Is 1.5 million enough for FatFIRE ?

1.5 million dollars may seem like a crazy amount of money. For sure, it could allow you to retire early, but will it really be by high standard retirement, aka Fat Fire, or do you still need to be savvy and count every penny in order to not run out of money? Let’s find out!

Fat FIRE

It is a variant of the Financial Independence, Retire Early concept. People dedicated to this idea focus on accumulating enough capital in order not to have to work anymore. Although achieving FIRE means financial independence, it is not necessary to become a millionaire in order to reach that goal.

People seeking early retirement, according to the FIRE idea, are willing to sacrifice the standard of living a little bit in exchange for real freedom and independence.

Fat FIRE, however, is slightly different. The idea is to save enough money so you don’t have to work anymore but still keep a high standard of living. The standard of life does not necessarily need to reflect the top 1% of Americans but for sure should be comparable to a higher middle-class level.

So is $1.5 million enough for Fat FIRE? In this report, we will answer this question in detail. We will analyze the case of a typical household with monthly expenses of $8000.

We will also assume that the accumulated capital will not be kept in a bank account but will be invested in many different asset classes with an average annual interest rate of 8%, which is more or less the long-term market average for US stocks.

To be as precise as possible, we will deduct income tax (15%) from the interest you earn each month, and later on, we will analyze the impact of inflation on your portfolio.

So in our imaginary scenario, Fat FIRE prospects for a family with $1.5 million of liquid assets look like this:

| Initial savings: | $15 000,00 | |

| Interest rate: | 0.08% | |

| Monthly withdrawal: | $80,00 | |

| The annual increase in withdrawal: | 0% | |

| Your savings will last for: | 15 years 8 months |

Assuming you will not just keep your capital in a savings account but have it invested in high-yield asset classes like stocks or REITs with an average return rate of 0.08%, you could withdraw $80,00 a month for 15 years 8 months until your capital of $15 000,00 gets depleted.

Unfortunately, this assumption is rather optimistic and, in practice, difficult to replicate in real life. For several reasons:

The interest rate of 8% is too optimistic.

Although an assumed APR of 8% is what you could expect from stocks, it is advised to lower your exposure to high-volatility assets during retirement. So in practice, your $15 000,00 will give you a lower return rate than in the example above.

Inflation

What’s more, the example above does not consider inflation which is a main obstacle in long-term investing.

Taxes

As you probably expect, you will have to pay income tax from interests earned on your capital. The calculation below assumes that those $80,00 are after-tax deductions.

Can I retire on $15 000,00?

In most cases. yes. You can retire with $15 000,00. Below we describe what criteria you should meet in order to retire early with $15 000,00 in savings. You could calculate your own scenario using our calculator.

In order to find the precise answer, you need to ask yourself the following questions.

How much money do I need per month?

Answering this question is key to preparing a retirement plan. If your monthly expenses are in balance, there is a high possibility you will be able to quit your job with $15 000,00 in savings, but if your costs of living are very high, there is no chance that $15 000,00 will be enough for early retirement.

It’s very important to be as precise as possible. You need to calculate not only your regular daily expenses for food and bills.

You should also include expenses you pay once a year, like property tax, insurance, etc. Finally, you should add a reserve to some unexpected events like car and home repairs. The best way to do that is to add an extra 20% to 30% to the projected monthly expenses.

What is my projected time of retirement?

This question is as important as the previous one. The situation for people in their 30s or even 40s is much different than for those above 50 years old.

The older you are, the less money you will spend on retirement. Therefore older people have an advantage over millennials.

At the end of the article, we present the table with calculations of how much money you could withdraw per month from your saved $15 000,00, depending on your age.

What is my effective interest rate from your investments?

The compound interest is your greatest ally. Thanks to this magic formula, you will be able to benefit twice from each dollar you make, and that $15 000,00 you have saved will last longer.

