV): NPV is used to calculate the current total value of a future income stream, making it crucial for assessing the profitability of investments.

-

Return on Equity (ROE): ROE measures a corporation's profitability by revealing how much profit a company generates with the money shareholders have invested.

-

Return on Assets (ROA): This indicator measures how efficient a company is at using its assets to generate earnings.

-

Debt-to-Equity Ratio (D/E): This ratio indicates the relative proportion of shareholders' equity and debt used to finance a company's assets.