The table below shows how much interest per month you can get from $15 000,00, depending on the average interest rate of your portfolio.

| Interest rate | Monthly interests | Tax | Interests after tax |

|---|---|---|---|

| -3.92% | - $49,-25 | $0,-7 | - $49,-18 |

| -2.92% | - $36,-68 | $0,-5 | - $36,-64 |

| -1.92% | - $24,-12 | $0,-3 | - $24,-9 |

| -0.92% | - $11,-56 | $0,-1 | - $11,-55 |

| 0.08% | $1,01 | $0,01 | $1,00 |

| 1.08% | $13,57 | $0,03 | $13,54 |

| 2.08% | $26,14 | $0,04 | $26,10 |

How high will inflation be in the future?

Another important factor that is most often forgotten is inflation. The biggest enemy of savers. It should never be underestimated since even low inflation of 1% to 2% could ruin your plan of early retirement.

The table below shows how $15 000,00 will decrease in value over time due to inflation.

| Inflation | Initial value | Future value after: | ||

|---|---|---|---|---|

| 10 years | 20 years | 30 years | ||

| 1% | $15 000,00 | $13 573,17 | $12 282,15 | $11 114,02 |

| 2% | $15 000,00 | $12 282,20 | $10 056,36 | $8 234,23 |

| 3% | $15 000,00 | $11 112,61 | $8 232,61 | $6 098,77 |

| 4% | $15 000,00 | $10 053,70 | $6 738,22 | $4 516,00 |

For more details, you may visit our inflation loss calculator to check how much will be $15 000,00 worth in the future.

How long will $15 000,00 last in retirement?

This depends mostly on two factors: the number of monthly withdrawals and the effective interest rate of your investments. The table below shows how long your savings will last depending on those two factors. The calculations assume that the entire amount of $15 000,00 will be invested, and you will receive regular interest. In most cases, in order to keep a certain standard of living, you will need to spend not just the interest but some portion of accumulated capital as well.

| Interest rate | Monthly withdrawal | Savings will last for |

|---|---|---|

| 4% | $64,00 | 37 years 11 months |

| $80,00 | 24 years 6 months | |

| $96,00 | 18 years 4 months | |

| $120,00 | 13 years 5 months | |

| 6% | $64,00 | 1000 years 1 months |

| $80,00 | 46 years | |

| $96,00 | 25 years 4 months | |

| $120,00 | 16 years 4 months | |

| 8% | $64,00 | 1000 years 1 months |

| $80,00 | 1000 years 1 months | |

| $96,00 | 1000 years 1 months | |

| $120,00 | 22 years 4 months | |

| 10% | $64,00 | 1000 years 1 months |

| $80,00 | 1000 years 1 months | |

| $96,00 | 1000 years 1 months | |

| $120,00 | 1000 years 1 months |

As you see, if you keep your expenses in check, you could retire with $15 000,00 in savings. With the monthly withdrawals of $64,00 you will be more likely to retire than if you keep spending $120,00 a month.

A high-interest rate is also an important factor. However, since you won’t have direct control over it is best to assume the low performance of your investments and be positively surprised eventually.

How to retire with $15 000,00?

Once you know what criteria should be met in order to be able to retire with $15 000,00, you can prepare your plan.

- Calculate your monthly living expenses. Try to be as accurate as possible.

- Calculate how much interest a month you make from $15 000,00 in savings. You can use our interest calculator.

- Deduct income tax from the interest earned.

- If the interest amount after tax may cover your expenses, you could safely retire.

If you wish to retire comfortably with $15 000,00 you can live not only from interests, but you could start spending saved capital. However, such an approach carries a risk that your savings will get depleted sooner than you might expect.

At what age can you retire with $15 000,00?

If you are young, in your 20s or 30s, you might need to accumulate higher capital or wait a few more years. Below we will analyze at what age you could retire safely with $15 000,00.

How can you retire early at 35 with $15 000,00?

To be completely honest, it will be very difficult. It will require a lot of effort and a bit of luck.

- You need to decrease your spending in order not to deplete $15 000,00 too soon.

- You need to take some risk and invest aggressively in order to reach a high return rate.

Of course, you can always move to a country with lower costs of living where you can retire with $15 000,00.

How can you retire early at 45 with $15 000,00?

This scenario will be difficult as well but much more probable than retirement at 35 with $15 000,00. These additional 10 years make a big difference.

- You need to decrease your spending in order not to deplete $15 000,00 too soon.

- You need to invest your savings with a decent interest rate, but it could be a balanced portfolio according to the 60/40 rule.

How can you retire early at 50 with $15 000,00?

If you are reasonable and can keep your spending in check, $15 000,00 is more than enough to retire early. This is much sooner than the official retirement age in the US and any other country. With Calcopolis you can estimate your standard of life on that early retirement.

- Visit our living from a savings calculator.

- Fill in the form with all necessary data, like your desired retirement income, expected interest rate, and income tax value.

- The calculator will give you precise information if the analyzed scenario is viable or not.

Is FatFIRE possible if I have $1.5 million?

As you have seen in our calculation $1.5 million is more than enough for reasonable people to retire early with a decent standard of life and a higher middle-class level.

However, if you are still young, you need to be responsible and not run into a spending spree. You still need to have your costs in check; however, there will be room for some luxury.

It is very important to invest wisely to protect the money from inflation.

If you have less than 1.5 million dollars, you could check our similar analysis, where we try to answer if 1 million is enough for early retirement or even if $800k is enough to retire.

Install CalcoPolis as App Add Calcopolis icon to homescreen and gain quick access to all calculators. Click here to see how »

Table of Contents

- How much money do you need not to have to work anymore?

- Is one million dollars enough to take early retirement?

- How much money do you need to have $5,000 in interest per month?

- The 4% rule

- How to become a rentier?

- Step 1. Estimate your needs

- Step 2. Create your plan

- Step 3. Execute the plan

- How to save a million dollars?

- Join the FIRE movement

How much money do you need not to have to work anymore?

Many people want to become financially independent. Early retirement is becoming an increasingly popular goal for young and ambitious people. However, the question is - how much money do you need for early retirement?

This website allows you to calculate how much capital you need to live on your savings.

Key functionality:

-

The calculator takes into account dividends and interests from assets you have accumulated;

-

In the form, you enter the monthly withdrawal you want to pay out for a living;

-

The program takes into account of the rising level of inflation;

-

And the taxes that need to be deducted from your capital gains.

-

As a result you will see for how many years a certain amount of money will be enough.

Is one million dollars enough to take early retirement?

A $1,000,000 may seem like a huge amount of money. But is it really enough to safely retire early?

The amount of money required to retire depends on several factors.

First of all, you should estimate how much money you need per month for a comfortable life.

Consider not only your current life situation, but the future one as well. If you plan to start a family or buy a house your monthly bill will go up. Likewise, if your kids are about to move out and live on their own your monthly spendings might decrease.

Second, use our calculator to verify if your expected savings amount will last for the rest of your life.

Our website takes into account the projected increase in inflation over the years. This will give you a clear idea of how much money you need to live freely on your savings in retirement.

The table below shows sample scenarios of how long your savings will last with different withdrawal rates. The example assumes an average inflation level of 2% and 15% capital gains tax.

|

Initial balance |

APR |

Monthly withdrawal |

Savings will last for |

Link to simulation |

|---|---|---|---|---|

| $1,000,000 | 6% | $2,000 | over 100 years | link » |

| $1,000,000 | 6% | $3,000 | 62 years | link » |

| $1,000,000 | 6% | $4,000 | 33 years | link » |

| $1,000,000 | 6% | $5,000 | 23 years | link » |

| $1,000,000 | 6% | $6,000 | 18 years | link » |

As you can see, your monthly needs have a considerable impact on your chances to retire early. Albeit, it is worth noting that is not the only variable worth considering.

Annual interest rate is another factor that impacts your retirement plan. The table below shows different scenarios with the same withdrawals of $4,000 per month (like before we took 2% inflation and 15% tax into account).

| Initial balance | APR | Monthly withdrawal | Savings will last for | Link to simulation |

| $1,000,000 | 3% | $4,000 | 22 years | link » |

| $1,000,000 | 4% | $4,000 | 24 years | link » |

| $1,000,000 | 5% | $4,000 | 28 years | link » |

| $1,000,000 | 6% | $4,000 | 33 years | link » |

| $1,000,000 | 7% | $4,000 | 43 years | link » |

Of course future return rate is the factor that is impossible to predict so it is wise to be a little bit pessimistic about it since it would be better to be positively surprised by the performance of your future investments than the opposite.

How much money do you need to have $5,000 in interest per month?

With constantly increasing average lifespan it is wise not to burn your savings. That is why many people plan to live from interests only. This leads to the question of how much money you need to be able to earn $5000 per month in interest.

Unfortunately there is no easy answer, because much depends on future return rates, but the table below shows you a few possible scenarios.

| Monthly withdrawal (after 15% tax) | APR | Required balance | Link to simulation |

| $5,000 | 3% | $2,000,000 | link » |

| $5,000 | 4% | $1,500,000 | link » |

| $5,000 | 5% | $1,200,000 | link » |

| $5,000 | 6% | $1,000,000 | link » |

| $5,000 | 7% | $857,143 | link » |

You can analyze different scenarios using our compound interest calculator. To be as realistic as possible you should take into account inflation as well. You can do this with the help of our inflation calculator.

The 4% rule

Since the problem of uncertainty of the future level of return applies to all investors, the safe level of payouts has been analyzed many times in the past.

To solve this issue the informal rule of thumb was presented by Bill Bengen. He claims that a 4% withdrawal rate allows one to enjoy retirement without worry of running out of money.

The idea assumes that the capital is invested in assets that not only give a protection against inflation, but also allow to achieve real profits. For example, a mix of stocks and bonds.

According to the author, if you don’t exceed 4% withdrawals your portfolio is safe from inflation and potential crisis on the market.

Of course there are critics of this rule. They suggest that nothing is written in stone and applying this rule does not guarantee anything. With increasing life expectancy the investors are advised to be careful on any assumption here).

We suggest using our calculator to find the best withdrawal rate for you. Below you can see few examples:

| Savings | APR | Monthly interests | Tax (15%) | Safe monthly withdrawal | Link |

| $1 000 000 | 4% | $3 333 | $500 | $2 833 | |

| $2 000 000 | 4% | $6 667 | $1 000 | $5 667 | |

| $3 000 000 | 4% | $10 000 | $1 500 | $8 500 | |

| $4 000 000 | 4% | $13 333 | $2 000 | $11 333 | |

| $5 000 000 | 4% | $16 667 | $2 500 | $14 167 |

How to become a rentier?

Step 1. Estimate your needs

To estimate how much money you will need to join the ranks of rentiers, you need to calculate your current expenses. Determine how much money you spend each month on living.

Next, write down your expenses. It's best if you divide them into two lists:

- necessary expenses,

- optional expenses.

The pool of money necessary to get by should also include a financial cushion for unforeseen expenses. Sooner or later, you will be faced with circumstances such as car repair, medical treatment or home renovation.

For example, the amount necessary for a comfortable life can range from $3000 to $6000. It depends on your individual needs.

If you are planning a family or a costly hobby - the minimum monthly amount should increase accordingly.

Of course, you can plan for more comfort in your retirement life. Remember, however, that then you will have to wait a bit longer for a well-deserved retirement.

Step 2. Create your plan

If you have figured out the approximate monthly amount necessary for a comfortable life, you are well on your way to early retirement planning. Before continuing, however, there are a few tips that will help you with this.

- Pay off your debts

- Increase your earnings

- Save and invest

Step 3. Execute the plan

Investing is the most important step in the entire plan. Through the magic of compound interest, time works in your favor - as long as your investments beat inflation. Then all you need is consistency and persistence.

How to save a million dollars?

Putting aside a million dollars may sound like an impossible task. However, in practice, it is achievable by almost everyone.

Let’s analyze the following example:

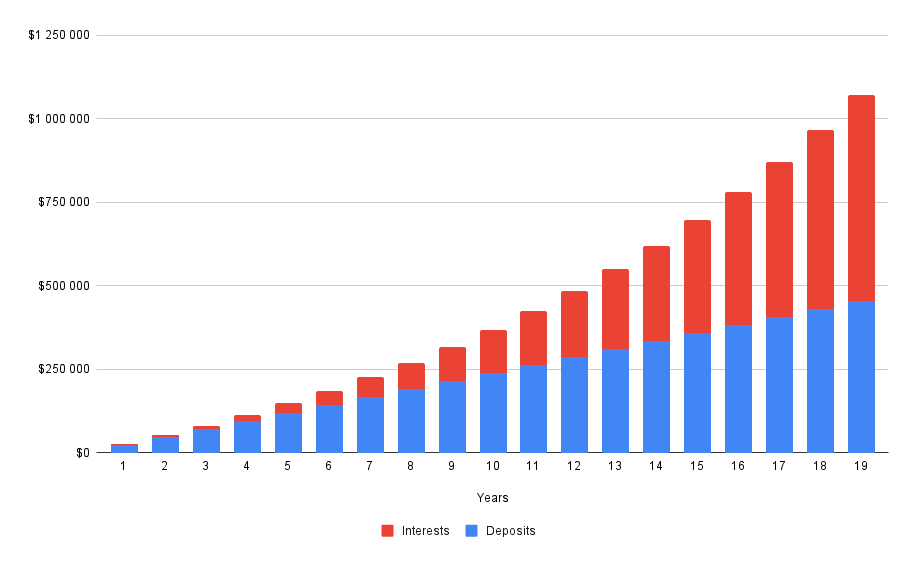

Saving $2,000 per month for 19 years with 8% annual interest rate.

https://calcopolis.com/saving/saving/a_0-c_1200-d_1900-i_800-r_0-s_200000-t_0-m_22800

| Year | Sum of deposits | Sum of interests | Savings | Annual increase |

| 1 | $24 000 | $1 066 | $25 066 | |

| 2 | $48 000 | $4 212 | $52 212 | $27 146 |

| 3 | $72 000 | $9 612 | $81 612 | $29 399 |

| 4 | $96 000 | $17 451 | $113 451 | $31 840 |

| 5 | $120 000 | $27 933 | $147 933 | $34 482 |

| 6 | $144 000 | $41 278 | $185 278 | $37 344 |

| 7 | $168 000 | $57 721 | $225 721 | $40 444 |

| 8 | $192 000 | $77 522 | $269 522 | $43 801 |

| 9 | $216 000 | $100 958 | $316 958 | $47 436 |

| 10 | $240 000 | $128 331 | $368 331 | $51 373 |

| 11 | $264 000 | $159 969 | $423 969 | $55 637 |

| 12 | $288 000 | $196 224 | $484 224 | $60 255 |

| 13 | $312 000 | $237 480 | $549 480 | $65 256 |

| 14 | $336 000 | $284 152 | $620 152 | $70 672 |

| 15 | $360 000 | $336 690 | $696 690 | $76 538 |

| 16 | $384 000 | $395 581 | $779 581 | $82 891 |

| 17 | $408 000 | $461 352 | $869 352 | $89 771 |

| 18 | $432 000 | $534 573 | $966 573 | $97 222 |

| 19 | $456 000 | $615 864 | $1 071 864 | $105 291 |

Key takeaways:

-

Over time interests earned make an ever increasing impact on the saving rate

-

Starting from 9th year, the interests earned exceed annual deposits

-

It takes nearly 4 years to accumulate first 100k

-

From 19th year onward you save more money annually than you saved for the first 4 years

This is the magic of compound interest. If you give it some time, it can work wonders. If you are interested in your own custom scenario try out our savings calculator.

It is worth noting that the simulation above doesn’t count any rises and extra cash you may acquire along the way.

Join the FIRE movement

The FIRE movement, which consists in trying to save as much of one's own income as possible in order to achieve financial freedom quickly, is becoming more and more popular.

Followers of this method save as much as 70% of their income in order to achieve early retirement.

- Estimate how much money you need each month - simply put your spending into Excel.

- Calculate what amount of money will allow you to withdraw such an amount monthly - you can do this using this calculator.

- Calculate how much you have to save each month in order to reach your goal.

- Do not procrastinate! Start now :)

Are you dreaming of retiring early? We have just the tool for you - FIRE calculator. This powerful calculator will help you create a tailored financial independence plan that is perfect for your unique situation. Take control of your future and start planning for your retirement today!

Authors

Created by Lucas Krysiak on 2022-03-09 18:11:39 | Last review by Mike Kozminsky on 2022-03-12 14:14:49